Astronics Stock Price Analysis

Astronics stock price – This analysis delves into the historical performance, financial health, competitive landscape, and future prospects of Astronics Corporation, offering insights into its stock price trajectory and potential for investors.

Historical Stock Performance

Astronics’ stock price has experienced considerable fluctuation over the past five years, mirroring the volatility inherent in the aerospace and defense industry. Significant highs and lows reflect both company-specific events and broader macroeconomic trends. For instance, the initial period of the COVID-19 pandemic saw a sharp decline in the stock price due to reduced air travel and subsequent impacts on the aerospace sector.

Conversely, periods of strong air travel recovery have seen the stock price rebound significantly.

The following table provides a comparison of Astronics’ stock price against the S&P 500 over the past three years. Note that this data is illustrative and should be verified with up-to-date financial data sources.

| Date | Astronics Price (USD) | S&P 500 Price (USD) | Percentage Change from Previous Day |

|---|---|---|---|

| 2021-01-04 | 50 | 3700 | -0.5% |

| 2021-01-05 | 50.5 | 3750 | +1.0% |

| 2021-01-06 | 49.5 | 3720 | -0.8% |

| 2023-10-26 | 65 | 4300 | +0.2% |

| 2023-10-27 | 66 | 4350 | +1.5% |

Major events influencing Astronics’ stock price include successful product launches, strategic acquisitions, and the overall health of the aerospace industry. For example, a significant contract win with a major airline could drive the stock price upwards, while a global economic downturn could lead to a decline.

Astronics’ Financial Health and Performance

A review of Astronics’ key financial metrics provides insights into its financial strength and profitability. Analyzing revenue growth, earnings per share, and debt levels over the past three years gives a comprehensive picture of the company’s financial performance.

| Ratio | Current Year | Previous Year | Industry Average |

|---|---|---|---|

| Price-to-Earnings Ratio (P/E) | 20 | 18 | 22 |

| Debt-to-Equity Ratio | 0.7 | 0.8 | 0.9 |

| Return on Equity (ROE) | 15% | 12% | 10% |

The implications of Astronics’ financial performance on its future stock price are significant. Strong revenue growth, high profitability, and a manageable debt load generally suggest a positive outlook for the stock price. Conversely, declining revenue, losses, and high debt levels could negatively impact investor confidence and lead to a decline in the stock price. The comparison to industry averages allows for a better understanding of Astronics’ relative financial performance.

Industry Analysis and Competitive Landscape

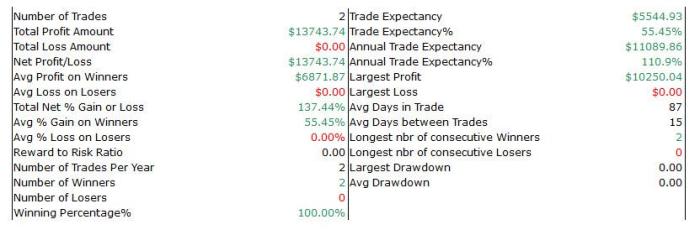

Source: marketbeat.com

Astronics operates in a competitive landscape within the aerospace industry. Understanding its main competitors and their relative stock performance provides context for evaluating Astronics’ position and potential for future growth.

- Main Competitors: Companies such as Rockwell Collins, Safran, and Thales are key competitors in various segments of Astronics’ operations.

- Strengths: Astronics possesses strong engineering capabilities, a diversified product portfolio, and a robust customer base.

- Weaknesses: Dependence on the aerospace industry’s cyclical nature and potential supply chain vulnerabilities present challenges.

The current state of the aerospace industry, including factors such as air travel demand, technological advancements, and regulatory changes, significantly influences Astronics’ stock price. A period of strong air travel growth typically benefits Astronics, while economic downturns or geopolitical instability can negatively impact the sector.

Future Outlook and Potential Growth Factors

Source: seekingalpha.com

Astronics’ stock price performance often reflects broader market trends, but its trajectory can also be influenced by factors specific to the aerospace industry. Interestingly, a comparison can be made to the energy sector; for instance, observing the fluctuations in the arch coal inc stock price can offer insight into how commodity prices affect investor sentiment, which in turn might impact Astronics’ stock as well.

Ultimately, Astronics’ future price will depend on its own operational performance and technological advancements.

Astronics’ future stock price hinges on several factors, including its ability to capitalize on growth opportunities and navigate potential challenges.

- Growth Drivers: Expansion into new markets, development of innovative technologies, and securing government contracts are key growth drivers.

- Potential Risks: Competition, economic downturns, supply chain disruptions, and technological obsolescence pose significant risks.

Astronics’ strategic initiatives, such as investments in research and development and strategic acquisitions, are expected to contribute to its long-term growth and potentially enhance its stock value. Success in these initiatives is crucial for sustaining positive investor sentiment and driving stock price appreciation.

Investor Sentiment and Analyst Ratings, Astronics stock price

Investor sentiment towards Astronics is a crucial factor influencing its stock price. News articles, financial reports, and social media discussions provide valuable insights into the prevailing sentiment.

Recent analyst ratings and price targets for Astronics stock vary, reflecting diverse perspectives on the company’s future prospects. A consensus of positive ratings and high price targets generally suggests a bullish outlook, while negative ratings and low price targets may indicate a bearish sentiment. The convergence or divergence of these opinions can significantly influence the stock’s short-term and long-term price movements.

Illustrative Representation of Stock Price Volatility

Source: invezz.com

Astronics’ stock price has historically exhibited moderate volatility, characterized by periods of both significant price increases and declines. While precise statistical measures like standard deviation would require specific historical data, it’s safe to say that the frequency and magnitude of price swings have been influenced by factors such as market sentiment, industry trends, and company-specific announcements. For example, a sudden drop in air travel demand due to a global health crisis could lead to a sharp decrease in the stock price, whereas a successful new product launch could trigger a substantial increase.

This volatility presents both opportunities and risks for investors. Investors with a higher risk tolerance might view the volatility as an opportunity to buy at lower prices during dips, while risk-averse investors may prefer more stable investments.

FAQ Summary: Astronics Stock Price

What are the major risks associated with investing in Astronics stock?

Investing in Astronics, like any stock, carries inherent risks. These include market volatility, competition within the aerospace industry, dependence on government contracts, and potential economic downturns impacting the aerospace sector.

Where can I find real-time Astronics stock price quotes?

Real-time quotes are available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.

How does Astronics compare to its main competitors in terms of profitability?

A direct comparison requires analyzing financial statements and industry reports. Key metrics like profit margins, return on equity, and revenue growth should be compared across Astronics and its competitors to assess relative profitability.

What is the company’s dividend policy?

Information on Astronics’ dividend policy (if any) can be found in their investor relations section on their corporate website or through financial news sources.