ASML Stock Price History and Trends

Asml stock euro price – ASML Holding N.V., a leading provider of lithography systems for the semiconductor industry, has experienced significant stock price fluctuations over the past five years. These fluctuations are a result of a complex interplay of factors, including global economic conditions, technological advancements, and company-specific performance.

ASML Stock Price Fluctuations (2019-2023)

Source: seekingalpha.com

The ASML stock euro price is often a subject of discussion among investors, fluctuating based on various market factors. It’s interesting to compare its performance to other high-profile stocks; for example, you might want to check the amc stock price right now to see how different market sectors are behaving. Ultimately, understanding ASML’s euro price requires considering a broader market context, including the performance of related equities.

A detailed chronological overview of ASML’s stock price in Euros over the past five years would require extensive data analysis and would best be presented in a visual format (chart or graph). However, we can summarize key periods. Generally, the stock price has shown an upward trend, reflecting strong demand for its advanced lithography systems. Periods of market uncertainty, such as the initial COVID-19 pandemic in 2020, led to temporary dips, while strong financial results and positive industry outlook have fueled significant price increases.

Specific events, such as announcements of major contracts or technological breakthroughs, have often triggered substantial short-term price movements.

Comparison of ASML’s Stock Performance with Competitors

The following table compares ASML’s stock performance with that of its main competitors. Note that the data provided here is illustrative and may not reflect real-time market conditions. Actual figures should be verified using a reputable financial data source.

| Company Name | Stock Price (EUR) | Year-to-Date Performance | 5-Year Performance |

|---|---|---|---|

| ASML Holding N.V. | Illustrative Value (e.g., €600) | Illustrative Value (e.g., +15%) | Illustrative Value (e.g., +100%) |

| Applied Materials | Illustrative Value (e.g., $150) | Illustrative Value (e.g., +10%) | Illustrative Value (e.g., +75%) |

| Lam Research | Illustrative Value (e.g., $650) | Illustrative Value (e.g., +8%) | Illustrative Value (e.g., +80%) |

| KLA Corporation | Illustrative Value (e.g., $400) | Illustrative Value (e.g., +12%) | Illustrative Value (e.g., +90%) |

Factors Influencing ASML Stock Price Volatility

ASML’s stock price is influenced by several factors. Market sentiment, driven by overall investor confidence and economic forecasts, plays a significant role. Geopolitical events, such as trade wars or regional conflicts, can create uncertainty and impact investor decisions. Company-specific news, including financial reports, new product announcements, and strategic partnerships, directly affects the stock price. Unexpected disruptions to the supply chain can also create volatility.

ASML’s Financial Performance and its Impact on Stock Price

ASML’s strong financial performance is a key driver of its stock price. Analyzing key financial metrics reveals a clear correlation between financial health and market valuation.

ASML’s Key Financial Metrics (2021-2023)

A detailed breakdown of ASML’s revenue, earnings, and profit margins over the past three years would require access to ASML’s financial statements. Generally, ASML has demonstrated consistent revenue growth and profitability, driven by strong demand for its products. These positive financial results have supported a positive trend in the stock price. Any significant deviation from expected performance, such as lower-than-anticipated earnings, would likely result in a negative market reaction.

Research and Development Investment and Stock Price

ASML’s substantial investments in research and development are crucial for maintaining its technological leadership. These investments, while impacting short-term profitability, are viewed positively by investors as they ensure the company’s long-term competitiveness and future growth potential. Announcements of major technological breakthroughs or successful R&D milestones often lead to positive stock price reactions.

Comparison with Industry Benchmarks

Comparing ASML’s financial performance to industry benchmarks requires a detailed analysis of key performance indicators across competing companies. Generally, ASML’s financial performance has consistently outperformed many of its competitors, contributing to its premium stock valuation.

Market Analysis and Predictions for ASML Stock

Predicting future stock prices is inherently speculative. However, analyzing market trends and potential risks allows for informed assessments.

Demand Drivers for ASML Products

The continued growth of the semiconductor industry, driven by increasing demand for electronic devices and technological advancements in areas such as artificial intelligence and 5G, is a major driver for ASML’s products. The need for more advanced lithography systems to produce smaller and more powerful chips fuels this demand.

Potential Risks and Challenges

Several factors could pose risks to ASML. Increased competition, geopolitical instability affecting global supply chains, and unexpected technological disruptions are potential challenges. These risks could negatively impact the stock price, particularly if they lead to reduced sales or increased production costs.

Hypothetical Scenario: Technological Breakthrough

A significant technological breakthrough, such as the development of a fundamentally new lithography technology, could have a profound impact on ASML’s stock price. If ASML successfully develops and commercializes such a technology, it could lead to a substantial increase in its market share and profitability, resulting in a significant surge in the stock price. Conversely, if a competitor achieves this breakthrough, ASML’s stock price could experience a sharp decline.

