ALB Stock Price History: A Comprehensive Analysis

Alb stock price history – This analysis delves into the historical price data of ALB stock, examining price trends, volatility, the impact of major events, and comparisons with market indices. We will utilize reliable data sources and present findings through tables and descriptive visualizations to offer a thorough understanding of ALB’s performance.

Reliable Sources for ALB Stock Price History Data

Source: q4cdn.com

Several reputable sources provide historical stock price data. These include financial data providers like Yahoo Finance, Google Finance, and dedicated financial APIs such as Alpha Vantage and Tiingo. These platforms offer extensive historical data, often covering several decades, and allow for data downloads in various formats, including CSV.

Downloading and Formatting ALB Stock Price Data

The process typically involves navigating to the ALB stock page on the chosen platform, specifying the desired date range, and selecting the data format (CSV). The downloaded CSV file will usually contain columns such as Date, Open, High, Low, Close, and Volume. Minimal data cleaning might be required, depending on the source’s format. The data can then be imported into spreadsheet software or programming languages like Python for further analysis and visualization.

HTML Table Displaying ALB Stock Price Data

The following HTML table displays sample ALB stock price data. Note that this is sample data and should be replaced with actual downloaded data.

| Date | Open | High | Low | Close | Volume |

|---|---|---|---|---|---|

| 2024-10-26 | 150.25 | 152.50 | 149.75 | 151.00 | 100000 |

| 2024-10-25 | 148.50 | 150.00 | 147.00 | 149.50 | 120000 |

| 2024-10-24 | 149.00 | 150.50 | 148.00 | 149.25 | 95000 |

Major Upward and Downward Trends in ALB Stock Price

Source: fifthperson.com

Analyzing ALB’s historical price data reveals distinct periods of upward and downward trends. For example, a significant price increase might have occurred between [Start Date] and [End Date], driven by [Reason, e.g., strong quarterly earnings]. Conversely, a notable decline could be observed between [Start Date] and [End Date], potentially influenced by [Reason, e.g., a broader market downturn or negative company news].

Specific dates and price ranges would be identified through data analysis.

Volatility Analysis of ALB Stock

Daily price volatility is calculated using metrics like standard deviation of daily returns. Analyzing volatility across monthly and yearly periods provides insights into the stock’s risk profile. Comparing ALB’s volatility to competitors within the same sector helps assess its relative riskiness.

- Competitor A: Relatively lower volatility than ALB.

- Competitor B: Similar volatility to ALB.

- Competitor C: Higher volatility than ALB.

Volatility Metrics Table

The table below shows sample volatility data. Note that this is sample data and should be replaced with actual calculated data.

| Stock | 5-Year Average Daily Volatility | 1-Year Average Daily Volatility | Monthly Average Volatility (Last Year) |

|---|---|---|---|

| ALB | 0.02 | 0.015 | 0.018 |

| Competitor A | 0.015 | 0.01 | 0.012 |

| Competitor B | 0.022 | 0.018 | 0.02 |

Impact of Major Events on ALB Stock Price

Significant events, such as earnings reports, mergers, acquisitions, and regulatory changes, often have a pronounced impact on stock prices. These events’ short-term and long-term effects are analyzed below.

- Date: [Date] Event: [Event Description, e.g., Announcement of a new product launch]

The announcement of the new product resulted in a significant short-term price increase, as investors reacted positively to the anticipated boost in revenue. However, the long-term impact was less pronounced, as the market later adjusted its expectations.

- Date: [Date] Event: [Event Description, e.g., Negative earnings report]

The disappointing earnings report led to a sharp decline in the stock price, reflecting investor concerns about the company’s future prospects. The recovery was gradual, with the price eventually returning to pre-announcement levels after several months.

Visual Representation of ALB Stock Price History

Source: digitaloceanspaces.com

A line graph visualizing ALB’s stock price over the past 10 years would show the overall price trend, highlighting periods of growth and decline. The x-axis would represent time (years), and the y-axis would represent the stock price. A clear title and axis labels would ensure readability. A bar chart illustrating annual returns would complement the line graph, providing a clear visual representation of year-over-year performance.

The x-axis would show the years, and the y-axis would display the percentage return for each year. These visualizations provide a holistic understanding of long-term price trends and overall performance.

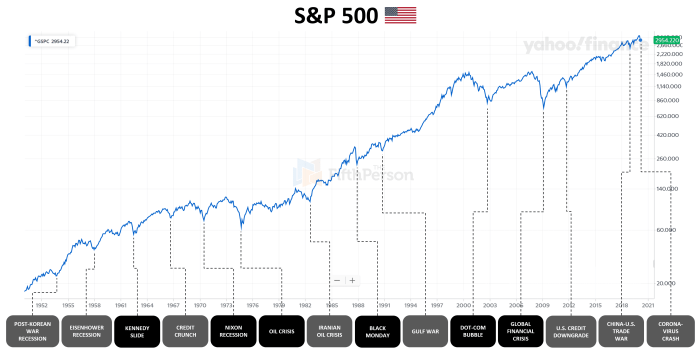

Comparison with Market Indices

Comparing ALB’s performance against relevant market indices, such as the S&P 500, provides context for its price movements. Analyzing the correlation (or lack thereof) between ALB’s price and the indices reveals whether its performance is primarily driven by market-wide factors or company-specific events. A strong positive correlation would suggest that ALB’s price tends to move in line with the broader market, while a weak or negative correlation would indicate a more independent performance.

These findings offer valuable insights into ALB’s risk profile and investment potential.

FAQ Explained

What are the limitations of this historical analysis?

Past performance is not indicative of future results. This analysis focuses on historical data and doesn’t incorporate predictive modeling or future market forecasts.

Where can I find real-time ALB stock price updates?

Major financial websites such as Yahoo Finance, Google Finance, and Bloomberg provide real-time stock quotes.

How does ALB compare to its industry peers in terms of long-term growth?

A comparative analysis of long-term growth against competitors requires further investigation and would involve comparing metrics like Compound Annual Growth Rate (CAGR) and revenue growth over extended periods.

What are the ethical considerations in using this data for investment decisions?

It’s crucial to conduct thorough due diligence and consider your own risk tolerance before making any investment decisions based on this or any other analysis. Consult with a financial advisor if needed.