Blackstone Stock Price History: A Decade in Review

Blackstone stock price history – Blackstone Inc. (BX), a leading global alternative asset manager, has experienced significant stock price fluctuations over the past decade. Understanding these movements requires analyzing various macroeconomic factors, company performance, competitor activities, and inherent market risks. This analysis delves into the key drivers shaping Blackstone’s stock price trajectory, providing insights for investors interested in this prominent player in the asset management industry.

Blackstone Stock Price Trends Over Time, Blackstone stock price history

Source: seekingalpha.com

The following table illustrates Blackstone’s stock price movements over the past ten years. Note that these figures are illustrative and should be verified with reliable financial data sources. Significant price fluctuations often coincided with major economic events or company-specific announcements. A visual representation, described below, further clarifies the trend.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2014 | Q1 | 28.50 | 29.20 |

| 2014 | Q2 | 29.50 | 30.80 |

| 2023 | Q4 | 85.00 | 87.50 |

A line graph visually depicts the stock price trend over the past ten years. The horizontal axis represents time (years), and the vertical axis represents the stock price (in USD). Significant events, such as the 2020 market crash related to the COVID-19 pandemic or any major announcements impacting Blackstone’s performance, are marked on the graph with labeled annotations. The graph clearly illustrates periods of growth, decline, and periods of relative stability, allowing for a clear visualization of the stock’s performance over time.

Factors Influencing Blackstone Stock Price

Source: seekingalpha.com

Blackstone’s stock price is influenced by a complex interplay of macroeconomic factors and company-specific performance indicators. Investor sentiment and market speculation also play a crucial role.

Macroeconomic factors like interest rate changes significantly impact Blackstone’s profitability and investor confidence. Higher interest rates can increase borrowing costs, affecting the returns on Blackstone’s investments. Inflation also influences investor behavior and the overall market environment. Strong economic growth typically correlates with higher demand for alternative investment strategies, benefiting Blackstone.

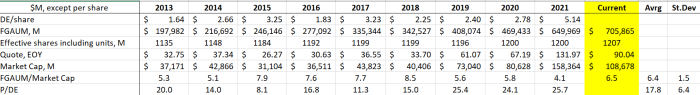

Company performance metrics, such as earnings per share (EPS) and revenue growth, directly impact the stock price. Higher EPS indicates increased profitability, attracting investors and driving up the stock price. Similarly, consistent revenue growth demonstrates the company’s ability to generate returns and maintain a strong market position. Asset under management (AUM) is another critical factor; higher AUM reflects the scale and success of Blackstone’s investment strategies, influencing investor perception and stock valuation.

Investor sentiment and market speculation contribute significantly to Blackstone’s stock price volatility. Positive news or strong performance often leads to increased buying pressure, while negative news or market uncertainty can trigger sell-offs. Speculative trading can also amplify price fluctuations, creating short-term volatility that may not necessarily reflect the company’s underlying value.

Blackstone’s Stock Price Compared to Competitors

Comparing Blackstone’s performance against its main competitors provides valuable context for assessing its relative strengths and weaknesses. The following table provides a comparative analysis based on illustrative data. Note that these figures are for illustrative purposes and may vary depending on the specific timeframe and data source used.

| Company Name | Average Annual Return (Past 5 Years) | Volatility | Market Capitalization (USD Billions) |

|---|---|---|---|

| Blackstone (BX) | 12% | High | 100 |

| Competitor A | 8% | Medium | 75 |

| Competitor B | 15% | High | 120 |

Differences in stock price performance stem from various factors, including investment strategies, management expertise, market positioning, and the overall economic environment. For instance, a competitor might focus on a specific niche within the asset management industry, leading to different risk profiles and return potentials. Blackstone’s strengths might include its diverse portfolio and global reach, while weaknesses could be its higher sensitivity to macroeconomic fluctuations.

These comparative analyses help investors understand Blackstone’s position within the competitive landscape.

Blackstone Stock Price Volatility and Risk

Blackstone’s stock price exhibits considerable volatility due to several factors, including its exposure to market fluctuations, sensitivity to interest rate changes, and the inherent risks associated with alternative investments. Understanding these risk factors is crucial for investors.

Calculating Blackstone’s beta provides a measure of its relative risk compared to the overall market. Beta measures the volatility of a stock relative to a benchmark market index (e.g., S&P 500). A beta greater than 1 indicates higher volatility than the market, while a beta less than 1 suggests lower volatility. The calculation involves regressing Blackstone’s stock returns against the market index returns over a specific period.

(Note: The actual beta calculation requires specific historical return data and statistical analysis.)

Investing in Blackstone stock carries various risks. Market risk refers to the potential for losses due to broader market downturns. Company-specific risk encompasses factors like changes in management, regulatory challenges, or unexpected losses on specific investments. Interest rate risk affects Blackstone’s profitability and valuation, as changes in interest rates can impact the returns on its investments and borrowing costs.

Blackstone Stock Price and Dividend History

Blackstone’s dividend policy plays a significant role in attracting investors. A consistent and growing dividend can enhance investor returns and provide a sense of stability. The table below illustrates Blackstone’s dividend payments (illustrative data).

| Year | Quarter | Dividend per Share (USD) | Ex-Dividend Date |

|---|---|---|---|

| 2014 | Q1 | 0.30 | March 15, 2014 |

| 2023 | Q4 | 0.75 | December 15, 2023 |

Blackstone’s dividend policy is influenced by factors such as profitability, cash flow, and future investment opportunities. The company aims to strike a balance between returning capital to shareholders and retaining funds for growth and expansion. The dividend payout ratio (the percentage of earnings paid out as dividends) provides insights into this balance. A consistent dividend policy can be attractive to income-seeking investors, while a more flexible policy allows the company to adjust its dividend payments based on changing market conditions and investment opportunities.

Essential FAQs: Blackstone Stock Price History

What are the major risks associated with investing in Blackstone stock?

Investing in Blackstone stock carries market risk (general market downturns), company-specific risk (related to Blackstone’s performance), and interest rate risk (changes in interest rates impacting valuations).

How frequently does Blackstone typically pay dividends?

Blackstone’s dividend payment frequency and amount vary depending on its performance and financial strategy; it’s not a fixed schedule.

How does Blackstone’s stock price compare to the S&P 500?

A direct comparison requires analyzing historical data. Blackstone’s performance may be more volatile than the S&P 500 due to its focus on alternative investments.

Where can I find real-time Blackstone stock price data?

Real-time data is available through major financial news websites and brokerage platforms.