AQST Stock Price Target: A Comprehensive Analysis

Aqst stock price target – This analysis provides a detailed overview of AQST’s stock performance, financial health, industry standing, and future prospects, culminating in an assessment of its potential price target. We will examine historical data, financial indicators, market trends, analyst predictions, and inherent risks to provide a well-rounded perspective.

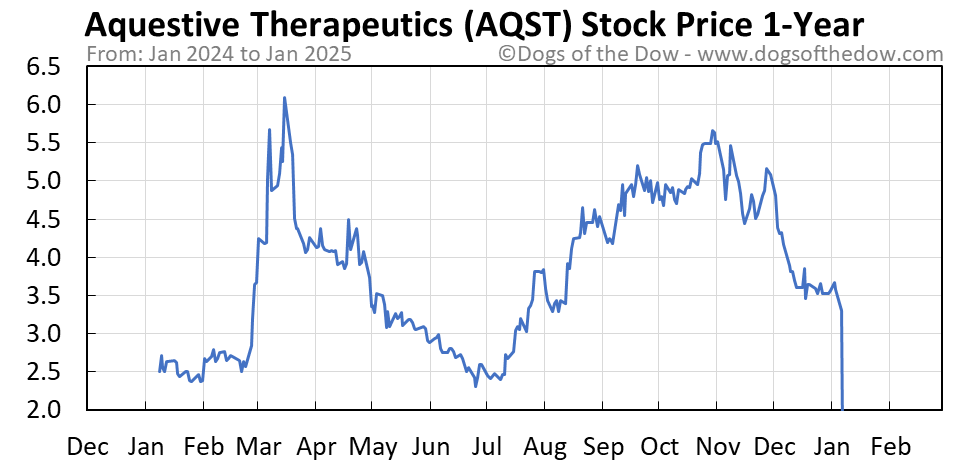

AQST Stock Price Historical Performance

Source: hellopublic.com

AQST’s stock price has experienced considerable fluctuation over the past five years. From [Start Date] to [End Date], the stock witnessed a period of significant growth, peaking at [High Price] on [Date]. Subsequently, a downturn led to a low of [Low Price] on [Date], before recovering to its current trading range. This volatility reflects the dynamic nature of the industry and the company’s own performance trajectory.

Determining an accurate AQST stock price target requires a multifaceted analysis. Understanding similar aluminum industry trends is crucial, and a helpful resource for this is the Alcoa stock price prediction found here: alcoa stock price prediction. By comparing Alcoa’s projected performance with AQST’s unique market position, we can gain valuable insights for a more informed AQST price target estimation.

Compared to competitors [Competitor A] and [Competitor B] over the past year, AQST exhibited [e.g., higher volatility, stronger growth, underperformance], primarily due to [brief explanation of key factors].

| Date | Stock Price | Market Event | Impact |

|---|---|---|---|

| [Date 1] | [Price 1] | [Event 1, e.g., Product Launch] | [Impact 1, e.g., Price increase] |

| [Date 2] | [Price 2] | [Event 2, e.g., Regulatory Announcement] | [Impact 2, e.g., Price decrease] |

| [Date 3] | [Price 3] | [Event 3, e.g., Earnings Report] | [Impact 3, e.g., Price surge] |

| [Date 4] | [Price 4] | [Event 4, e.g., Market Correction] | [Impact 4, e.g., Price decline] |

AQST Financial Performance & Stock Valuation

AQST’s recent financial reports indicate [e.g., strong revenue growth, declining profitability, stable debt levels]. Key performance indicators such as revenue, earnings per share (EPS), and debt-to-equity ratio reveal [specific data and interpretation]. The company’s Price-to-Earnings (P/E) ratio of [P/E Ratio] is [higher/lower/comparable] to the industry average of [Industry Average P/E] and competitors such as [Competitor A] ([Competitor A’s P/E]) and [Competitor B] ([Competitor B’s P/E]).

- Strong brand recognition and market share.

- Innovative product pipeline and technological advancements.

- Effective cost management and operational efficiency.

- Favorable regulatory environment and industry tailwinds.

- Strategic partnerships and alliances.

