Understanding Stock Price Targets

Any stock price target – Stock price targets, predictions of a stock’s future price, are a crucial element in investment analysis. Understanding how these targets are derived, their limitations, and how to incorporate them into a broader investment strategy is vital for informed decision-making. This section explores the methodologies, influencing factors, and comparative analysis of various models used in determining stock price targets.

Stock Price Target Methodologies

Several methodologies are employed to determine stock price targets. These range from fundamental analysis, focusing on a company’s intrinsic value, to technical analysis, examining price charts and trends. Discounted cash flow (DCF) models project future cash flows and discount them to their present value, providing an intrinsic value estimate. Relative valuation methods compare a company’s metrics (e.g., price-to-earnings ratio) to its peers to derive a target price.

Technical analysis uses chart patterns and indicators to predict future price movements. A combination of these approaches is often used for a more comprehensive assessment.

Factors Influencing Stock Price Targets

Numerous factors influence stock price targets. Strong financial performance, including revenue growth, profitability, and efficient cash flow management, positively impacts targets. Favorable industry trends, such as increasing demand or technological advancements, can also boost targets. Conversely, economic downturns, rising interest rates, or increased competition can negatively influence price targets. Geopolitical events and regulatory changes also play significant roles.

Comparison of Stock Valuation Models, Any stock price target

Different valuation models offer varying levels of accuracy and applicability. DCF models are considered robust but require precise future cash flow projections, which can be challenging. Relative valuation is simpler but relies on comparable companies and market sentiment. Technical analysis is useful for short-term predictions but lacks a strong theoretical foundation. The choice of model depends on the investment horizon, the company’s characteristics, and the investor’s risk tolerance.

For example, a growth stock might be better analyzed using a DCF model, while a mature, dividend-paying stock might be better suited for relative valuation.

Sources of Stock Price Target Information

Reliable sources for stock price targets are crucial. It’s important to assess the credibility and potential biases of each source before making investment decisions.

Reputable Sources of Stock Price Targets

Source: medium.com

Reputable sources include financial news outlets like Bloomberg and Reuters, analyst reports from investment banks (e.g., Goldman Sachs, Morgan Stanley), and investment platforms such as Yahoo Finance or Google Finance. These sources often provide a range of price targets from multiple analysts, offering a more comprehensive view.

Evaluating Source Credibility

Criteria for evaluating credibility include the analyst’s track record, the methodology used, the depth of research, and the disclosure of potential conflicts of interest. Analysts with consistent accuracy and transparent methodologies are more reliable. It is also important to consider whether the source has a history of bias or a particular agenda.

Potential Biases in Stock Price Target Information

Sources may exhibit biases. Investment banks might provide overly optimistic targets to attract investment banking business from the companies they cover. News outlets may sensationalize targets to attract readers. Independent research firms may have their own biases, often related to their investment philosophy or clientele.

Interpreting and Utilizing Stock Price Targets

Stock price targets should be viewed as one piece of a larger investment puzzle, not the sole determinant of investment decisions. Understanding their limitations and incorporating them into a broader strategy is essential for effective risk management.

Limitations of Stock Price Targets

Stock price targets are inherently uncertain. Unexpected events can significantly impact a stock’s price, rendering targets inaccurate. Targets should be viewed as potential outcomes, not guarantees. Over-reliance on targets can lead to poor investment decisions.

Types of Stock Price Targets

Source: researchgate.net

| Target Type | Time Horizon | Methodology | Reliability |

|---|---|---|---|

| Short-Term | Less than 1 year | Technical Analysis, Sentiment Analysis | Lower |

| Medium-Term | 1-3 years | Combination of Fundamental and Technical Analysis | Moderate |

| Long-Term | More than 3 years | Discounted Cash Flow, Relative Valuation | Higher (but still uncertain) |

| Consensus Target | Varies | Average of multiple analyst targets | Potentially higher, but still subject to individual analyst biases |

Incorporating Stock Price Targets into Investment Strategy

A robust investment strategy involves diversifying across asset classes, conducting thorough due diligence, and managing risk effectively. Stock price targets can be one factor in the decision-making process, but they should be considered alongside other relevant information, such as financial statements, industry analysis, and macroeconomic conditions. Setting stop-loss orders to limit potential losses is crucial risk management.

Impact of Market Events on Stock Price Targets

Unexpected market events can significantly alter stock price targets. Understanding these potential impacts is critical for informed investment decisions.

Market Events and Their Impact on Stock Price Targets

- Economic Downturns: Generally lead to lower price targets across most sectors due to reduced consumer spending and business investment.

- Geopolitical Instability: Can create significant volatility and uncertainty, affecting targets depending on the industry and geographic exposure of the company.

- Regulatory Changes: New regulations can positively or negatively impact targets depending on their nature and the industry affected.