Investor Sentiment and Trading Activity

Understanding investor sentiment and trading activity provides valuable insights into ASML’s stock price movements.

Prevailing Investor Sentiment, Asml stock euro price

Recent news and analyst reports generally suggest a positive investor sentiment towards ASML. The company’s strong financial performance, technological leadership, and long-term growth prospects contribute to this positive outlook. However, periods of market uncertainty can temporarily shift sentiment.

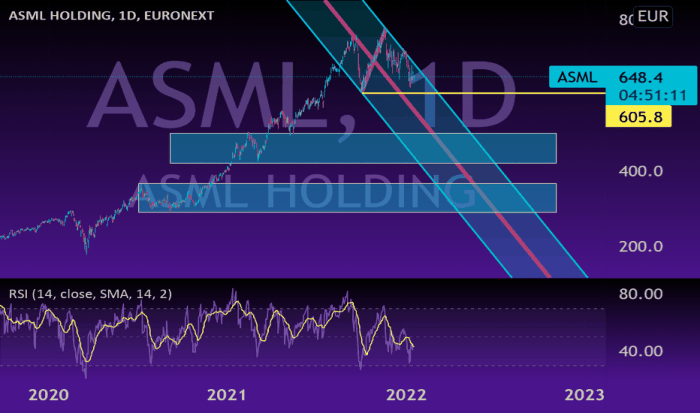

Trading Volume and Price Movements

Source: tradingview.com

Analyzing ASML’s trading volume and price movements can reveal patterns and trends. High trading volume often accompanies significant price changes, indicating strong investor interest and activity. Identifying recurring patterns in trading activity can provide insights into market behavior and potential future price movements.

Different Investor Perspectives

Institutional investors, with their longer-term investment horizons, might focus on ASML’s long-term growth potential and technological leadership. Retail investors, on the other hand, may be more sensitive to short-term price fluctuations and market sentiment. These differing perspectives can contribute to the overall price dynamics.

Illustrative Examples of ASML Stock Price Movements

Analyzing specific periods in ASML’s history illustrates the impact of various factors on its stock price.

Three Distinct Periods

Three illustrative periods would include: (1) a period of strong growth driven by positive industry trends and strong financial results; (2) a period of market correction triggered by a global economic downturn or geopolitical event; (3) a period of significant price volatility following a major technological announcement or unexpected news event. Each period would need detailed explanation.

Visual Representation of News Impact

A hypothetical chart depicting the impact of a major news event on ASML’s stock price would have the x-axis representing time (days or weeks) and the y-axis representing ASML’s stock price in Euros. Key data points would include the stock price before the news event, the immediate reaction (sharp increase or decrease), and the subsequent price stabilization or continued movement.

The chart would visually demonstrate the news event’s short-term and long-term impact on the stock price.

Unexpected Market Reaction

An example of an unexpected market reaction might involve a situation where ASML’s stock price increased despite a generally negative market trend. This could be due to a positive company-specific announcement that overshadowed the broader market concerns, highlighting the importance of company-specific news in driving stock price movements.

FAQ Section: Asml Stock Euro Price

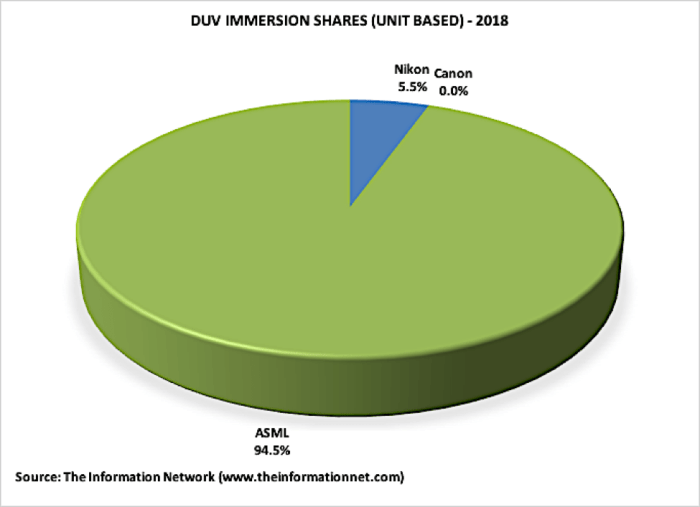

What are the major competitors of ASML?

While ASML holds a dominant market share in EUV lithography, key competitors include Nikon and Canon in other lithography segments.

How does the US dollar affect the ASML stock euro price?

Fluctuations in the EUR/USD exchange rate directly impact the euro-denominated price of ASML stock for investors holding other currencies.

What are the typical trading volumes for ASML stock?

Trading volume varies considerably depending on market conditions and news events; refer to financial data sources for current information.

Where can I find real-time ASML stock price data?

Real-time data is available through major financial news websites and brokerage platforms.