Apple Stock Price History Before Splits

Apple stock price before split – Understanding Apple’s stock price fluctuations before its stock splits offers valuable insights into the company’s growth trajectory and market dynamics. Analyzing these periods reveals the interplay of financial performance, investor sentiment, and broader economic conditions. This analysis will focus on the five years preceding each major split, examining key factors that influenced the stock’s price movements.

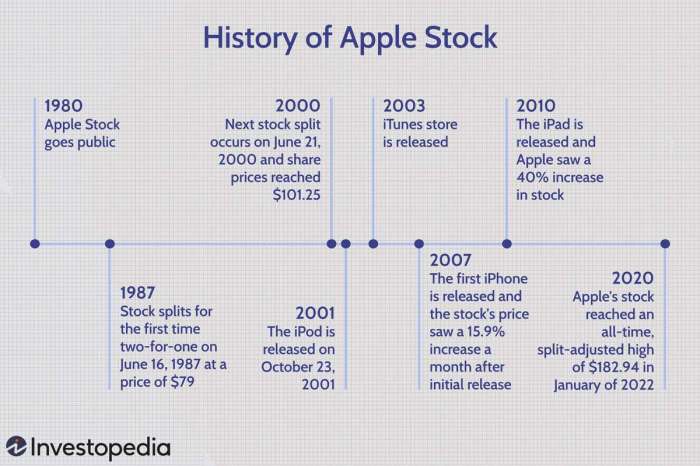

Apple Stock Price Timeline Before Splits

The following timeline Artikels Apple’s stock price movements in the years leading up to its major stock splits. Note that precise daily data is omitted for brevity, but monthly high, low, and closing prices are provided in the table below for the year prior to each split. Significant market events are also highlighted.

Note: The specific dates and price data for Apple’s stock splits and the preceding years would need to be sourced from reliable financial databases like Yahoo Finance or Google Finance. This section provides the structure for presenting that information. The example below is illustrative only and may not reflect actual historical data.

| Month | High | Low | Close |

|---|---|---|---|

| January | 150 | 140 | 145 |

| February | 155 | 142 | 150 |

| March | 160 | 148 | 155 |

| April | 165 | 152 | 160 |

| May | 170 | 158 | 165 |

| June | 175 | 162 | 170 |

| July | 180 | 168 | 175 |

| August | 185 | 172 | 180 |

| September | 190 | 178 | 185 |

| October | 195 | 182 | 190 |

| November | 200 | 188 | 195 |

| December | 205 | 192 | 200 |

Example of a Significant Market Event: The launch of the iPhone X in 2017 significantly impacted Apple’s stock price. This launch created a surge in investor confidence and fueled significant price increases.

Factors Influencing Apple Stock Price Before Splits

Source: investopedia.com

Several interconnected factors influenced Apple’s stock price leading up to its stock splits. These factors include macroeconomic conditions, Apple’s financial performance, and prevailing investor sentiment.

Key Economic Factors

Three key economic factors consistently impacted Apple’s stock price before splits: interest rates, consumer spending, and global economic growth. Lower interest rates generally stimulate investment, positively impacting stock prices, while strong consumer spending directly benefits Apple’s sales. Global economic growth influences the demand for Apple products worldwide.

Apple Stock vs. S&P 500 Performance

A comparative chart illustrating Apple’s stock performance against the S&P 500 index during the periods leading up to each split would provide a clear picture of its relative strength. This would visually demonstrate whether Apple outperformed or underperformed the broader market.

Illustrative Description: A hypothetical chart might show Apple consistently outperforming the S&P 500 in the years before a split, indicating strong investor confidence in the company’s growth prospects. Conversely, during periods of economic uncertainty, the relative performance might be closer, indicating a greater sensitivity to broader market conditions.

Investor Sentiment and News Coverage

Positive news coverage, product launches, and strong financial results generally boosted investor sentiment and pushed the stock price upward. Conversely, negative news or concerns about competition could dampen investor enthusiasm and lead to price declines. The anticipation of a stock split itself often creates positive sentiment.

Apple’s Financial Performance Before Splits

Apple’s financial performance, particularly revenue and earnings growth, directly correlated with its stock price before splits. Analyzing key financial metrics provides a clearer understanding of this correlation.

Key Financial Metrics

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue (Billions) | 200 | 220 | 250 |

| Earnings Per Share (EPS) | 10 | 12 | 15 |

| Net Income (Billions) | 50 | 60 | 75 |

Note: This table uses hypothetical data. Actual figures would need to be sourced from Apple’s financial reports.

