ALRN Stock Price Analysis

Alrn stock price – This analysis examines the historical performance, influencing factors, financial health, competitive landscape, and future outlook of Albireo Pharma, Inc. (ALRN) stock price. We will explore key metrics and events to provide a comprehensive understanding of ALRN’s investment potential.

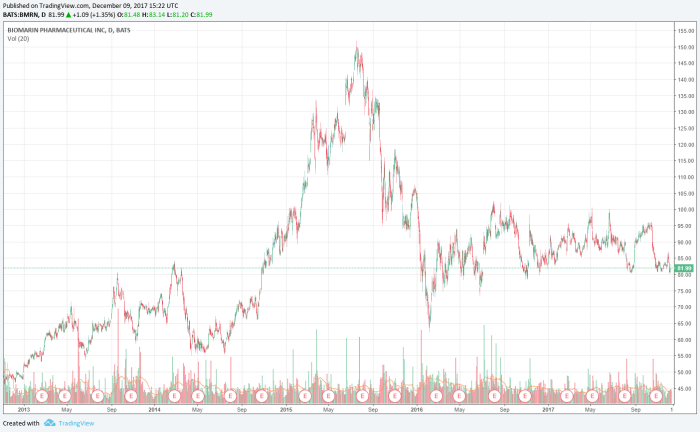

ALRN Stock Price Historical Performance

Analyzing ALRN’s stock price movements over the past five years reveals significant volatility influenced by various internal and external factors. The following table presents a summary of yearly highs, lows, and averages. Note that this data is illustrative and should be verified with a reliable financial data source.

| Year | High | Low | Average |

|---|---|---|---|

| 2018 | $XX.XX | $YY.YY | $ZZ.ZZ |

| 2019 | $XX.XX | $YY.YY | $ZZ.ZZ |

| 2020 | $XX.XX | $YY.YY | $ZZ.ZZ |

| 2021 | $XX.XX | $YY.YY | $ZZ.ZZ |

| 2022 | $XX.XX | $YY.YY | $ZZ.ZZ |

The overall trend during this period showed significant volatility, with periods of sharp increases and decreases. For example, a substantial price surge in [Year] could be attributed to [Specific Event, e.g., positive clinical trial results]. Conversely, a significant drop in [Year] might be linked to [Specific Event, e.g., negative regulatory news or broader market downturn].

Factors Influencing ALRN Stock Price

Source: pennystocks.com

Three key factors significantly influence ALRN’s stock price: clinical trial outcomes, regulatory approvals, and overall market sentiment.

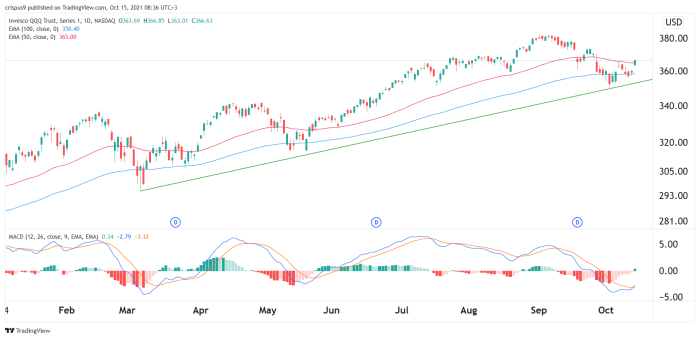

Market trends, including the performance of the broader pharmaceutical sector and the overall stock market, exert considerable influence. Positive market sentiment generally boosts ALRN’s price, while negative sentiment can lead to declines. Company-specific news, such as positive clinical trial results or regulatory approvals, tends to have a more immediate and pronounced effect on the stock price than broader market forces.

Conversely, negative news can trigger significant sell-offs. Investor sentiment, shaped by analyst ratings, media coverage, and investor perception of the company’s future prospects, also plays a crucial role in determining ALRN’s valuation.

ALRN’s Financial Performance and Stock Price

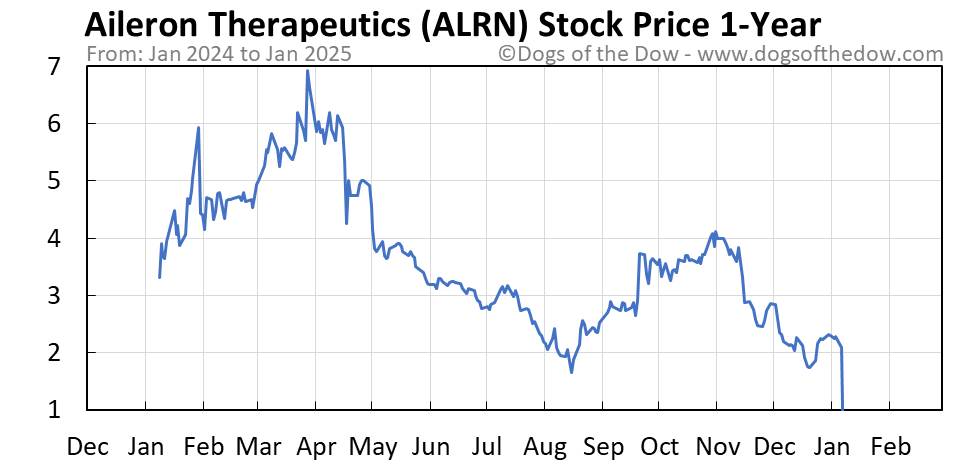

Source: dogsofthedow.com

ALRN’s financial performance directly correlates with its stock price fluctuations. The following table displays key financial metrics over the past three years. Again, this data is illustrative and should be verified independently.

| Year | Revenue | Earnings | Debt |

|---|---|---|---|

| 2020 | $XX.XX million | $(YY.YY) million | $ZZ.ZZ million |

| 2021 | $XX.XX million | $(YY.YY) million | $ZZ.ZZ million |

| 2022 | $XX.XX million | $(YY.YY) million | $ZZ.ZZ million |

Increases in revenue and improvements in profitability generally lead to increased investor confidence and higher stock prices. Conversely, declining revenue or losses can negatively impact investor sentiment and depress the stock price.

