Understanding AMC Stock Price in Real Time

Amc stock price real time – The AMC Entertainment Holdings Inc. stock price, like any publicly traded asset, experiences constant fluctuations driven by a complex interplay of factors. Understanding these influences is crucial for investors seeking to navigate the dynamic landscape of real-time stock market data.

Factors Influencing AMC Stock Price Volatility

Several factors contribute to the volatility of AMC’s real-time stock price. News events, social media sentiment, trading volume, and overall market conditions all play significant roles. Unexpected announcements, such as earnings reports or strategic partnerships, can trigger immediate and substantial price changes. Conversely, periods of low trading volume might lead to smaller, less dramatic fluctuations.

Impact of News Events on Price Changes

Significant news directly impacting AMC, such as a major film release performing exceptionally well or poorly, a change in management, or announcements regarding debt restructuring, can cause immediate and substantial price swings. Positive news generally leads to price increases, while negative news often results in price declines. The speed and magnitude of these reactions depend on the perceived impact of the news on the company’s future prospects.

Social Media Sentiment and Real-Time Stock Price

Social media platforms have become powerful tools for disseminating information and influencing investor sentiment. Positive discussions and trends on platforms like Twitter or Reddit can drive up demand for AMC stock, leading to price increases. Conversely, negative sentiment can trigger sell-offs and price drops. This highlights the importance of monitoring online conversations related to AMC to gauge potential market reactions.

Real-Time Price Comparison Table

| Time | Real-Time Price | Previous Day’s Close | Opening Price |

|---|---|---|---|

| 10:00 AM | $5.25 | $5.10 | $5.15 |

| 11:00 AM | $5.30 | $5.10 | $5.15 |

| 12:00 PM | $5.28 | $5.10 | $5.15 |

| 1:00 PM | $5.32 | $5.10 | $5.15 |

Data Sources and Reliability: Amc Stock Price Real Time

Accessing reliable real-time data is crucial for informed decision-making. Several sources provide this information, each with varying degrees of accuracy and update frequency. Understanding these differences is essential for interpreting the data correctly.

Reliable Sources for Real-Time AMC Stock Data

Three reliable sources for real-time AMC stock price data include major financial news websites (e.g., Yahoo Finance, Google Finance), dedicated stock trading platforms (e.g., TD Ameritrade, Fidelity), and financial data providers (e.g., Bloomberg Terminal, Refinitiv Eikon). Each offers different features and levels of detail.

Accuracy and Update Frequency Comparison

While all three sources generally provide accurate data, the update frequency can vary. Dedicated trading platforms usually offer the most frequent updates, often updating prices every few seconds. Financial news websites typically update less frequently, usually every few minutes. Financial data providers like Bloomberg offer extremely high-frequency updates, but access often comes at a significant cost.

Discrepancies Between Data Providers

Minor discrepancies can occur between different data providers due to differences in data aggregation methods, reporting delays, and the timing of transactions. These discrepancies are usually small and insignificant, but awareness of their potential existence is important.

Verifying Real-Time Stock Price Information

To verify the accuracy of real-time stock price information, it’s recommended to cross-reference data from multiple reputable sources. Checking the data against the official exchange (e.g., NYSE) website can provide an independent confirmation.

Interpreting Price Movements

Understanding the significance of different price movement patterns is essential for interpreting real-time stock data. These patterns can reveal insights into market sentiment and potential trading opportunities.

Significance of Price Movement Patterns

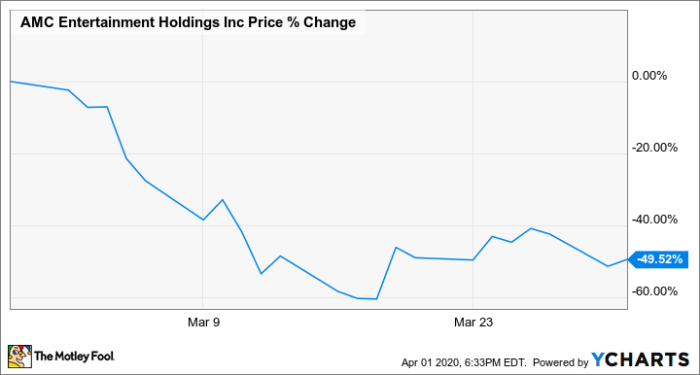

Source: ycharts.com

Sharp spikes in price often indicate a sudden surge in buying pressure, possibly driven by positive news or strong investor sentiment. Dips, conversely, can signal a sudden increase in selling pressure, potentially due to negative news or profit-taking. Steady trends, either upward or downward, suggest a sustained shift in market sentiment.