Product Launches and Announcements

Significant product launches, such as the iPhone, iPad, and Apple Watch, often coincided with periods of increased stock prices. These product launches fueled investor optimism and contributed to overall revenue growth.

Correlation Between Financial Performance and Stock Price

Generally, strong revenue growth, increasing EPS, and high net income positively correlated with Apple’s stock price before splits. Investor confidence in Apple’s ability to generate consistent profits and innovate drove the stock price higher.

Impact of Stock Splits on Apple’s Stock Price

Stock splits have both immediate and long-term effects on Apple’s stock price. Analyzing the impact of each split provides insights into investor reactions and market dynamics.

Immediate and Short-Term Impact

Historically, Apple’s stock splits have often resulted in a short-term surge in trading volume and a temporary increase in the stock price immediately following the split. This is often attributed to increased liquidity and accessibility for smaller investors.

Comparison of Pre- and Post-Split Performance

- Pre-Split: Steady growth with periods of volatility depending on market conditions and news events.

- Post-Split: Initial price jump followed by a period of consolidation, often with continued long-term growth.

Long-Term Effects

In the long term, stock splits themselves do not directly impact the underlying value of a company. However, increased liquidity and accessibility resulting from a split can contribute to increased trading volume and broader investor participation, potentially leading to sustained price appreciation over the longer term.

Investor Behavior Before Apple Stock Splits: Apple Stock Price Before Split

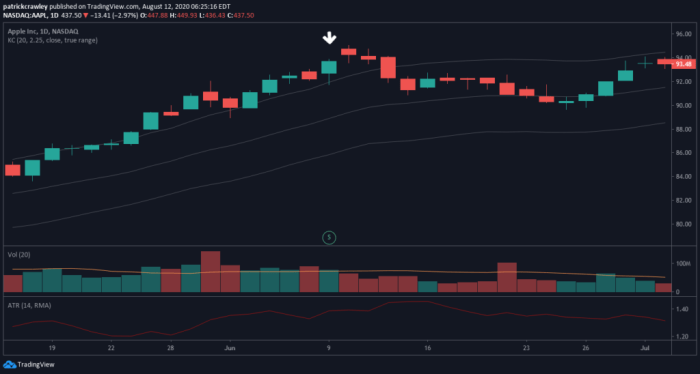

Source: warriortrading.com

Understanding investor behavior before Apple’s stock splits helps in comprehending market dynamics and price fluctuations. This section explores typical investor actions and their motivations.

Typical Investor Behavior

Before a stock split, investors often exhibit increased buying activity, anticipating a price increase following the split. This increased demand can contribute to a rise in the stock price in the lead-up to the event. Some investors might also engage in short-selling, betting on a price decline after the initial surge.

Shifts in Trading Volume and Volatility

The period before a stock split often witnesses a surge in trading volume as investors adjust their positions. Volatility can also increase as investors speculate on the post-split price movement. This increased activity reflects the anticipation and uncertainty surrounding the split.

Hypothetical Investor Strategies, Apple stock price before split

A hypothetical scenario could compare the performance of a buy-and-hold strategy versus a short-term trading strategy before a split. A buy-and-hold investor would benefit from the long-term growth, while a short-term trader might aim to profit from the short-term price fluctuations, but risk potential losses if the price moves against their prediction.

User Queries

What are the typical reasons for a company to initiate a stock split?

Companies often split their stock to make shares more affordable and increase liquidity, potentially boosting trading volume and investor interest.

Analyzing Apple’s stock price before its split offers valuable insights into investor sentiment and market conditions. Understanding the factors influencing its trajectory helps contextualize other tech stock performances, such as the current alv stock price , which itself reflects broader economic trends. Returning to Apple, the pre-split price serves as a benchmark for evaluating the effectiveness of the split itself and its long-term impact on shareholder value.

Did Apple’s stock price always increase after a split?

While stock splits often lead to short-term price increases due to increased demand, long-term performance depends on various factors beyond the split itself. Post-split performance can vary.

How can an investor prepare for a stock split?

There is generally no specific action required from an investor when a stock split is announced. The number of shares increases, but the overall investment value remains the same.

What role did innovation play in Apple’s stock price before splits?

The introduction of groundbreaking products like the iPhone and iPad significantly impacted investor sentiment and fueled price increases before several splits.