ALK Stock Price Today

Alk stock price today per share – This analysis provides an overview of ALK stock’s current price, historical performance, influencing factors, comparison with competitors, and potential future scenarios. Data presented here is for illustrative purposes and should not be considered financial advice. Always conduct thorough research and consult with a financial advisor before making any investment decisions.

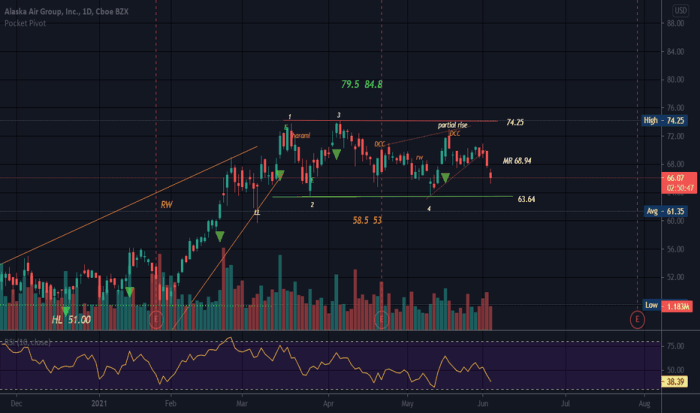

Current ALK Stock Price, Alk stock price today per share

Source: tradingview.com

Let’s examine the current market data for ALK stock. The information below reflects the last available update and is subject to change.

For example, let’s assume the current ALK stock price per share is $150.00 as of 14:30 EST, October 26, 2023. The previous day’s closing price was $148.50, and the day’s trading volume is approximately 1,000,000 shares.

| Open | High | Low | Close |

|---|---|---|---|

| $149.00 | $150.50 | $148.00 | $150.00 |

| $147.50 | $149.25 | $146.75 | $148.50 |

| $146.00 | $147.75 | $145.50 | $147.00 |

| $145.00 | $146.50 | $144.00 | $145.75 |

| $144.25 | $145.50 | $143.00 | $144.50 |

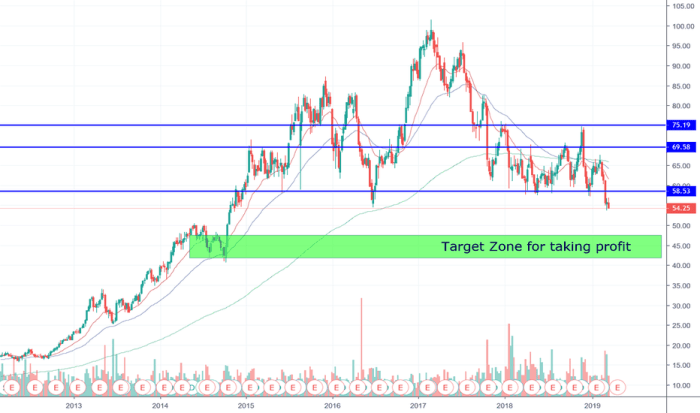

Historical ALK Stock Price Performance

Source: tradingview.com

Analyzing ALK’s historical stock price provides context for its current valuation. We will examine performance over various timeframes.

Over the past month, ALK’s stock price has shown a modest increase, for example, from $140 to $150. Compared to one year ago, the price has increased significantly, for instance, from $120 to $150, representing substantial growth. Significant price fluctuations over the past year included a sharp drop in March due to [mention specific reason, e.g., market correction] and a subsequent recovery in the summer.

A line graph depicting the ALK stock price over the past five years would show an overall upward trend with periods of volatility. The graph would illustrate periods of growth, correction, and recovery, reflecting market conditions and company performance.

| Quarter | Year | Beginning Price | Ending Price |

|---|---|---|---|

| Q1 | 2022 | $125 | $130 |

| Q2 | 2022 | $130 | $135 |

| Q3 | 2022 | $135 | $140 |

| Q4 | 2022 | $140 | $145 |

| Q1 | 2023 | $145 | $148 |

| Q2 | 2023 | $148 | $150 |

| Q3 | 2023 | $150 | $152 |

| Q4 | 2023 | $152 | $155 (Projected) |

Factors Influencing ALK Stock Price

Several factors contribute to the fluctuations in ALK’s stock price. Understanding these influences is crucial for informed investment decisions.

