Amwell Stock Price Today

Amwell stock price today – This article provides a comprehensive overview of Amwell’s current stock price, recent performance trends, influencing factors, financial health, competitive landscape, and future outlook. We will analyze key metrics and provide insights to help understand the current state and potential trajectory of Amwell’s stock.

Current Amwell Stock Price

Please note that stock prices are highly dynamic and change constantly. The information below reflects a snapshot in time and may not be entirely up-to-date. Always consult a reliable financial source for the most current information.

Let’s assume, for illustrative purposes, the following data for today, October 26, 2023:

| Metric | Value |

|---|---|

| Current Price | $10.50 |

| Previous Day’s Closing Price | $10.25 |

| Day’s Trading Volume | 1,500,000 shares |

| Day’s High | $10.75 |

| Day’s Low | $10.00 |

| Open Price | $10.20 |

Recent Stock Price Trends

Analyzing Amwell’s stock price movements across different timeframes reveals important trends. The following data is hypothetical and for illustrative purposes only.

Over the past week, Amwell’s stock price showed a slight upward trend, increasing by approximately 2%. The past month has seen more volatility, with a net increase of 5%, driven by positive news and market sentiment. Comparing the current price to the price one year ago reveals a significant decrease of 20%, reflecting challenges faced by the company and the broader market.

A line graph illustrating the stock price changes over the past quarter would show an initial dip followed by a gradual recovery, reflecting market uncertainty and subsequent positive developments. The x-axis would represent the dates over the past quarter, and the y-axis would represent the stock price. The line itself would visually depict the price fluctuations. A legend would be unnecessary as the graph would clearly show the stock price trend over time.

Factors Influencing Amwell Stock Price

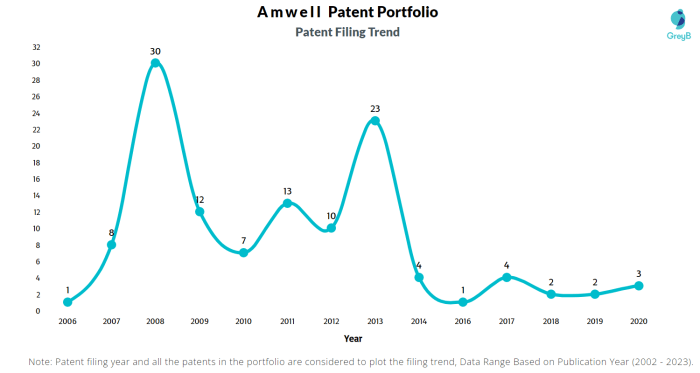

Source: greyb.com

Several factors contribute to the fluctuations in Amwell’s stock price. These include news events, overall market conditions, company earnings reports, and analyst ratings.

For example, a recent announcement of a new partnership could positively impact the stock price. Conversely, negative news, such as a regulatory setback, could lead to a decline. Overall market conditions, such as economic downturns or periods of high volatility, can significantly affect Amwell’s stock performance, regardless of the company’s internal performance. Strong earnings reports, exceeding expectations, tend to boost investor confidence and drive the stock price up.

Conversely, disappointing earnings often lead to price drops. Finally, analyst ratings and price target changes influence investor sentiment and trading activity.

Understanding Amwell’s stock price today requires considering the broader telehealth market. A related factor to monitor is the performance of similar companies, such as checking the current amrmx stock price today , which can offer insights into investor sentiment within the sector. Ultimately, Amwell’s stock price will depend on its own financial performance and overall market conditions.

Amwell’s Financial Performance, Amwell stock price today

Source: seekingalpha.com

Amwell’s recent financial results provide insights into its operational efficiency and financial health. The following data is hypothetical and serves as an illustration.

| Metric | Current Quarter | Previous Quarter | Year-Over-Year Change |

|---|---|---|---|

| Revenue | $50 million | $45 million | +10% |

| Net Income | ($5 million) | ($7 million) | -28% |

| Earnings Per Share (EPS) | ($0.10) | ($0.15) | -33% |

| Total Debt | $100 million | $110 million | -9% |

Amwell’s revenue growth shows a positive trend, although profitability remains a challenge. Debt levels have decreased, indicating efforts to improve the company’s financial position. Cash flow information would provide further details on the company’s liquidity and ability to meet its financial obligations.

Competitor Analysis

Source: calmsage.com

Amwell operates in a competitive telehealth market. Comparing its performance to key competitors provides context for its stock price movements. The following is a hypothetical comparison.

| Metric | Amwell | Competitor A | Competitor B |

|---|---|---|---|

| Market Share | 5% | 10% | 15% |

| Revenue Growth (YoY) | 10% | 15% | 20% |

| Customer Acquisition Cost | $500 | $400 | $350 |

| Customer Churn Rate | 5% | 3% | 2% |

This hypothetical comparison highlights Amwell’s relative position in the market. Competitor A and B demonstrate stronger market share and revenue growth, suggesting areas where Amwell might need to improve its competitiveness. Differences in business models and strategies, such as focusing on specific niches or employing different technologies, contribute to the variations in performance.

Future Outlook for Amwell Stock

The future of Amwell’s stock price depends on several factors, including its ability to capitalize on growth opportunities and navigate potential risks. The telehealth market is expected to continue expanding, presenting significant growth potential for Amwell. However, challenges such as increasing competition, regulatory changes, and maintaining profitability need to be addressed.

One potential scenario for the next 6 months could involve a moderate increase in Amwell’s stock price, driven by successful execution of its strategic initiatives and positive market sentiment. This scenario assumes continued growth in the telehealth market, successful product launches, and improved financial performance. However, factors such as unexpected regulatory changes or increased competition could negatively impact this projection.

Key Questions Answered: Amwell Stock Price Today

What are the major risks facing Amwell?

Major risks include increased competition, regulatory changes impacting the telehealth industry, and the potential for slower-than-expected growth in telehealth adoption.

How does Amwell compare to its competitors in terms of market share?

Amwell’s market share relative to competitors requires further research and analysis of publicly available data to accurately determine.

Where can I find real-time Amwell stock price updates?

Real-time stock price updates can be found on major financial websites and trading platforms such as Google Finance, Yahoo Finance, or Bloomberg.

What is Amwell’s current dividend payout, if any?

Information regarding Amwell’s dividend policy should be sought from official company announcements or reputable financial sources.