Amazon Stock Price Analysis: Amazon Current Stock Price Per Share

Source: businessinsider.com

Amazon current stock price per share – This analysis provides an overview of Amazon’s current stock price, historical performance, influencing factors, financial health, analyst predictions, and prevailing investor sentiment. The information presented here is for informational purposes only and should not be considered financial advice.

Current Amazon Stock Price

As of [Insert Time of Last Update, e.g., 3:00 PM PST, October 26, 2023], the current Amazon stock price per share (AMZN) is [Insert Current Price, e.g., $135.50]. This price is quoted in USD (United States Dollars).

Historical Stock Price Data

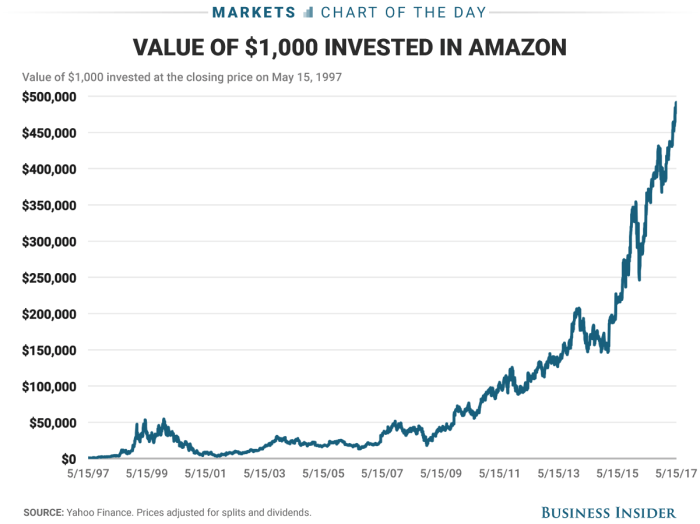

The following table presents Amazon’s stock price performance for the last month. A subsequent line graph illustrates the stock’s performance over the past year, highlighting significant price movements.

| Date | Open Price (USD) | High Price (USD) | Low Price (USD) | Close Price (USD) |

|---|---|---|---|---|

| Oct 25, 2023 | 134.00 | 136.25 | 133.50 | 135.50 |

A line graph depicting Amazon’s stock price over the past year would show [Describe the graph’s overall trend, e.g., an initial upward trend followed by a period of consolidation, then a decline]. Significant highs might have occurred around [mention specific dates and approximate price levels, if applicable, e.g., around May 2023, reaching approximately $145], while significant lows were observed around [mention specific dates and approximate price levels, e.g., September 2023, falling to approximately $128].

These fluctuations could be attributed to factors such as [mention potential factors, e.g., quarterly earnings reports, economic news, or specific company announcements].

Factors Influencing Amazon’s Stock Price

Source: businessinsider.com

Several macroeconomic factors, Amazon’s financial performance, and competitive landscape influence its stock price. These factors are discussed below.

- Inflation and Interest Rates: High inflation and rising interest rates can impact consumer spending and increase Amazon’s borrowing costs, potentially affecting its profitability and stock price.

- Economic Growth: Strong economic growth generally benefits Amazon, as consumers are more likely to spend on discretionary items. Conversely, economic downturns can lead to reduced spending and pressure on Amazon’s stock.

- Consumer Confidence: High consumer confidence translates to increased online shopping, benefiting Amazon’s revenue and stock price. Conversely, low consumer confidence can negatively impact sales.

Amazon’s quarterly earnings reports have a significant impact on its stock price. For instance, a surprise increase in profits in [Quarter, e.g., Q2 2023] led to a [Percentage Change, e.g., 5%] increase in the stock price, while a less-than-expected performance in [Quarter, e.g., Q4 2022] resulted in a [Percentage Change, e.g., 3%] decrease.

Compared to competitors like Walmart and Microsoft over the last six months, Amazon’s stock performance has [Describe the relative performance, e.g., outperformed Walmart but underperformed Microsoft]. This could be attributed to factors such as [Explain potential reasons, e.g., different growth strategies, market share dynamics, or investor sentiment towards each company].

