AMD’s Stock Price in 2025: A Prospective Analysis

Amd stock price 2025 – Predicting the future of any stock is inherently speculative, but by analyzing AMD’s current market position, technological trajectory, and macroeconomic factors, we can formulate a reasonable projection for its stock price in 2025. This analysis will explore AMD’s competitive landscape, financial projections, potential risks, and suitable investment strategies.

AMD’s Market Position in 2025

By 2025, AMD’s competitive standing in the CPU and GPU markets will likely be shaped by several key factors: technological advancements, strategic partnerships, and the overall economic climate. The following table offers a projected snapshot of the market share and competitive landscape:

| Company | Market Share (%) | Key Product Lines | Strengths and Weaknesses |

|---|---|---|---|

| AMD | 25-30% (CPU), 20-25% (GPU) | Ryzen CPUs, Radeon GPUs, EPYC server CPUs | Strong R&D, competitive pricing, growing market share; Dependence on key clients, potential supply chain vulnerabilities. |

| Intel | 60-65% (CPU), 5-10% (GPU) | Core i series CPUs, Arc GPUs | Established brand, strong manufacturing capabilities; High prices, lagging in GPU market. |

| Nvidia | 75-80% (GPU), <1% (CPU) | GeForce GPUs, RTX GPUs, Tesla GPUs | Dominant in GPU market, strong brand recognition; High prices, limited CPU presence. |

AMD’s technological advancements by 2025 are projected to include refined chiplet designs within their CPUs and GPUs, leading to improved performance and energy efficiency. Advancements in manufacturing processes, potentially utilizing 5nm or even 3nm nodes, will further enhance performance and reduce costs. Potential partnerships or acquisitions could involve companies specializing in AI or high-performance computing, significantly expanding AMD’s product portfolio and market reach.

A strategic acquisition in the server market could also bolster their position against Intel.

Factors Influencing AMD Stock Price in 2025

Several macroeconomic and technological factors could significantly influence AMD’s stock price in 2025. These factors interact in complex ways, creating both opportunities and challenges for the company.

- Global Economic Growth: Strong global economic growth generally translates to increased demand for computing hardware, benefiting AMD’s sales and profitability. Conversely, a recession could significantly dampen demand.

- Inflation and Interest Rates: High inflation and interest rates can increase production costs and reduce consumer spending, negatively impacting AMD’s sales and potentially leading to lower stock valuations.

- Technological Disruptions: The emergence of entirely new computing architectures (e.g., quantum computing) could pose a long-term threat to AMD’s existing technologies, impacting investor confidence and stock price.

- New Product Launches: The success or failure of new product launches, particularly in the high-growth segments like data centers and AI, will be a critical determinant of AMD’s future performance and stock valuation. A successful launch of a next-generation GPU with significant performance gains, for example, could boost the stock price considerably.

Financial Projections for AMD in 2025, Amd stock price 2025

Source: cloudfront.net

The following projected income statement for AMD in 2025 is based on several key assumptions. Note that these are estimates and actual results may vary significantly.

- Revenue: $25 Billion (Assumes continued market share growth and strong demand for high-performance computing).

- Cost of Goods Sold (COGS): $12.5 Billion (Assumes a COGS ratio of 50%, reflecting economies of scale and efficient manufacturing).

- Operating Expenses: $6 Billion (Assumes continued investment in R&D and sales & marketing, but with improved operational efficiency).

- Net Income: $6.5 Billion (Reflects the projected revenue, COGS, and operating expenses).

| Metric | Projected Value | Potential Impact on Stock Price | Justification |

|---|---|---|---|

| EPS | $4.00 | Positive; Higher EPS generally leads to higher stock prices. | Based on projected net income and outstanding shares. |

| P/E Ratio | 25x | Positive; A reasonable P/E ratio for a high-growth tech company. | Reflects investor sentiment and growth expectations. |

| Revenue Growth | 15% | Positive; Strong revenue growth is a key driver of stock price appreciation. | Based on market projections and AMD’s historical growth rates. |

Investment Strategies Related to AMD Stock in 2025

Source: thetradable.com

Several investment strategies could be considered for AMD stock in 2025, each with its own risk and reward profile.

