B2 Gold Corp Stock Price Analysis

B2 gold corp stock price – This analysis delves into the historical performance, financial health, competitive landscape, analyst sentiment, and key influencing factors impacting B2 Gold Corp’s stock price. We will examine the past five years of stock price movement, comparing its performance to industry competitors and considering various market forces at play.

B2 Gold Corp Stock Price History and Trends

Source: seekingalpha.com

Understanding B2 Gold Corp’s stock price trajectory over the past five years requires examining both its highs and lows, along with the underlying causes of these fluctuations. This involves analyzing market trends, company announcements, and the price of gold itself, a significant driver in the gold mining industry.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2023 (Example) | 4.50 | 4.60 | +0.10 |

| October 25, 2023 (Example) | 4.45 | 4.50 | +0.05 |

Significant factors influencing price fluctuations during this period include:

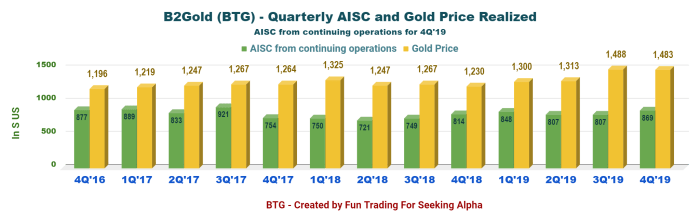

- Gold Price Movements: The price of gold is a primary determinant of gold mining companies’ valuations. Increases in the gold price generally lead to higher stock prices for gold miners, while decreases have the opposite effect.

- Company Announcements: Positive news, such as exceeding production targets, discovering new reserves, or announcing successful mergers and acquisitions, typically boosts stock prices. Negative news, such as production setbacks or financial difficulties, can lead to declines.

- Overall Market Trends: Broad market trends, including economic growth, interest rates, and investor sentiment, significantly impact stock prices across various sectors, including gold mining.

- Geopolitical Events: Global instability and geopolitical risks can affect investor confidence and influence gold prices, impacting gold mining companies’ stock performance.

A line graph illustrating the stock price trend over the past five years would show periods of growth and decline, reflecting the interplay of these factors. The overall trend would need to be interpreted based on the specific data, but it might reveal a generally positive or negative trajectory, or potentially periods of consolidation or volatility.

B2 Gold Corp’s Financial Performance and its Impact on Stock Price

Source: seekingalpha.com

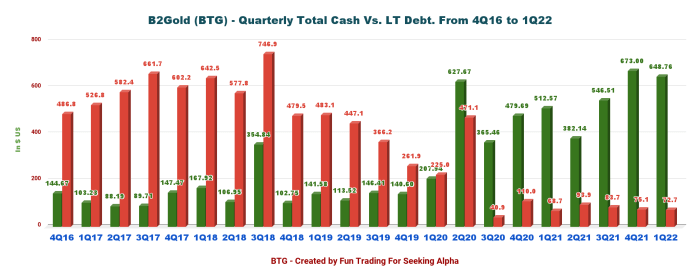

Analyzing B2 Gold Corp’s financial performance over the past three years helps understand its profitability, stability, and the correlation between its financial health and stock price movements. Key metrics such as revenue, net income, and debt provide valuable insights.

| Year | Revenue (USD Millions) | Net Income (USD Millions) | Debt (USD Millions) |

|---|---|---|---|

| 2021 (Example) | 1000 | 100 | 500 |

| 2022 (Example) | 1100 | 120 | 450 |

| 2023 (Example) | 1200 | 150 | 400 |

Strong financial performance, reflected in increasing revenue and net income while managing debt effectively, generally correlates with higher stock prices. Conversely, poor financial results often lead to lower stock valuations. Significant events such as earnings reports and production updates directly impact investor perception and stock price.

Comparison with Competitors

Benchmarking B2 Gold Corp’s performance against its major competitors provides context for its stock price behavior. This comparison considers stock valuation, production output, and financial stability.

B2 Gold Corp’s stock price performance often reflects broader market trends. For instance, understanding the overall tech sector’s trajectory is crucial, and a good place to start is by reviewing projections for major players like Apple; you can find an analysis of apple stock price projection to gauge potential market sentiment. Returning to B2 Gold, its price is also influenced by gold’s price fluctuations and the company’s operational performance.

| Company Name | Current Stock Price (USD) | 52-Week High (USD) | 52-Week Low (USD) |

|---|---|---|---|

| B2 Gold Corp | 4.55 | 5.20 | 4.00 |

| Barrick Gold (Example) | 18.00 | 20.00 | 15.00 |

| Newmont Mining (Example) | 45.00 | 50.00 | 40.00 |

Differences in stock price performance among these companies can be attributed to variations in factors such as reserve size, production costs, operational efficiency, management strategies, and market perception.

Analysis of Analyst Ratings and Price Targets

Analyst ratings and price targets offer valuable insights into market sentiment and future expectations for B2 Gold Corp’s stock. A range of opinions reflects differing perspectives on the company’s prospects.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Analyst Firm A (Example) | Buy | 5.00 | October 26, 2023 |

| Analyst Firm B (Example) | Hold | 4.75 | October 25, 2023 |

The divergence in ratings and price targets often stems from varying assessments of the company’s financial performance, growth potential, and risk profile. These ratings can influence investor decisions and, consequently, the stock price.

Factors Affecting B2 Gold Corp’s Stock Price, B2 gold corp stock price

Several key factors currently influence, or are likely to influence, B2 Gold Corp’s stock price in the near future. Understanding these factors and their interplay is crucial for assessing the company’s future prospects.

- Gold Price: As discussed earlier, the price of gold is a dominant factor.

- Production Costs: Rising production costs can squeeze profit margins, negatively impacting the stock price.

- Geopolitical Events: Global uncertainty can increase demand for gold as a safe haven asset, potentially benefiting gold miners.

- Regulatory Changes: New environmental regulations or mining laws can significantly affect operating costs and profitability.

These factors interact in complex ways. For instance, a rising gold price can offset increased production costs, while geopolitical instability might increase gold demand but also introduce operational risks. A hypothetical scenario: a significant drop in the gold price, coupled with rising energy costs, could lead to a substantial decline in B2 Gold Corp’s stock price, as profitability is severely impacted.

Helpful Answers

What are the major risks associated with investing in B2 Gold Corp stock?

Investing in B2 Gold Corp, like any mining stock, carries inherent risks, including gold price volatility, operational challenges (e.g., production disruptions), geopolitical instability in operating regions, and regulatory changes.

Where can I find real-time B2 Gold Corp stock price updates?

Real-time stock price updates for B2 Gold Corp are available through major financial websites and brokerage platforms such as Google Finance, Yahoo Finance, Bloomberg, and others.

How does B2 Gold Corp compare to other gold mining companies in terms of dividend payouts?

A comparison of B2 Gold Corp’s dividend policy with competitors requires researching dividend yield and payout ratios of similar companies. This information is typically available on financial news websites and company investor relations pages.