Alibaba’s Influence on AliExpress’s Potential Stock Valuation

Aliexpress stock price – Alibaba Group Holding Limited, the parent company of AliExpress, plays a significant role in shaping the potential valuation of its e-commerce platform. Understanding Alibaba’s financial health and market position is crucial to assessing AliExpress’s prospects.

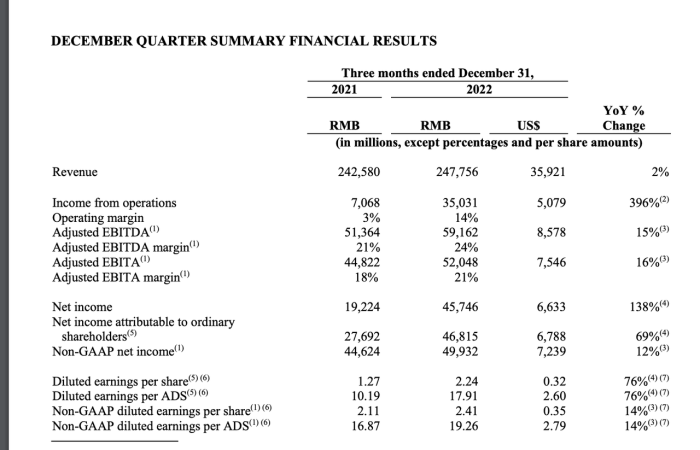

Alibaba’s Financial Performance and Impact on AliExpress

Alibaba’s financial performance directly influences AliExpress’s potential valuation. Strong revenue growth and profitability at the parent company generally translate to positive investor sentiment towards AliExpress, even though it’s not independently publicly traded. Conversely, a downturn in Alibaba’s performance can negatively affect perceptions of AliExpress’s future.

Alibaba’s Market Position and Investor Sentiment

Alibaba’s overall market position as a global e-commerce giant significantly impacts investor perception of AliExpress. A strong market position for Alibaba often boosts confidence in its subsidiaries, including AliExpress. Conversely, challenges faced by Alibaba can lead to decreased investor confidence in its ecosystem.

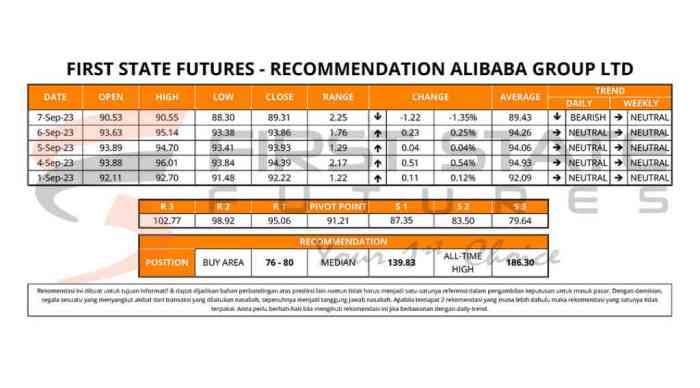

Relationship Between Alibaba’s Stock Price and AliExpress’s Valuation

Alibaba’s stock price serves as a key indicator of investor sentiment towards the entire Alibaba ecosystem. While AliExpress doesn’t have its own publicly traded stock, a rise in Alibaba’s stock price generally suggests a positive outlook for AliExpress’s potential future valuation. A decline in Alibaba’s stock price could signal potential risks or challenges for AliExpress.

Hypothetical Scenario: Alibaba Stock Price Change Impacting AliExpress

Source: investopedia.com

Let’s imagine a scenario where Alibaba’s stock price experiences a 10% increase due to strong quarterly earnings. This positive news could lead to increased investor interest in the Alibaba ecosystem, potentially boosting the perceived value of AliExpress and attracting more investment should it ever go public. Conversely, a 10% drop in Alibaba’s stock price due to regulatory concerns might negatively impact the perceived value of AliExpress.

AliExpress’s Business Model and Market Position

Understanding AliExpress’s core business model, market share, and competitive landscape is essential for evaluating its potential.

AliExpress’s Business Model and Revenue Streams

AliExpress operates as a business-to-consumer (B2C) e-commerce platform, connecting millions of primarily small and medium-sized enterprises (SMEs) in China and other countries with global consumers. Its primary revenue stream comes from commissions charged to sellers on each successful transaction. Additional revenue is generated through marketing and advertising services offered to sellers.

AliExpress’s Market Share and Global Competition

AliExpress holds a significant share of the global e-commerce market, particularly in certain regions. While precise figures vary depending on the source and metrics used, it competes with giants like Amazon, eBay, and others. Its competitive advantage often lies in offering lower prices, a vast selection of goods, and access to niche products.

Factors Driving AliExpress’s Market Share Growth or Decline

Several factors influence AliExpress’s market share. Growth is driven by factors like expanding product offerings, improving logistics, and targeted marketing campaigns. Declines could result from increased competition, changes in consumer preferences, or geopolitical events impacting cross-border trade.

AliExpress’s Competitive Advantages and Disadvantages

AliExpress benefits from its vast network of sellers, low prices, and a wide selection of products. However, challenges include concerns about product quality, longer shipping times compared to local e-commerce platforms, and potential logistical complexities in international shipping.

Global Economic Factors Affecting AliExpress

Global economic conditions significantly influence AliExpress’s performance. Understanding these factors and their potential impact is crucial for assessing its future.

