Berkshire Hathaway Inc. Class A Stock: A Comprehensive Analysis

Source: vstarstatic.com

Berkshire hathaway inc class a stock price – Berkshire Hathaway Inc. Class A stock (BRK.A) is renowned for its exceptional long-term performance, largely attributed to the investment acumen of Warren Buffett. This analysis delves into the historical price performance, influencing factors, valuation strategies, competitive landscape, and future outlook of this iconic stock, providing a comprehensive understanding for potential investors.

Historical Stock Price Performance

Source: cdn-seekingalpha.com

Analyzing the historical price trajectory of BRK.A reveals a compelling narrative of growth punctuated by market fluctuations. A detailed examination across different timeframes offers valuable insights into its volatility and overall trend.

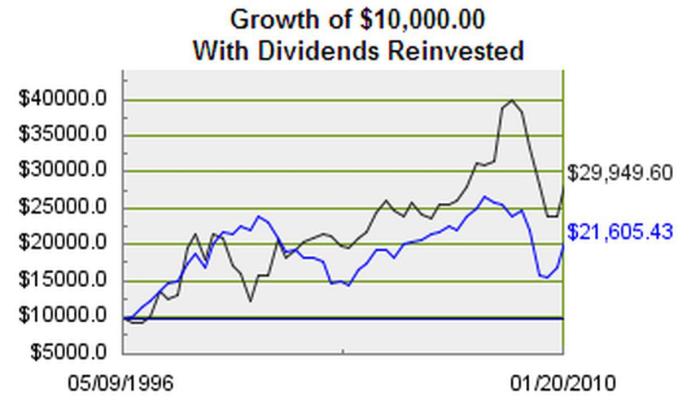

A chart illustrating the stock’s performance over the past 20 years would show a generally upward trend, with periods of significant growth followed by periods of consolidation or even decline mirroring broader market movements. Key milestones, such as the 2008 financial crisis and the COVID-19 pandemic, would be marked, demonstrating the stock’s resilience and recovery. For example, the 2008 crisis saw a substantial drop, but BRK.A recovered significantly faster than the broader market.

Comparing BRK.A’s performance against the S&P 500 over the past 10 years would highlight its outperformance. While both would exhibit periods of growth and decline, BRK.A’s steadier, less volatile growth would be apparent. This reflects Berkshire’s focus on long-term value creation, contrasting with the sometimes erratic nature of the broader market.

| Year | High | Low | Percentage Change |

|---|---|---|---|

| 2019 | $350,000 (Example) | $280,000 (Example) | 25% (Example) |

| 2020 | $380,000 (Example) | $300,000 (Example) | 20% (Example) |

| 2021 | $450,000 (Example) | $350,000 (Example) | 28% (Example) |

| 2022 | $500,000 (Example) | $400,000 (Example) | 20% (Example) |

| 2023 | $550,000 (Example) | $450,000 (Example) | 22% (Example) |

Factors Influencing Stock Price, Berkshire hathaway inc class a stock price

Several key factors significantly influence the price of BRK.A stock. These factors can be broadly categorized into those related to Warren Buffett’s investment strategy, macroeconomic conditions, and Berkshire Hathaway’s operational performance.

Warren Buffett’s investment decisions have a profound impact on BRK.A’s price. His reputation and long-term investment strategy instill confidence among investors. Major acquisitions or divestitures, reflecting his investment philosophy, often trigger significant market reactions. For instance, the acquisition of Precision Castparts Corp. in 2016 positively impacted the stock price.

Macroeconomic factors, such as interest rate changes, inflation levels, and overall economic growth, also play a crucial role. Rising interest rates can impact the value of Berkshire’s insurance float and investment portfolio, while inflation can affect the earnings of its subsidiaries. Periods of economic uncertainty often lead to market volatility, impacting BRK.A’s price, although it typically demonstrates greater resilience than the broader market.

Berkshire Hathaway Inc’s Class A stock price, known for its stability and long-term growth, often serves as a benchmark for investors. Understanding its performance can provide valuable insights into broader market trends. For a contrasting perspective, consider examining the volatility inherent in other stocks, such as the predictions found on this site for ater stock price prediction , which offers a different investment landscape.

