Factors Influencing Stock Price Alterations

Alter stock price – Stock prices are dynamic, constantly fluctuating in response to a multitude of factors. Understanding these influences is crucial for investors seeking to navigate the complexities of the market. This section explores key macroeconomic, company-specific, and psychological elements that drive stock price changes.

Macroeconomic Indicators and Stock Prices

Broad economic conditions significantly impact stock valuations. Inflation, for example, erodes purchasing power and can lead to higher interest rates, making borrowing more expensive for companies and potentially slowing economic growth. This often results in lower stock prices. Conversely, lower inflation and lower interest rates can stimulate economic activity, potentially boosting corporate profits and driving stock prices higher.

The relationship isn’t always direct, however; unexpected inflation can create uncertainty, impacting investor confidence and thus stock prices negatively.

Company Performance and Stock Prices

A company’s financial performance is a primary driver of its stock price. Strong earnings reports, indicating robust revenue and profitability, generally lead to increased investor confidence and higher stock prices. Conversely, disappointing earnings, coupled with negative future outlooks, can trigger significant price declines. Product launches, successful marketing campaigns, and strategic acquisitions also impact investor perception and subsequently, stock prices. Successful product launches, for example, can signal future growth potential, driving up the stock price.

Investor Sentiment and Market Psychology

Investor sentiment, encompassing the overall mood and expectations of the market, plays a significant role in stock price fluctuations. Periods of optimism and confidence often lead to higher prices, while fear and uncertainty can trigger sell-offs. Market psychology, including herd behavior and speculative bubbles, can amplify these effects, leading to significant price swings that may not always be directly related to fundamental company performance.

Short-Selling and Buy-and-Hold Strategies

Short-selling, where investors borrow and sell shares, anticipating a price drop to buy back later at a lower price, contributes to price volatility. This strategy can exacerbate downward pressure during periods of negative sentiment. Conversely, buy-and-hold strategies, where investors maintain long-term ownership regardless of short-term fluctuations, tend to stabilize prices and reduce volatility over the long term. The interplay between these opposing strategies shapes the overall price trajectory.

Geopolitical Events and Stock Prices

Geopolitical events, such as wars, political instability, and trade disputes, can significantly impact stock prices. These events introduce uncertainty and risk, affecting investor confidence and potentially leading to market-wide sell-offs or sector-specific declines. The impact depends on the nature and severity of the event and its potential ramifications on specific industries or economies.

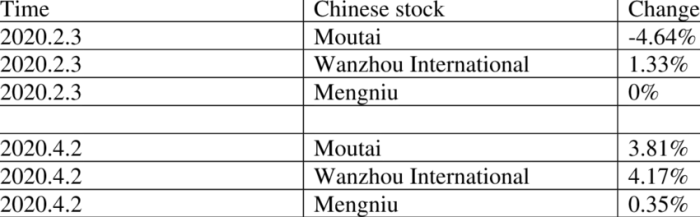

| Event | Stock Affected | Price Change Percentage | Explanation |

|---|---|---|---|

| Start of the Ukraine War | Energy Companies | +20% | Increased demand for oil and gas due to sanctions and supply chain disruptions. |

| Brexit Referendum | UK Banks | -15% | Uncertainty surrounding the future of the UK economy and its financial sector. |

| US-China Trade War | Technology Companies | -10% | Increased tariffs and trade restrictions impacting global supply chains. |

| 9/11 Attacks | Airlines | -30% | Significant decrease in air travel due to security concerns and travel restrictions. |

Mechanisms for Stock Price Manipulation

Market manipulation involves artificial inflation or deflation of stock prices for personal gain. Understanding the techniques and implications is crucial for maintaining market integrity and protecting investors.

Methods of Market Manipulation

Pump-and-dump schemes are a common form of manipulation. In this scheme, manipulators artificially inflate a stock’s price through coordinated buying and positive publicity (the “pump”), then sell their shares at the inflated price (the “dump”), leaving other investors with losses. Other methods include spreading false or misleading information, using wash sales (creating artificial trading volume), and engaging in spoofing (placing orders with no intention of execution to influence prices).