- Technological Disruptions: Can create significant opportunities or threats, drastically altering price targets for companies in affected industries.

- Natural Disasters: Can negatively impact targets for companies with operations in affected areas.

Company Responses to Changing Stock Price Targets

Companies may respond to changes in their stock price targets by adjusting their strategies. They might increase cost-cutting measures, accelerate innovation, or pursue mergers and acquisitions to improve their performance and regain investor confidence. Conversely, companies with consistently high price targets may choose to pursue expansion strategies.

Visual Representation of Stock Price Targets

Visual representations are essential for understanding the historical context of a stock’s price, its price target, and key events influencing its performance.

Visual Representation Narrative

A line graph can effectively display the historical stock price, the price target(s) as a horizontal line, and key events marked with annotations. The x-axis represents time, and the y-axis represents the stock price. Data points represent the daily or weekly closing price. Key events, such as earnings announcements, significant news, or market downturns, can be marked with vertical lines or annotations.

Different colors can be used to distinguish the stock price from the price target. Shaded areas could represent periods of economic expansion or contraction. This visual allows for a clear understanding of the stock’s price movement relative to its target, highlighting the impact of various events.

Types of Charts for Displaying Stock Price Targets

Line graphs are ideal for showing price trends over time. Bar charts can compare price targets from different analysts or over different time periods. Candlestick charts can provide additional information on daily price fluctuations and trading volume. The choice of chart depends on the specific information to be conveyed.

Stock Price Target Accuracy and Reliability

Assessing the accuracy and reliability of stock price targets is crucial for informed investment decisions. Understanding the factors influencing accuracy and the inherent margin of error is vital.

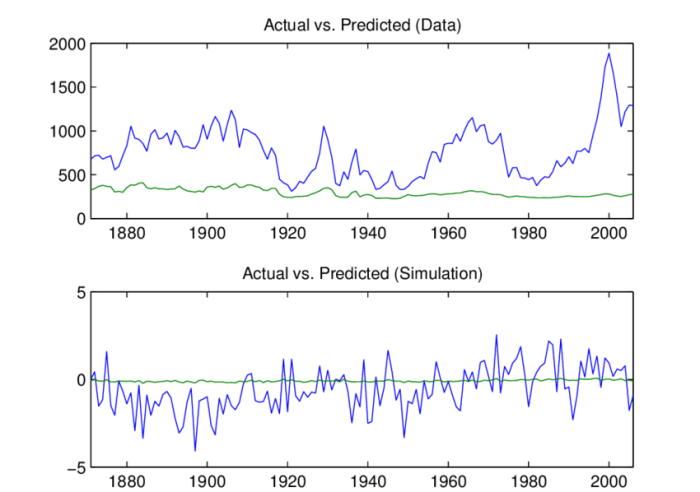

Accuracy of Stock Price Targets Over Time

The accuracy of stock price targets varies significantly depending on the source, the time horizon, and the market conditions. While some analysts consistently demonstrate higher accuracy, no source guarantees perfect predictions. Historical data on analyst accuracy can be analyzed to assess the reliability of different sources, but past performance is not necessarily indicative of future results.

Factors Contributing to Accuracy or Inaccuracy

Factors influencing accuracy include the quality of the underlying data, the sophistication of the models used, the accuracy of future projections, and the impact of unforeseen events. Overly optimistic or pessimistic biases can also lead to inaccuracies. The complexity of the market and the unpredictable nature of human behavior contribute to inherent limitations in accuracy.

Margin of Error in Stock Price Target Predictions

A margin of error is inherent in all stock price target predictions. This reflects the uncertainty associated with future events and the limitations of the models used. The wider the margin of error, the less reliable the target. Investors should consider this margin of error when making investment decisions.

FAQ Overview: Any Stock Price Target

How frequently are stock price targets updated?

The frequency of updates varies greatly depending on the source and the specific stock. Some analysts provide regular updates, perhaps monthly or quarterly, while others may only issue revisions when significant news or events impact the company’s prospects.

What is the difference between a price target and a price forecast?

While often used interchangeably, a price target typically represents a specific price level an analyst believes a stock will reach, while a price forecast may encompass a range of potential outcomes or probabilities.

Determining any stock price target requires careful consideration of various factors. A helpful resource for tracking real-time data, especially if you’re interested in a specific company, is checking the current figures; for example, you can readily find information on amazon stock price google finance. Ultimately, though, remember that any stock price target is just an estimate, and market fluctuations can significantly impact the actual outcome.

Are stock price targets always accurate?

No, stock price targets are not always accurate. They are inherently estimates based on various assumptions and models, and market conditions can change unexpectedly, rendering even the most carefully constructed targets inaccurate.

Should I invest solely based on a stock’s price target?

No, relying solely on a stock’s price target is highly risky. A comprehensive investment strategy should consider many factors, including fundamental analysis, risk tolerance, and diversification.