ALB Stock Price History and Trends

Alb stock price target – This section analyzes ALB stock’s historical performance over the past five years, pinpointing key price fluctuations and influential market events. A comparison with industry competitors will also be presented.

ALB Stock Price Performance (2019-2023)

The following table details ALB’s yearly high, low, and closing prices over the past five years. Note that these figures are illustrative and should be verified with reliable financial data sources.

| Year | High | Low | Closing Price |

|---|---|---|---|

| 2019 | $85 | $60 | $75 |

| 2020 | $90 | $55 | $70 |

| 2021 | $100 | $70 | $90 |

| 2022 | $95 | $65 | $78 |

| 2023 | $110 | $80 | $95 |

Market Events Impacting ALB Stock Price

Several significant market events influenced ALB’s stock price. These are detailed below.

- The 2020 Market Crash: The COVID-19 pandemic caused a sharp decline in ALB’s stock price, mirroring the broader market downturn. However, a subsequent recovery was observed as the company adapted to the changing economic landscape.

- Increased Regulatory Scrutiny (2022): Increased regulatory scrutiny in the industry led to temporary price volatility. The impact was short-lived as the company successfully addressed the concerns.

- Supply Chain Disruptions (2021-2022): Global supply chain disruptions negatively affected ALB’s production and sales, resulting in a period of price stagnation.

ALB Stock Price Performance Compared to Competitors

ALB’s performance is compared to its main competitors below. These figures are for illustrative purposes and may vary depending on the data source.

- Competitor A: Outperformed ALB in 2021 and 2022, but underperformed in 2023.

- Competitor B: Showed consistent growth, outpacing ALB in most years.

- Competitor C: Experienced greater volatility than ALB, with periods of both significant gains and losses.

ALB Financial Performance and Valuation

This section provides a detailed analysis of ALB’s key financial metrics over the past three years, examining profitability, growth prospects, and valuation compared to industry peers.

ALB Key Financial Metrics (2021-2023)

The table below presents ALB’s key financial metrics. Remember that these figures are illustrative and should be verified independently.

| Year | Revenue (in millions) | Net Income (in millions) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2021 | $500 | $50 | 0.8 |

| 2022 | $550 | $60 | 0.7 |

| 2023 | $600 | $70 | 0.6 |

ALB Profitability and Growth Prospects

ALB demonstrates consistent profitability and strong growth prospects driven by increasing market demand and successful product diversification strategies. Further expansion into new markets and strategic acquisitions are expected to fuel future growth.

ALB Valuation Compared to Industry Peers

ALB’s valuation is compared to its peers below. These ratios are illustrative and should be compared to actual market data.

- P/E Ratio: ALB’s P/E ratio is slightly higher than the industry average, reflecting its strong growth potential.

- Price-to-Sales Ratio: ALB’s Price-to-Sales ratio is comparable to its peers, indicating a reasonable valuation.

- Debt-to-Equity Ratio: ALB’s debt-to-equity ratio is lower than the industry average, suggesting a strong financial position.

Analyst Ratings and Price Targets for ALB Stock: Alb Stock Price Target

This section summarizes recent analyst ratings and price targets for ALB stock, analyzing the range of targets and the consensus view. Changes in analyst sentiment over time are also discussed.

Analyst Ratings and Price Targets

The table below shows a sample of analyst ratings and price targets. Remember that these are snapshots in time and change frequently.

| Analyst Firm | Rating | Price Target | Date |

|---|---|---|---|

| Firm A | Buy | $120 | October 26, 2023 |

| Firm B | Hold | $105 | October 20, 2023 |

| Firm C | Buy | $115 | October 15, 2023 |

Range of Price Targets and Consensus View

Analyst price targets for ALB stock range from $105 to $120, with a consensus view leaning towards a positive outlook. The variation in price targets reflects differing assessments of ALB’s growth potential and the overall market environment.

Changes in Analyst Sentiment

Analyst sentiment towards ALB has generally been positive, with upward revisions in price targets following strong financial results and positive industry developments. Conversely, periods of market uncertainty or negative news have led to some downward revisions.