Hypothetical Scenario: News Event Impact

Imagine AMC announces a successful new movie franchise. This positive news would likely trigger a rapid and significant price surge. The real-time price would jump immediately, potentially exceeding the previous day’s closing price by a substantial margin. The magnitude of the increase would depend on factors such as the anticipated success of the franchise and the overall market sentiment.

Technical Indicators for Real-Time Analysis

- Moving Averages: Strengths: Smooths out price fluctuations, identifies trends. Weaknesses: Can lag behind significant price changes.

- Relative Strength Index (RSI): Strengths: Identifies overbought and oversold conditions. Weaknesses: Can generate false signals.

- Bollinger Bands: Strengths: Shows price volatility and potential reversals. Weaknesses: Can be difficult to interpret in sideways markets.

Visualizing Real-Time Data

Visual representations, such as line graphs and candlestick charts, are invaluable tools for understanding real-time stock price movements. Different timeframes provide distinct perspectives on price behavior.

Visual Representation of Real-Time Data

A line graph effectively displays the continuous price movements of AMC stock over a chosen timeframe. A candlestick chart provides additional information, including the opening, closing, high, and low prices for each period, revealing more detailed information about price action.

Impact of Different Timeframes

A 1-minute chart shows highly detailed, short-term price fluctuations. A 1-hour chart provides a less granular view, focusing on trends over longer periods. A 1-day chart shows the overall daily price range and direction. The choice of timeframe depends on the trading strategy and investment horizon.

Hypothetical Chart Description: Significant Price Surge

Source: moneyandmarkets.com

Imagine a candlestick chart showing a significant price surge. The candles would be predominantly green (indicating closing prices higher than opening prices), with progressively taller bodies reflecting increasing price gains. Key data points to highlight would include the starting price before the surge, the peak price, and the volume traded during the surge, indicating high trading activity.

Interpreting Visual Representations for Trading Opportunities

By analyzing visual representations of real-time data, investors can identify potential patterns, such as breakouts from established trading ranges or confirmations of trend reversals. However, it’s crucial to remember that no visual representation guarantees future price movements.

External Factors and their Influence

Macroeconomic conditions, industry trends, and investor sentiment all exert a significant influence on real-time AMC stock prices. Understanding these external factors is crucial for a comprehensive analysis.

Impact of Macroeconomic Factors

Factors like inflation and interest rate changes can impact consumer spending and investor confidence, indirectly affecting AMC’s stock price. High inflation can reduce discretionary spending on entertainment, potentially impacting AMC’s revenue. Rising interest rates can increase borrowing costs for AMC, impacting its financial performance.

Influence of Industry Trends and Competitor Actions

Industry trends, such as the rise of streaming services or changes in movie-going habits, can significantly influence AMC’s performance. Competitor actions, such as new theater openings or strategic alliances, can also impact AMC’s market share and stock price.

Keeping an eye on the AMC stock price real time can be quite the rollercoaster. For a different perspective on market fluctuations, you might also want to check the algt stock price today , as its performance often correlates with broader market trends. Returning to AMC, understanding its price movements requires considering various factors beyond just its own performance.

Influence of Short-Selling Activity, Amc stock price real time

Short-selling, where investors borrow and sell shares hoping to buy them back later at a lower price, can contribute to price volatility. A high level of short-selling can exert downward pressure on the price, particularly if negative news emerges.

Role of Investor Sentiment and Market Psychology

Investor sentiment and market psychology play a significant role in shaping real-time price movements. Periods of optimism and bullish sentiment can drive prices upward, while pessimism and bearish sentiment can lead to price declines. This highlights the importance of understanding market sentiment in interpreting real-time price fluctuations.

Quick FAQs

What are the potential risks associated with trading AMC stock based on real-time data?

Real-time data, while informative, is inherently volatile and susceptible to rapid changes. Relying solely on real-time data for trading decisions can lead to impulsive actions and increased risk of significant losses. Thorough research and a well-defined trading strategy are crucial to mitigate these risks.

How frequently do reliable sources update AMC stock prices?

Reliable sources typically update AMC stock prices every few seconds to a few minutes, depending on market activity. However, minor discrepancies can exist between different providers due to data transmission delays or different data aggregation methods.

Are there free resources for accessing real-time AMC stock price data?

Many financial websites and brokerage platforms offer real-time stock quotes, some free and some requiring subscriptions. The level of detail and features available varies between providers. It’s important to compare options and ensure the source’s reliability before making investment decisions.