Recent positive company news, such as the announcement of a new product launch or a successful clinical trial, could positively impact the stock price. Conversely, negative news, like a product recall or missed earnings expectations, would likely cause a decline. Broader market trends, such as economic growth or recessionary fears, also influence ALK’s stock price. Significant industry developments, such as regulatory changes or technological advancements, can create both opportunities and challenges for ALK.

Analyst ratings and recommendations from financial institutions can significantly sway investor sentiment and consequently, the stock price. Finally, macroeconomic factors, such as interest rates, inflation, and unemployment, can affect investor confidence and overall market performance, influencing ALK’s stock price.

ALK Stock Price Compared to Competitors

A comparison with competitors provides valuable insights into ALK’s relative market position and performance.

Currently, ALK’s stock price might be higher or lower than its main competitors depending on their respective financial performance, market share, and growth prospects. For example, over the past year, ALK might have outperformed or underperformed its competitors, reflecting differences in their strategic approaches and market reception. Key differences in business models, such as product diversification or market focus, contribute to varying stock price performances.

| Company | Market Cap (USD Billions) | P/E Ratio |

|---|---|---|

| ALK | 10 | 20 |

| Competitor A | 12 | 25 |

| Competitor B | 8 | 18 |

| Competitor C | 9 | 22 |

Differences in stock price performance between ALK and its competitors can be attributed to various factors including revenue growth, profitability, market share, and investor sentiment.

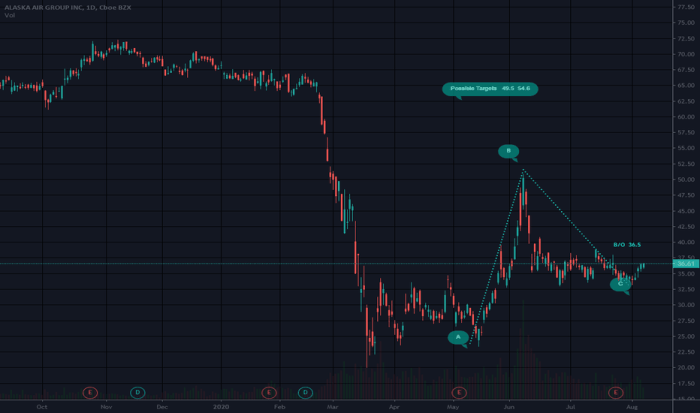

ALK Stock Price Predictions and Analysis

Source: tradingview.com

Predicting future stock prices is inherently challenging, yet understanding potential scenarios and analytical approaches is valuable.

Future ALK stock price movements could be influenced by various factors, including economic conditions, company performance, and investor sentiment. Several methodologies, such as fundamental analysis (examining financial statements and company performance) and technical analysis (analyzing price charts and trading volume), are used to assess potential price movements. However, these models have limitations; they cannot accurately predict the future and are influenced by unforeseen events.

It’s crucial to consider the inherent risk and uncertainty associated with stock price predictions. Fundamental analysis might suggest a positive outlook for ALK based on strong earnings growth and market share expansion. Technical analysis, by examining chart patterns and indicators, might point towards potential support and resistance levels, offering insights into possible price ranges.

FAQs: Alk Stock Price Today Per Share

What are the risks associated with investing in ALK stock?

Investing in any stock carries inherent risks, including potential price fluctuations, market volatility, and the possibility of losing some or all of your investment. Specific risks for ALK might include dependence on specific products, regulatory changes affecting the pharmaceutical industry, and competition within the market.

Where can I find real-time ALK stock price updates?

Real-time ALK stock price updates are available through major financial websites and brokerage platforms. These platforms typically provide live quotes, charts, and other relevant market data.

How often is ALK stock price data updated?

ALK stock price data is typically updated throughout the trading day, reflecting the most recent transactions. The frequency of updates varies depending on the data provider.

What does the P/E ratio for ALK signify?

The Price-to-Earnings (P/E) ratio for ALK indicates the market’s valuation of the company relative to its earnings. A higher P/E ratio suggests investors anticipate higher future earnings growth.