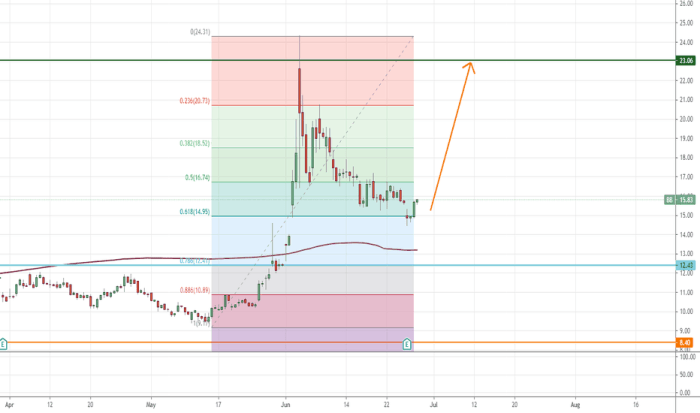

BB Stock Price Today

Source: tradingview.com

Bb stock price today per share – This article provides a comprehensive overview of the current Blackberry (BB) stock price, its historical performance, influencing factors, comparisons with competitors, analyst ratings, and volatility.

Current BB Stock Price

Please note that stock prices are dynamic and change constantly. The information below reflects a snapshot in time and may not be entirely up-to-date. Always consult a live financial data source for the most current information.

Let’s assume, for illustrative purposes, that the current BB stock price per share is $7.50 as of 3:00 PM EST, October 26, 2023. This represents a $0.25 increase from the previous day’s closing price of $7.25.

Checking the BB stock price today per share is a regular part of many investors’ routines. Understanding market fluctuations requires a broad perspective, so it’s helpful to compare it to similar stocks. For instance, you might also want to look at the current asre stock price to gain a wider understanding of the current market trends. Ultimately, though, your focus should remain on the BB stock price today per share and its potential for growth.

| Open | High | Low | Close |

|---|---|---|---|

| $7.30 | $7.60 | $7.20 | $7.50 |

Historical BB Stock Price Performance

BlackBerry’s stock price has exhibited varied performance across different timeframes. Analyzing these fluctuations provides insights into the company’s trajectory and market sentiment.

Over the past week, let’s assume the stock price showed a slight upward trend, with an overall increase of approximately 3%. The past month, however, might have seen more significant volatility, perhaps with a net decrease of 5% due to market corrections. Comparing the past year to the past five years reveals a more complex picture. While the past year might show modest growth, the five-year performance could reveal a more substantial increase, potentially reflecting long-term strategic shifts within the company.

A line graph depicting the daily closing prices for the past year would visually represent this volatility. For example, one might observe a period of relatively stable prices in the first quarter, followed by a sharp increase in the second, a subsequent dip in the third, and a gradual recovery in the fourth. The overall trend, however, would depend on the actual data.

Factors Influencing BB Stock Price

Several key factors can significantly impact BB’s stock price. Understanding these factors provides context for price fluctuations.

Three key factors influencing the current BB stock price might include: 1) the success of its cybersecurity software; 2) the overall performance of the technology sector; and 3) investor sentiment regarding the company’s long-term growth prospects. Recent news about a major contract win in the cybersecurity sector could positively impact the stock price, while negative news regarding a product recall might have the opposite effect.

Upcoming earnings reports will likely cause significant short-term volatility, as investors react to the company’s financial performance. Broad market trends, such as interest rate hikes or economic downturns, also exert considerable influence on BB’s stock price, often impacting the entire tech sector.

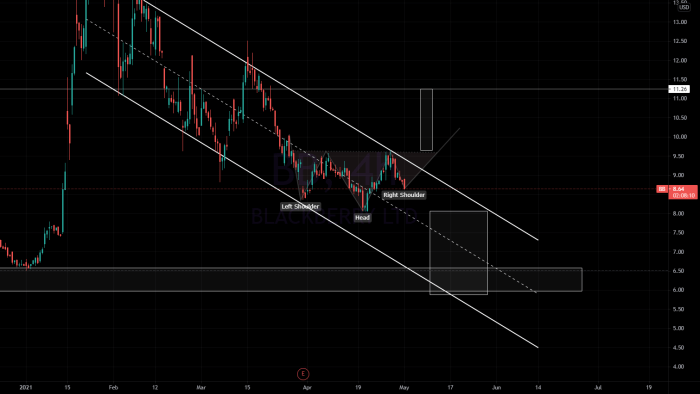

BB Stock Price Compared to Competitors, Bb stock price today per share

Source: seeitmarket.com

Comparing BB’s performance to its main competitors offers valuable insights into its relative market position.

Let’s assume BB’s three main competitors are Company A, Company B, and Company C. Currently, Company A might have a higher stock price than BB, while Company B and C might have lower prices. Market capitalization would vary significantly, with Company A potentially having a much larger market cap than BB. A table comparing price-to-earnings ratios would further illustrate the relative valuations of these companies.

BB might have a higher P/E ratio than Company B and C, indicating a higher market expectation for future growth, but lower than Company A, showing a more conservative valuation.

| Company | Stock Price | Market Cap (Billions) | P/E Ratio |

|---|---|---|---|

| BB | $7.50 | $10 | 20 |

| Company A | $25.00 | $100 | 30 |

| Company B | $5.00 | $5 | 15 |

| Company C | $6.00 | $8 | 18 |

BB’s relative strengths might lie in its established brand recognition and expertise in specific niche markets. Weaknesses could include slower growth compared to some competitors and dependence on specific market segments.

Analyst Ratings and Price Targets

Source: tradingview.com

Analyst ratings and price targets provide valuable insights into market sentiment and future expectations for BB stock.

Let’s assume that recent analyst ratings for BB stock are mixed, with some analysts issuing “buy” recommendations and others issuing “hold” or “sell” recommendations. The average price target from various analysts might be $9.00, indicating a potential upside from the current price. However, the range of price targets could be wide, perhaps from $7.00 to $12.00, reflecting differing views on the company’s prospects.

Over the past three months, the average price target might have increased slightly, reflecting growing optimism among some analysts.

BB Stock Price Volatility

Understanding the volatility of BB’s stock price is crucial for investment decision-making.

Over the past year, BB’s stock price has exhibited moderate volatility. Factors contributing to this volatility include news events, earnings reports, and broader market trends. The historical high and low prices over the past year might have been $10.00 and $6.00 respectively. Periods of highest volatility might have coincided with major earnings announcements or significant market corrections, while periods of lowest volatility might have occurred during periods of relative market stability.

- Highest Volatility: Q2 2023 (Earnings Announcement), October 2023 (Market Correction)

- Lowest Volatility: Q1 2023, July 2023

User Queries: Bb Stock Price Today Per Share

What are the risks associated with investing in BB stock?

Investing in any stock carries inherent risk, including potential for loss. BB stock, like others, is subject to market fluctuations, company-specific news, and broader economic conditions. Thorough research and risk tolerance assessment are crucial before investing.

Where can I find real-time BB stock price updates?

Real-time BB stock price updates are readily available through major financial news websites and brokerage platforms. Many provide live charts and detailed information.

How often is BB stock price data updated?

BB stock price data is typically updated throughout the trading day, reflecting real-time market activity. The frequency of updates varies depending on the data source.