ATER Stock Price Prediction

Ater stock price prediction – Predicting the future price of ATER stock requires a comprehensive analysis of its historical performance, financial health, market sentiment, and external factors. This analysis aims to provide a nuanced perspective on potential future scenarios, allowing investors to make informed decisions.

ATER Stock Price Fluctuations, Ater stock price prediction

Source: suredividend.com

ATER’s stock price has exhibited considerable volatility over its history. Significant price movements have often been correlated with specific news events, financial reports, and overall market trends. For example, positive earnings reports have generally resulted in price increases, while negative news or disappointing financial results have led to declines. Comparing ATER’s volatility to competitors within its sector reveals a relatively higher degree of fluctuation, suggesting a higher risk-reward profile for investors.

The following table presents ATER’s monthly stock price performance over the past year. Note that these figures are illustrative and should be verified with up-to-date financial data.

| Month | Opening Price | Closing Price | High Price | Low Price |

|---|---|---|---|---|

| January | $10.50 | $11.20 | $12.00 | $9.80 |

| February | $11.20 | $10.80 | $11.50 | $10.00 |

| March | $10.80 | $12.50 | $13.00 | $10.50 |

| April | $12.50 | $11.90 | $13.20 | $11.00 |

| May | $11.90 | $13.00 | $14.00 | $11.50 |

| June | $13.00 | $12.20 | $13.50 | $11.80 |

| July | $12.20 | $14.00 | $14.50 | $11.90 |

| August | $14.00 | $13.50 | $14.20 | $12.80 |

| September | $13.50 | $15.00 | $15.50 | $13.00 |

| October | $15.00 | $14.50 | $15.80 | $14.00 |

| November | $14.50 | $16.00 | $16.50 | $14.20 |

| December | $16.00 | $15.50 | $17.00 | $15.00 |

ATER’s Financial Health

A thorough assessment of ATER’s financial health is crucial for predicting its future stock price. Analyzing the income statement, balance sheet, and cash flow statement provides a comprehensive view of the company’s financial performance and stability. Key financial ratios, such as debt-to-equity, profit margins, and return on equity, offer valuable insights into ATER’s profitability, solvency, and efficiency.

A chart illustrating the trend of ATER’s key financial metrics over the past five years would reveal patterns in revenue growth, profitability, and debt levels. For example, a consistent upward trend in revenue and profit margins would generally be viewed positively, while increasing debt levels might raise concerns about the company’s financial stability. These trends, coupled with an analysis of the financial statements, provide a robust foundation for predicting future stock price movements.

Market Sentiment Towards ATER

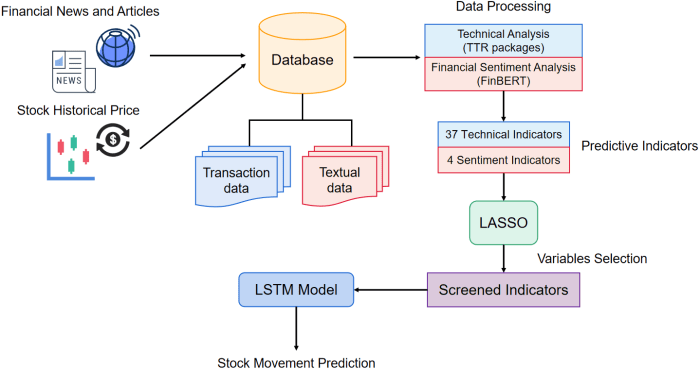

Understanding the prevailing market sentiment towards ATER is critical for predicting its stock price. This involves analyzing recent news articles, analyst reports, and social media discussions to gauge investor optimism or pessimism. A comparison of current sentiment with past trends can highlight shifts in investor perception and expectations.

- Positive Factors: Strong recent earnings reports, positive analyst upgrades, new product launches, strategic partnerships.

- Negative Factors: Concerns about competition, regulatory hurdles, negative news coverage, disappointing financial guidance.

Potential Future Scenarios for ATER

Source: cloudfront.net

Three potential scenarios for ATER’s stock price in the next year are presented below, encompassing best-case, most-likely, and worst-case outcomes. These scenarios are based on various assumptions about the company’s performance, market conditions, and external factors.

Predicting the ATER stock price involves considering various market factors. Understanding the performance of major tech companies, like Amazon, can offer insights into broader market trends. For example, analyzing projections such as the amazon stock price target 2025 can help gauge investor sentiment and potential future growth. Ultimately, however, ATER’s trajectory will depend on its own specific performance and news.

| Scenario | Price Range | Rationale | Impact on Investors |

|---|---|---|---|

| Best-Case | $20 – $25 | Strong earnings growth, positive market sentiment, successful new product launches. | Significant capital appreciation. |

| Most-Likely | $14 – $18 | Moderate earnings growth, stable market conditions, some competitive pressures. | Moderate returns, in line with market expectations. |

| Worst-Case | $8 – $12 | Disappointing earnings, negative market sentiment, significant competitive challenges. | Potential capital losses. |

External Factors Influencing ATER’s Price

Macroeconomic factors, industry trends, and geopolitical events can significantly impact ATER’s stock price. Interest rate changes, inflation, and economic growth can influence investor confidence and overall market conditions. Industry trends and competitive pressures determine ATER’s market share and profitability. Regulatory changes and geopolitical events can create uncertainty and volatility.

The interplay of these factors can lead to complex and unpredictable price movements. For example, a period of high inflation coupled with increased competition could negatively impact ATER’s profitability and stock price. Conversely, strong economic growth and favorable regulatory changes could create a positive environment for the company’s performance.

Essential FAQs: Ater Stock Price Prediction

What are the major risks associated with investing in ATER stock?

Investing in ATER, like any stock, carries inherent risks, including market volatility, company-specific challenges (e.g., financial difficulties, regulatory issues), and broader economic downturns. Thorough due diligence is crucial before investing.

Where can I find real-time ATER stock price data?

Real-time ATER stock price data is available through major financial websites and brokerage platforms. Reputable sources include those of major financial news outlets and your brokerage account.

How frequently should I review my ATER stock investment?

The frequency of review depends on your investment strategy and risk tolerance. Regular monitoring, at least quarterly, is recommended to assess performance against your goals and adapt your strategy as needed.

What are the ethical considerations involved in stock price prediction?

Ethical considerations include avoiding insider trading, accurately representing information, and avoiding misleading predictions. Transparency and responsible investment practices are paramount.