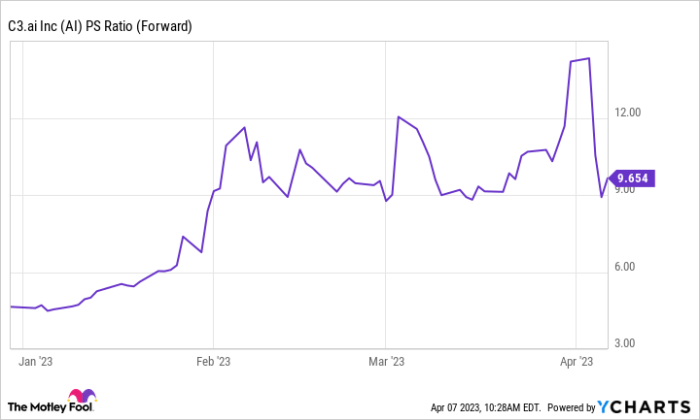

Comparison with Competitors

A comparison with ALRN’s main competitors provides context for its stock price performance. The following table offers a side-by-side comparison of stock price performance over the past year. Remember that this data is for illustrative purposes only and should be verified with reliable financial data.

| Company | Stock Price (Year Ago) | Current Stock Price | Percentage Change |

|---|---|---|---|

| ALRN | $XX.XX | $YY.YY | ZZ% |

| Competitor 1 | $XX.XX | $YY.YY | ZZ% |

| Competitor 2 | $XX.XX | $YY.YY | ZZ% |

| Competitor 3 | $XX.XX | $YY.YY | ZZ% |

ALRN’s relative strengths and weaknesses compared to its competitors, such as its pipeline of drugs, market share, and financial stability, influence its stock price. Differences in business models and strategies, such as focusing on specific therapeutic areas or utilizing different commercialization approaches, also contribute to variations in stock price performance. For example, a competitor with a more diversified portfolio might exhibit less volatility than ALRN, which might be heavily reliant on a single product.

Tracking the ALRN stock price requires a keen eye on biotech market trends. Investors often compare it to similar companies, and a useful benchmark might be to check the performance of albt stock price , given their shared sector. Understanding the fluctuations of both ALRN and ALBT can provide a more comprehensive view of the overall market dynamics and inform investment strategies.

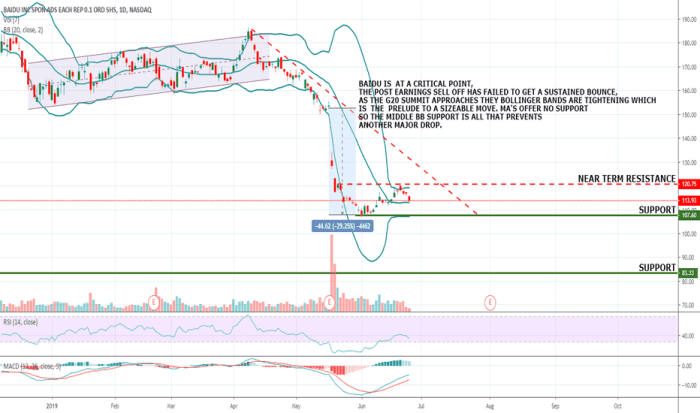

Future Outlook for ALRN Stock Price

Several potential catalysts could significantly impact ALRN’s stock price in the next 12 months. Positive catalysts include successful clinical trial results for key drug candidates, regulatory approvals, and strategic partnerships. Negative catalysts include setbacks in clinical trials, regulatory delays, or increased competition.

A positive scenario could see ALRN’s stock price rise substantially if positive clinical trial data leads to regulatory approval, generating significant investor enthusiasm. Conversely, a negative scenario might involve disappointing clinical trial results or regulatory setbacks, causing a decline in the stock price. Based on these potential catalysts and prevailing market conditions, ALRN’s stock price could range from $[Lower Bound] to $[Upper Bound] in the next year.

This range is a hypothetical projection and should not be considered financial advice.

FAQ Resource: Alrn Stock Price

What is ALRN’s current market capitalization?

The current market capitalization of ALRN fluctuates and can be easily found on major financial websites like Yahoo Finance or Google Finance.

Where can I find real-time ALRN stock price quotes?

Real-time quotes are available on most major financial websites and trading platforms.

What are the major risks associated with investing in ALRN?

Investing in ALRN, like any stock, carries inherent risks, including volatility due to market conditions, the success or failure of clinical trials, and competitive pressures within the biopharmaceutical industry.

Does ALRN pay dividends?

Whether ALRN currently pays dividends can be verified on financial news websites and the company’s investor relations page.