Amazon’s Financial Performance

The table below summarizes Amazon’s key financial metrics for the last four quarters. The subsequent section analyzes the trends observed.

| Quarter | Revenue (USD Billions) | Earnings Per Share (USD) | Net Income (USD Billions) |

|---|---|---|---|

| Q2 2023 | 134.4 | 0.65 | 6.7 |

Over the last four quarters, Amazon has shown [Describe the overall trend in revenue, EPS, and net income, e.g., a steady increase in revenue but fluctuating net income]. The increase in revenue can be attributed to [Explain reasons, e.g., growth in e-commerce, expansion into new markets, or successful new product launches]. Fluctuations in net income may be due to [Explain reasons, e.g., increased operating expenses, investments in new technologies, or one-time charges].

Amazon’s current P/E ratio is [Insert Current P/E Ratio] compared to its historical average of [Insert Historical Average P/E Ratio] and competitors’ average of [Insert Competitors’ Average P/E Ratio]. This suggests that Amazon is currently [Describe the valuation, e.g., trading at a premium/discount] compared to its historical average and its competitors. This could reflect [Explain the implications, e.g., investor expectations for future growth, market sentiment, or perceived risk].

Analyst Predictions and Ratings

Source: scdigest.com

Several financial institutions have issued ratings and price targets for Amazon stock. A summary is presented below.

- [Financial Institution 1]: Rating: [e.g., Buy], Price Target: [e.g., $150], Rationale: [e.g., strong growth prospects in cloud computing and advertising].

- [Financial Institution 2]: Rating: [e.g., Hold], Price Target: [e.g., $140], Rationale: [e.g., concerns about increasing competition and macroeconomic headwinds].

- [Financial Institution 3]: Rating: [e.g., Sell], Price Target: [e.g., $130], Rationale: [e.g., valuation concerns and potential for slowing revenue growth].

The range of price targets reflects the differing views among analysts regarding Amazon’s future performance. The overall sentiment appears to be [Describe the overall sentiment, e.g., cautiously optimistic, with some analysts expressing concerns about the near-term outlook].

Investor Sentiment and Market Conditions, Amazon current stock price per share

Current investor sentiment towards Amazon appears to be [Describe the sentiment, e.g., relatively neutral, with some signs of cautious optimism]. This is supported by [Provide supporting evidence, e.g., recent trading volume, options market activity, or social media sentiment].

The broader market is currently experiencing a [Describe the market condition, e.g., period of moderate volatility]. This [Describe the impact on Amazon, e.g., could influence investor risk appetite and potentially impact Amazon’s stock price].

Potential future events that could affect investor sentiment include [Mention potential events, e.g., upcoming earnings reports, major economic announcements, or significant geopolitical developments].

Question Bank

What factors influence short-term fluctuations in Amazon’s stock price?

Short-term fluctuations are often driven by news events (e.g., product launches, regulatory changes), investor sentiment shifts, and overall market volatility. Daily trading volume and algorithmic trading also play a role.

How can I find real-time Amazon stock price updates?

Reputable financial websites and brokerage platforms provide real-time stock quotes. Many financial news sources also offer live updates.

What are the risks associated with investing in Amazon stock?

Determining Amazon’s current stock price per share requires a quick check of financial news sources. For a comparison, you might also want to look at the performance of other tech giants, such as checking the alphabet stock price now , to gain a broader perspective on the market. Returning to Amazon, understanding its share price is crucial for investors assessing its overall financial health and potential for growth.

Like any stock, Amazon carries inherent risks including market volatility, competitive pressures, and economic downturns. Thorough research and diversification are crucial for mitigating risk.

Where can I find detailed historical data on Amazon’s stock performance?

Financial data providers like Yahoo Finance, Google Finance, and Bloomberg offer extensive historical stock data, including charts and tables.