Alibaba (BABA) Pre-Market Stock Price Dynamics: Baba Premarket Stock Price

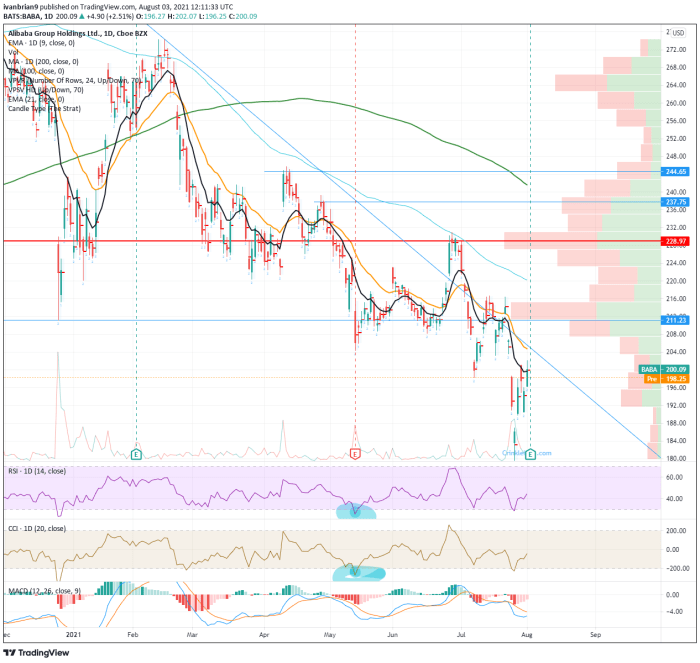

Source: tradingview.com

Baba premarket stock price – Understanding Alibaba’s (BABA) pre-market stock price movements is crucial for investors seeking to optimize their trading strategies. This analysis delves into the various factors influencing BABA’s pre-market activity, comparing it to regular trading hours and exploring the impact of news, financial indicators, global economics, and competitive dynamics.

Pre-Market Trading Dynamics

Several factors contribute to Alibaba’s pre-market price fluctuations. These include global market trends, anticipated news releases, and overnight developments impacting the broader technology sector or the Chinese economy. Pre-market trading volume for BABA is generally lower than during regular trading hours, reflecting reduced liquidity. However, significant news events can dramatically increase this volume. BABA’s pre-market price swings often represent a preview of the day’s overall price range, though the extent of fluctuation can vary considerably.

For example, imagine a scenario where a positive earnings pre-announcement is leaked before the official release. This could trigger a substantial upward surge in BABA’s pre-market price, setting a bullish tone for the entire trading day. Conversely, negative news, such as regulatory concerns in China, might lead to a sharp pre-market decline.

The Baba premarket stock price is showing some interesting movement today. It’s worth noting that the current market sentiment might be influenced by other major IPOs, such as the highly anticipated arm stock price ipo , which could impact investor decisions across the tech sector. Therefore, keeping an eye on the overall market trends is crucial when analyzing the Baba premarket stock price fluctuations.

| Date | BABA Pre-Market Price | S&P 500 Pre-Market Change | Hang Seng Index Pre-Market Change |

|---|---|---|---|

| October 26, 2023 | $85.50 | -0.2% | +0.5% |

| October 27, 2023 | $86.20 | +0.8% | +0.1% |

| October 28, 2023 | $85.90 | -0.1% | -0.3% |

| October 29, 2023 | $87.10 | +1.2% | +0.7% |

News and Information Impact, Baba premarket stock price

News events significantly influence BABA’s pre-market price. Positive news, such as strong sales figures or successful product launches, tends to drive the price upward. Negative news, including regulatory crackdowns or disappointing financial results, typically leads to declines. Investor sentiment, amplified by social media discussions and analyst reports, plays a crucial role in shaping pre-market expectations. For instance, a highly publicized negative report from a prominent analyst firm could trigger significant selling pressure before the market opens.