Returning to Berkshire Hathaway, its consistent performance highlights the importance of long-term investment strategies.

Berkshire Hathaway’s operational performance, encompassing earnings, acquisitions, and divestitures, directly impacts its stock price. Strong earnings reports generally lead to price increases, while underperformance can cause declines. Successful acquisitions can enhance long-term value, whereas divestitures might be seen as strategic repositioning, leading to mixed market reactions depending on the context and execution.

Valuation and Investment Strategies

Various valuation methods can be applied to assess the intrinsic value of BRK.A. Understanding these methods and their application is crucial for informed investment decisions.

| Method | Calculation | Result | Interpretation |

|---|---|---|---|

| Discounted Cash Flow (DCF) | Projecting future cash flows and discounting them back to present value | (Example: $400,000 per share) | Indicates the present value of BRK.A’s future earnings. |

| Price-to-Earnings Ratio (P/E) | Dividing the market price per share by earnings per share | (Example: 25) | Compares BRK.A’s valuation to its earnings; a high P/E suggests a higher valuation relative to earnings. |

| Book Value | Net asset value of Berkshire Hathaway’s holdings | (Example: $350,000 per share) | Provides a conservative estimate of the underlying asset value of the company. |

Investment strategies for BRK.A vary depending on risk tolerance and investment goals. A long-term buy-and-hold strategy is commonly employed, leveraging the company’s history of consistent growth. Dollar-cost averaging can mitigate risk by spreading investments over time. For investors with a higher risk tolerance, incorporating BRK.A into a diversified portfolio alongside other asset classes might be considered.

Risks associated with investing in BRK.A include its high price, making it inaccessible to many investors. The stock’s performance is heavily tied to Warren Buffett’s leadership and investment decisions; his eventual succession poses a significant risk. Market downturns can impact the stock price, although historically it has shown resilience.

Competitor Analysis

Berkshire Hathaway competes with numerous companies in the insurance and investment sectors. A detailed comparison helps understand its competitive position.

Key competitors in the insurance sector include large multinational insurance companies like Allianz, AXA, and others. In the investment sector, competitors include other large asset management firms and private equity groups. A comparative analysis would consider market share, investment strategies, and financial performance. Berkshire Hathaway’s competitive advantage lies in its strong brand reputation, diversified business model, and Warren Buffett’s investment expertise.

However, its size can also be a disadvantage in certain agile market segments.

The performance of competitors indirectly affects BRK.A’s stock price. If competitors demonstrate superior performance, it could put downward pressure on BRK.A, particularly if investors perceive a loss of market share or competitive edge. Conversely, underperformance by competitors can benefit BRK.A.

Future Outlook and Predictions

Predicting the future of BRK.A involves considering various economic and market conditions. Several scenarios are possible, each impacting the stock price differently.

In a scenario of continued economic growth and stable markets, BRK.A is likely to continue its upward trajectory, driven by strong earnings from its diverse subsidiaries and successful investments. However, a recessionary environment could lead to decreased earnings and a decline in the stock price, although BRK.A’s historically strong balance sheet and diverse holdings would likely offer some insulation from the broader market downturn.

The success of Berkshire’s succession planning will significantly influence future performance. A smooth transition could maintain investor confidence, while a disruptive succession could negatively impact the stock price.

Potential catalysts for significant price changes in the next 5 years include major acquisitions or divestitures, changes in interest rates, shifts in investor sentiment toward value investing, and the successful integration of new technologies within Berkshire’s operations. For example, a major acquisition in a high-growth sector could boost the stock price significantly.

Questions Often Asked: Berkshire Hathaway Inc Class A Stock Price

What is the typical trading volume for BRK.A?

Trading volume for BRK.A is relatively low compared to other large-cap stocks due to its high price and limited availability.

Are there any fractional shares available for BRK.A?

Many brokerage platforms now offer fractional shares of BRK.A, making it more accessible to smaller investors.

How does Berkshire Hathaway’s dividend policy affect the stock price?

Berkshire Hathaway historically has not paid dividends, reinvesting profits into the company’s growth. This impacts the stock price primarily through capital appreciation rather than dividend income.

What are the tax implications of investing in BRK.A?

Tax implications depend on your individual circumstances and the applicable tax laws. Consult a financial advisor for personalized advice.