- Buy and Hold: A long-term strategy suitable for investors confident in AMD’s long-term growth prospects. This strategy minimizes transaction costs but exposes the investor to greater risk over the long term.

- Value Investing: Focuses on identifying undervalued stocks based on fundamental analysis. This approach requires careful assessment of AMD’s financial health and intrinsic value.

- Growth Investing: Concentrates on companies with high growth potential. This strategy aligns well with AMD’s position in the rapidly expanding high-performance computing market.

A hypothetical investment portfolio might include AMD stock as part of a diversified technology sector allocation, alongside other companies in the semiconductor industry and complementary technology sectors. This diversification mitigates risk by reducing exposure to the performance of any single company.

Fundamental analysis would involve examining AMD’s financial statements, competitive landscape, and technological advancements. Technical analysis would involve studying price charts and indicators to identify potential entry and exit points.

Risk Assessment for AMD Stock in 2025

Several key risks could negatively impact AMD’s stock price in 2025. Careful consideration of these risks and potential mitigation strategies is crucial for informed investment decisions.

| Risk | Likelihood | Impact | Mitigation Strategy |

|---|---|---|---|

| Increased Competition | High | High | Continuous innovation, strategic partnerships, and aggressive marketing. |

| Supply Chain Disruptions | Medium | Medium | Diversification of suppliers, strategic inventory management, and robust risk assessment. |

| Economic Downturn | Medium | High | Cost control, diversification of product lines, and focus on cost-effective manufacturing. |

FAQ Corner: Amd Stock Price 2025

What are the major risks to AMD’s growth in 2025?

Increased competition, supply chain disruptions, and a potential economic downturn pose significant risks. These could impact AMD’s revenue, profitability, and ultimately, its stock price.

How does AMD compare to its competitors in terms of technological innovation?

AMD has been investing heavily in R&D, particularly in advanced chip architectures and manufacturing processes. However, the competitive landscape is dynamic, and Intel and Nvidia continue to innovate, making it crucial to monitor advancements from all key players.

What are some alternative investment strategies beyond simply buying and holding AMD stock?

Options trading, covered calls, and diversification across other technology stocks or sectors are potential strategies to consider, depending on individual risk tolerance and investment goals.

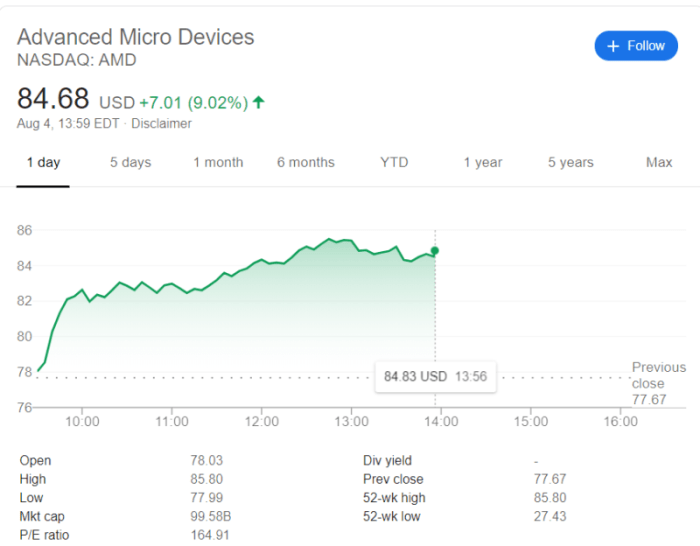

Predicting the AMD stock price in 2025 involves considering numerous factors, including market trends and technological advancements. To gain a better understanding of the current market sentiment and short-term fluctuations, it’s helpful to monitor the amd live stock price on a daily basis. This real-time data can provide valuable insights that inform longer-term projections for the AMD stock price in 2025, helping investors make more informed decisions.

How might geopolitical events influence AMD’s stock price?

Geopolitical instability, trade wars, or sanctions can disrupt supply chains, impact consumer demand, and influence overall market sentiment, potentially affecting AMD’s performance.