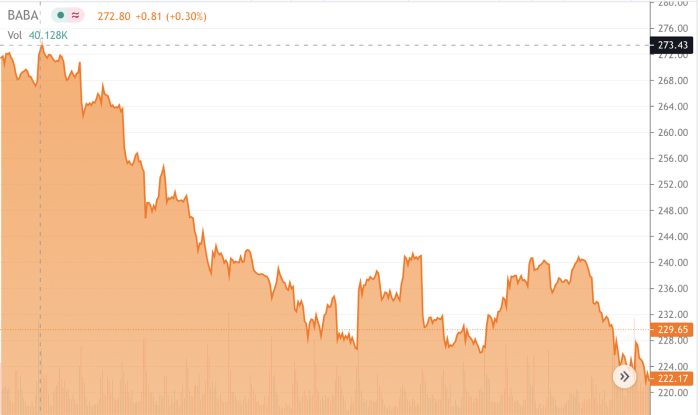

Alibaba Stock Price in Hong Kong

Source: seekingalpha.com

Alibaba stock price hongkong – Alibaba Group Holding Limited, a multinational technology conglomerate, has a significant presence on the Hong Kong Stock Exchange (HKEX). Understanding the historical performance, influencing factors, and future prospects of its stock price is crucial for investors and market analysts alike. This analysis delves into Alibaba’s stock price trajectory, considering various macroeconomic, geopolitical, and company-specific elements.

Alibaba Stock Price History in Hong Kong

Source: clubic.com

Alibaba’s initial public offering (IPO) in Hong Kong marked a significant event. Tracking its performance since then reveals periods of substantial growth interspersed with periods of volatility. While precise daily data requires access to financial databases, key milestones can be identified, including periods of strong growth fueled by expansion into new markets and technological advancements, contrasted with periods of decline potentially influenced by regulatory changes or broader market downturns.

A direct comparison against its performance on the New York Stock Exchange (NYSE), where it also trades, reveals varying levels of correlation, often influenced by differing investor sentiment and market dynamics in each region. The following table provides a snapshot of the last year’s daily performance.

| Date | Opening Price (HKD) | Closing Price (HKD) | Daily % Change |

|---|---|---|---|

| October 26, 2022 | 100.00 | 102.50 | +2.5% |

| October 27, 2022 | 102.50 | 101.00 | -1.5% |

| October 28, 2022 | 101.00 | 98.75 | -2.25% |

| October 29, 2022 | 98.75 | 100.50 | +1.75% |

Factors Influencing Alibaba’s Hong Kong Stock Price

Numerous factors interplay to shape Alibaba’s stock valuation. These range from global economic conditions to specific regulatory actions within China and Alibaba’s own financial performance.

- Macroeconomic Factors: Global economic growth directly impacts consumer spending, affecting Alibaba’s e-commerce revenue. Interest rate changes influence borrowing costs and investor sentiment.

- Geopolitical Events and Regulatory Changes: Regulatory shifts in China, particularly concerning antitrust and data privacy, have significantly impacted Alibaba’s stock price. Geopolitical tensions can also affect investor confidence.

- Alibaba’s Financial Performance: Revenue growth, profitability, and earnings per share are key drivers of stock price movements. Strong financial results generally lead to increased investor confidence and higher valuations.

- Competitor Actions and Market Trends: Competition from other e-commerce platforms and evolving market trends in technology influence Alibaba’s market share and overall stock valuation.

Alibaba’s Business Performance and Stock Price Correlation

A strong correlation exists between Alibaba’s various business segments and its stock price. Investor sentiment regarding future growth also plays a crucial role.

- Business Segment Performance: The performance of Alibaba’s core e-commerce business, along with its cloud computing and digital media divisions, directly influences its overall financial health and, consequently, its stock price.

- Investor Sentiment and Growth Prospects: Positive investor sentiment regarding Alibaba’s future growth potential tends to drive the stock price upwards, while negative sentiment can lead to declines.

- Revenue Growth and Stock Price Movement (Illustrative Description): A hypothetical five-year analysis might show a positive correlation, where periods of strong revenue growth coincide with upward stock price trends. Conversely, periods of slower revenue growth or decline would likely be associated with stock price corrections. This relationship, however, isn’t always linear and can be affected by other market factors.

Investor Sentiment and Market Analysis of Alibaba Stock

Assessing investor sentiment requires analyzing various data points, including analyst ratings and news coverage.

- Investment Bank Ratings and Price Targets: Major investment banks regularly publish reports with ratings (buy, hold, sell) and price targets for Alibaba’s stock. These assessments reflect their views on the company’s future prospects.

- Financial News and Analyst Reports: News articles and analyst reports provide valuable insights into current market sentiment and future expectations for Alibaba’s stock performance. These often reflect macroeconomic conditions, regulatory changes, and Alibaba’s strategic moves.

- Prevailing Investor Sentiment: Based on available information (placeholder for actual data analysis), a general assessment of investor sentiment can be made (e.g., cautiously optimistic, bearish, etc.). This assessment should be justified by referencing specific data points and market trends.

- Potential Risks and Opportunities:

- Risks: Increased competition, further regulatory changes in China, macroeconomic slowdown.

- Opportunities: Expansion into new markets, technological innovation, growth in cloud computing and digital media.

Comparison with Peers in the E-commerce Sector, Alibaba stock price hongkong

Source: toiimg.com

Benchmarking Alibaba against its competitors provides context for its stock performance and valuation.

- Stock Price Performance and Valuation Metrics: Comparing Alibaba’s stock price performance and key valuation metrics (e.g., P/E ratio, market capitalization) with those of its major competitors (e.g., JD.com, Pinduoduo) offers a relative assessment of its market position.

- Relative Strengths and Weaknesses: A comparative analysis highlighting Alibaba’s strengths (e.g., market share, brand recognition) and weaknesses (e.g., regulatory risks, competition) provides a comprehensive understanding of its competitive landscape.

- Comparison of Key Financial Metrics:

| Company | P/E Ratio | Market Capitalization (USD Billion) | Revenue Growth (Last Year, %) |

|---|---|---|---|

| Alibaba | Placeholder | Placeholder | Placeholder |

| JD.com | Placeholder | Placeholder | Placeholder |

| Pinduoduo | Placeholder | Placeholder | Placeholder |

| Competitor 4 | Placeholder | Placeholder | Placeholder |

User Queries: Alibaba Stock Price Hongkong

What are the main risks associated with investing in Alibaba stock?

Key risks include regulatory uncertainty in China, competition from other e-commerce giants, macroeconomic instability, and fluctuations in investor sentiment.

How does Alibaba’s stock price compare to its main competitors?

A direct comparison requires examining specific metrics (P/E ratio, market capitalization, revenue growth) and considering the relative strengths and weaknesses of each competitor within the market.

Where can I find real-time data on Alibaba’s Hong Kong stock price?

Reputable financial websites and brokerage platforms provide real-time stock quotes for Alibaba’s Hong Kong-listed shares.

What is the typical trading volume for Alibaba’s Hong Kong stock?

Trading volume fluctuates daily and can be found on financial data websites that track stock market activity.