A timeline of significant news events and their impact on BABA’s pre-market price could reveal patterns and correlations. For example, a major regulatory announcement from the Chinese government might cause a sharp pre-market drop, while a successful partnership with a major international company might lead to a surge.

Financial Indicators and Pre-Market Price

Key financial metrics, such as revenue growth, earnings per share (EPS), and profit margins, strongly correlate with BABA’s pre-market price movements. Earnings reports, particularly quarterly announcements, exert a considerable influence. Quarterly reports tend to have a more immediate and pronounced impact than annual reports, as they provide more frequent updates on the company’s performance.

A visualization of the relationship between BABA’s key financial ratios (e.g., Price-to-Earnings ratio, Return on Equity) and its pre-market price would reveal a positive correlation during periods of strong financial performance and a negative correlation during periods of weakness. Changes in revenue or profit projections, often released alongside earnings reports or investor updates, significantly affect pre-market trading activity. Positive revisions generally lead to price increases, while negative revisions trigger declines.

Global Economic Factors

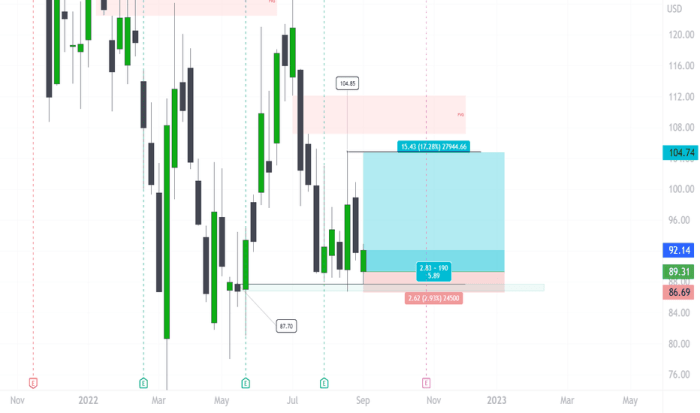

Source: fxstreet.com

Global economic events and macroeconomic indicators significantly influence BABA’s pre-market price. For instance, rising interest rates or high inflation can negatively impact investor sentiment towards growth stocks like BABA. Geopolitical events, such as trade disputes or international conflicts, can also cause significant volatility. Changes in currency exchange rates, particularly the US dollar versus the Chinese yuan, affect BABA’s valuation in US dollar terms, impacting its pre-market price.

International trade policies impacting China’s economy can have a ripple effect on BABA’s pre-market performance. For example, increased trade tensions between the US and China could negatively impact investor confidence and lead to a decline in BABA’s pre-market price.

Competitive Landscape and Pre-Market Price

Alibaba’s pre-market price is influenced by the performance of its main competitors, such as JD.com, Tencent, and Amazon. A comparative analysis of BABA’s pre-market performance against these competitors reveals that periods of strong competitor performance might exert downward pressure on BABA’s pre-market price, while periods of competitor weakness might have the opposite effect. New product launches or technological advancements by competitors can also influence BABA’s pre-market valuation.

- JD.com: Strong JD.com earnings could negatively impact BABA’s pre-market price due to increased competitive pressure.

- Tencent: Tencent’s success in specific market segments could influence investor allocation, potentially impacting BABA’s pre-market valuation.

- Amazon: Amazon’s expansion into new markets could create competitive challenges for BABA, potentially affecting its pre-market price.

FAQ Corner

What are the typical trading hours for BABA’s pre-market session?

Generally, BABA’s pre-market trading occurs from approximately 4:00 AM to 9:30 AM Eastern Time (ET) on the New York Stock Exchange.

How does BABA’s pre-market volume compare to its regular trading volume?

Pre-market volume is typically lower than regular trading hours, representing a smaller percentage of the overall daily trading activity.

Where can I find real-time BABA pre-market data?

Real-time pre-market data for BABA is available through various financial news websites and brokerage platforms.

What is the significance of BABA’s pre-market price relative to its closing price?

The pre-market price often provides an early indication of how the stock might perform during the regular trading session, but it’s not always indicative of the final closing price.