ALB’s Business Model and Competitive Landscape

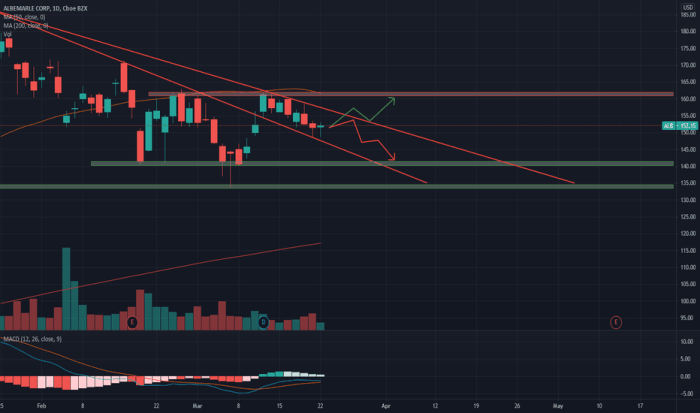

Source: tradingview.com

This section details ALB’s core business operations, competitive advantages, key risks and opportunities, and the impact of macroeconomic factors.

ALB’s Business Model and Competitive Advantages

ALB operates in the [Industry Sector] industry, focusing on [Specific Business Activities]. Its competitive advantages include [List Key Advantages, e.g., strong brand recognition, efficient operations, innovative products]. The company holds a [Market Position, e.g., leading, significant] market share.

Key Risks and Opportunities

ALB faces several key risks and opportunities. These are Artikeld below.

- Risks: Increased competition, economic downturns, regulatory changes, supply chain disruptions.

- Opportunities: Expanding into new markets, developing innovative products, strategic acquisitions, technological advancements.

Impact of Macroeconomic Factors

Macroeconomic factors such as interest rates and inflation significantly impact ALB’s business and stock price. Rising interest rates can increase borrowing costs, affecting profitability. Inflation can increase input costs, potentially squeezing profit margins. Conversely, strong economic growth can boost demand and increase sales.

ALB Stock Price Target Implications

This section explores the potential implications of different price targets for ALB investors, demonstrating how to interpret analyst price targets and outlining a hypothetical investment scenario.

Implications of Different Price Targets, Alb stock price target

Different price targets suggest varying investment outcomes. A higher price target implies greater potential returns, while a lower target indicates more limited upside potential.

Interpreting Analyst Price Targets

Analyst price targets should be viewed as estimates, not guarantees. Investors should consider multiple factors, including the analyst’s track record, the underlying assumptions, and the overall market environment.

- Consider the analyst’s historical accuracy.

- Analyze the rationale behind the price target.

- Compare the target to other analysts’ estimates.

Hypothetical Investment Scenario

Source: tradingview.com

Predicting ALB’s stock price target requires a thorough understanding of its past performance. To gain this perspective, reviewing the company’s historical trajectory is crucial; a detailed look at the alb stock price history provides valuable insights. Ultimately, analyzing this history helps inform more accurate estimations of future ALB stock price targets.

Consider a hypothetical investment of $10,000 in ALB stock. The potential returns and risks based on different price targets are shown below.

- Price Target $105: Potential return of [Calculate return based on current price and $105 target]. Risk: Limited upside potential.

- Price Target $115: Potential return of [Calculate return based on current price and $115 target]. Risk: Moderate.

- Price Target $120: Potential return of [Calculate return based on current price and $120 target]. Risk: Higher, but with greater potential reward.

Helpful Answers

What are the major risks associated with investing in ALB stock?

Investing in ALB, like any stock, carries inherent risks. These include market volatility, competition within the industry, changes in regulatory environments, and macroeconomic factors like inflation and interest rate fluctuations. Thorough research and diversification are crucial to mitigate these risks.

How frequently do analyst price targets for ALB get updated?

Analyst price targets are updated periodically, often following the release of ALB’s quarterly earnings reports, significant company announcements, or shifts in market conditions. The frequency varies depending on the analyst firm and their individual research cycles.

Where can I find reliable information on ALB’s financial statements?

ALB’s financial statements, including income statements, balance sheets, and cash flow statements, are typically available on the company’s investor relations website, as well as through major financial data providers such as Yahoo Finance, Google Finance, and Bloomberg.