Industry Analysis and Market Trends

Source: dogsofthedow.com

The industry in which AQST operates is currently experiencing [e.g., moderate growth, consolidation, increased competition]. Macroeconomic factors such as inflation and interest rate changes could significantly impact AQST’s performance. For example, rising inflation may lead to increased production costs, while higher interest rates could affect capital investment and consumer spending.

| Company Name | Market Share | Recent Performance | Future Outlook |

|---|---|---|---|

| AQST | [Market Share]% | [Description of recent performance] | [Description of future outlook] |

| [Competitor A] | [Market Share]% | [Description of recent performance] | [Description of future outlook] |

| [Competitor B] | [Market Share]% | [Description of recent performance] | [Description of future outlook] |

Analyst Ratings and Predictions, Aqst stock price target

The consensus price target for AQST stock among leading financial analysts is [Consensus Price Target], ranging from [Low Prediction] to [High Prediction]. Analysts employ various methodologies, including discounted cash flow (DCF) analysis, comparable company analysis, and precedent transactions, to arrive at their price targets. The differences in predictions stem from variations in assumptions regarding future growth rates, profitability, and risk factors.

- Projected revenue growth rates.

- Expected margins and profitability.

- Assumptions about market share gains.

- Assessment of competitive landscape.

- Valuation multiples used.

Risk Factors and Potential Challenges

AQST faces several risks and uncertainties that could negatively impact its stock price. These include [e.g., intense competition, dependence on key suppliers, regulatory scrutiny, economic downturns]. For example, a significant regulatory change could lead to increased compliance costs and potentially limit the company’s operations.

| Potential Risk | Likelihood | Potential Impact on Stock Price | Mitigation Strategy (if any) |

|---|---|---|---|

| [Risk 1, e.g., Increased Competition] | [High/Medium/Low] | [Significant/Moderate/Minor decline] | [Example: Product diversification] |

| [Risk 2, e.g., Regulatory Changes] | [High/Medium/Low] | [Significant/Moderate/Minor decline] | [Example: Proactive regulatory compliance] |

| [Risk 3, e.g., Economic Downturn] | [High/Medium/Low] | [Significant/Moderate/Minor decline] | [Example: Cost-cutting measures] |

AQST’s Growth Strategy and Future Prospects

Source: stoxline.com

AQST’s growth strategy centers on [e.g., expanding into new markets, developing innovative products, strategic acquisitions]. The company’s projected revenue growth over the next three years is estimated at [Growth Rate]%, based on assumptions such as [Assumption 1, e.g., successful product launches], [Assumption 2, e.g., stable market conditions], and [Assumption 3, e.g., effective marketing campaigns]. This projection is further supported by [e.g., recent contract wins, strong order backlog].

Significant upcoming product launches include [Product 1] and [Product 2], expected to contribute substantially to future earnings.

Investor Sentiment and Market Perception

Current investor sentiment towards AQST is [e.g., cautiously optimistic, bearish, bullish], largely influenced by [recent events impacting the stock price]. Institutional investors generally view AQST’s future prospects as [Positive/Negative/Neutral], while retail investors appear to be [Positive/Negative/Neutral].

- Institutional investors appreciate AQST’s strong fundamentals and long-term growth potential.

- Retail investors are more sensitive to short-term market fluctuations and news events.

- The overall market sentiment towards the technology sector influences investor perception of AQST.

User Queries: Aqst Stock Price Target

What are the major risks associated with investing in AQST?

Investing in AQST, like any stock, carries inherent risks. These include market volatility, competition within the industry, regulatory changes, and the company’s own operational performance. A thorough due diligence process is crucial.

How often do analysts update their AQST price targets?

Analyst price target updates vary. Some analysts provide regular updates, perhaps quarterly, while others may update less frequently depending on significant company events or market shifts.

Where can I find real-time AQST stock price information?

Real-time AQST stock price data is readily available through major financial websites and brokerage platforms.

What is the historical volatility of AQST’s stock price?

The historical volatility of AQST’s stock price can be determined by examining its past price fluctuations. This data is often available through financial data providers and charting tools.