Impact of Global Economic Factors on AliExpress, Aliexpress stock price

| Factor | Impact on AliExpress | Severity | Mitigation Strategies |

|---|---|---|---|

| Global Inflation | Increased operational costs, potential reduction in consumer spending, impacting sales volume and profitability. | High | Optimize supply chain, explore cost-cutting measures, focus on value-added services. |

| Recessionary Pressures | Reduced consumer spending, lower demand for non-essential goods, affecting sales and profit margins. | High | Diversify product offerings, focus on value-driven marketing, strengthen customer loyalty programs. |

| Currency Exchange Rate Fluctuations | Impacts profitability on international transactions, creating uncertainty in pricing and revenue streams. | Medium | Implement hedging strategies, optimize pricing models, diversify payment options. |

| Geopolitical Events and Trade Policies | Potential disruptions to supply chains, trade restrictions, impacting product availability and delivery times. | Medium to High (depending on the event) | Diversify sourcing locations, explore alternative logistics routes, engage in proactive risk management. |

Key Performance Indicators (KPIs) for AliExpress

Several key performance indicators (KPIs) are crucial for assessing AliExpress’s financial health and predicting potential stock price movements (if it were publicly traded).

AliExpress’s Key Performance Indicators

Five crucial KPIs for AliExpress include:

- Gross Merchandise Value (GMV): Total value of goods sold on the platform. A rising GMV indicates strong sales and market growth.

- Active Buyers: Number of unique buyers making purchases on AliExpress. An increase suggests expanding market reach and customer base.

- Average Order Value (AOV): Average amount spent per order. A higher AOV indicates successful upselling and customer engagement.

- Customer Acquisition Cost (CAC): Cost of acquiring a new customer. Lower CAC suggests efficient marketing and customer acquisition strategies.

- Net Profit Margin: Percentage of revenue remaining after deducting all expenses. A higher net profit margin indicates improved profitability and efficiency.

These KPIs, analyzed together, provide a comprehensive view of AliExpress’s performance and can be used to project future growth and profitability. For example, a consistent increase in GMV alongside a decreasing CAC would signal strong market performance and efficient operations.

Hypothetical KPI Changes and Investor Sentiment

Imagine a scenario where AliExpress reports a 20% increase in GMV and a 10% decrease in CAC. This positive trend would likely boost investor confidence, potentially leading to a positive impact on Alibaba’s stock price and positively influencing the perceived value of AliExpress, if it were independently traded.

AliExpress’s User Base and Customer Demographics: Aliexpress Stock Price

Understanding AliExpress’s customer base is vital for assessing its growth potential and adapting its strategies.

Characteristics of AliExpress’s Customer Base

AliExpress caters to a global customer base, with a significant concentration in emerging markets. Its users are typically price-sensitive, tech-savvy, and often seek unique or niche products not readily available locally. Age demographics vary significantly across regions, but generally include a substantial young adult and millennial population.

Impact of Changing Consumer Habits on AliExpress

Shifts in consumer spending habits, such as increased preference for sustainable products or locally sourced goods, could impact AliExpress’s revenue. Adapting to these changes through product diversification and promoting environmentally friendly practices is crucial for maintaining competitiveness.

Comparison of AliExpress’s User Base with Competitors

Compared to competitors like Amazon or eBay, AliExpress has a more globally diverse user base, with a higher proportion of customers from developing economies. However, it may face challenges in competing with established platforms that offer faster shipping and more localized customer service.

Impact of Shifting Demographics on AliExpress’s Future

Changes in global demographics, such as an aging population in certain regions or a rise in middle-class consumers in others, will influence AliExpress’s market position. Adapting its product offerings and marketing strategies to meet the needs of evolving demographics is essential for long-term success.

Technological Factors and Future Outlook

Source: seekingalpha.com

Technology plays a crucial role in AliExpress’s operations and future prospects.

Technology’s Role in AliExpress’s Operations

AliExpress relies heavily on technology for various aspects of its business, including logistics management, secure payment processing, and customer service. Advanced data analytics is used for personalized recommendations and targeted marketing. Automation and AI are increasingly used to optimize operations and enhance customer experience.

Emerging Technologies Impacting AliExpress

Emerging technologies like blockchain for enhanced security and transparency in transactions, AI-powered chatbots for improved customer support, and the expansion of 5G networks for faster logistics are expected to significantly influence AliExpress’s operations.

Technological Risks and Opportunities

Source: co.id

Technological advancements present both risks and opportunities. Risks include cybersecurity threats, the need for continuous adaptation to new technologies, and potential disruptions from innovative competitors. Opportunities include improved efficiency, enhanced customer experience, and the development of new revenue streams through innovative technology applications.

Vision for AliExpress’s Future Technological Advancements

AliExpress’s future success hinges on continuous investment in technology. A vision for the future might involve leveraging AI for more personalized shopping experiences, integrating advanced logistics solutions for faster and more reliable delivery, and utilizing blockchain for greater transparency and security. This would solidify its position as a global e-commerce leader.

FAQ Summary

How does Alibaba’s profitability directly affect a hypothetical AliExpress stock price?

Alibaba’s profits significantly influence a hypothetical AliExpress stock price because AliExpress operates within Alibaba’s ecosystem. Strong Alibaba profits suggest a healthy e-commerce environment, boosting investor confidence and potentially increasing the perceived value of its subsidiaries like AliExpress.

What are the biggest risks to AliExpress’s hypothetical stock valuation?

Major risks include increased competition from other e-commerce platforms, global economic downturns impacting consumer spending, shifts in consumer preferences, and regulatory changes in key markets.

Could AliExpress ever become an independently traded company?

It’s possible, but it would depend on Alibaba’s strategic decisions. An IPO for AliExpress would require careful consideration of market conditions and the potential benefits versus keeping it integrated within the Alibaba Group.