Legal and Ethical Implications of Stock Price Manipulation

Stock price manipulation is illegal and unethical. Regulatory bodies such as the Securities and Exchange Commission (SEC) actively investigate and prosecute manipulators. The penalties can include hefty fines, imprisonment, and a tarnished reputation, significantly impacting the individuals and entities involved. The ethical implications involve a breach of trust with investors and a distortion of market efficiency.

Insider Trading and Stock Prices

Insider trading, the illegal trading of securities based on non-public material information, significantly impacts stock prices. Individuals with access to confidential information can exploit this advantage to profit from price movements before the information becomes public. This practice undermines market fairness and erodes investor confidence.

Impact of False or Misleading Information

Disseminating false or misleading information, such as fabricated news or rumors, can influence stock prices dramatically. Such actions can cause panic selling or artificially inflated buying, depending on the nature of the information. The impact can be particularly severe for smaller companies with less liquidity, where even a small amount of misinformation can cause significant price swings.

Flowchart of a Typical Stock Manipulation Scheme, Alter stock price

A typical stock manipulation scheme might follow these steps:

- Identify a target stock.

- Accumulate a large position in the stock.

- Spread positive (often false) information to inflate the price.

- Sell the stock at the inflated price.

- Leave other investors with losses.

Predicting Stock Price Changes

Predicting stock price movements is inherently challenging, but various methods are employed. However, limitations and complexities exist, regardless of the approach used.

Limitations of Technical Analysis

Technical analysis, which relies on historical price and volume data to identify patterns and predict future movements, has limitations. While patterns can sometimes repeat, the market is constantly evolving, and past performance isn’t necessarily indicative of future results. Furthermore, technical analysis can be subjective, with different analysts interpreting the same data differently.

Understanding how to alter stock price involves analyzing various market factors. A helpful resource for comparative analysis is reviewing the historical performance of similar companies, such as examining the alb stock price history , which can offer insights into potential trends. Ultimately, predicting alterations in stock prices requires a comprehensive approach encompassing numerous variables beyond historical data alone.

Challenges of Fundamental Analysis

Fundamental analysis, which focuses on a company’s financial health and future prospects, also faces challenges. Accurately predicting future earnings, cash flows, and economic conditions is difficult. Furthermore, unexpected events and changes in investor sentiment can significantly impact stock prices, regardless of fundamental strength.

Quantitative Models for Stock Price Prediction

Quantitative models, such as time series analysis and machine learning algorithms, are used to predict stock price movements. These models can analyze vast datasets and identify complex relationships, but their accuracy is limited by the quality and completeness of the data, and the inherent unpredictability of the market. Overfitting, where a model performs well on historical data but poorly on new data, is a significant concern.

Sentiment Analysis and Stock Price Prediction

Sentiment analysis, which involves analyzing news articles, social media posts, and other textual data to gauge investor sentiment, can be used to anticipate price changes. Positive sentiment often precedes price increases, while negative sentiment can signal potential declines. However, sentiment analysis is not always accurate, and the interpretation of sentiment can be subjective.

Factors Difficult to Predict

- Unexpected geopolitical events (wars, political upheavals): Can trigger sudden and significant market reactions.

- Major technological breakthroughs or disruptions: Can create winners and losers in unexpected ways.

- Changes in regulatory environments: New regulations can significantly impact specific industries.

- Natural disasters or pandemics: Can cause widespread economic disruption and market volatility.

- Significant shifts in investor psychology: Sudden changes in market sentiment can lead to unpredictable price swings.

Regulatory Oversight and Stock Price Stability

Regulatory bodies play a vital role in maintaining market integrity and preventing stock price manipulation. Their actions significantly influence market stability and investor confidence.

Role of Regulatory Bodies

Regulatory bodies like the SEC in the United States and similar organizations globally are responsible for enforcing laws against market manipulation, insider trading, and other fraudulent activities. They investigate suspicious trading patterns, monitor market activity, and impose penalties on violators. Their actions aim to ensure fair and efficient markets.

Impact of Regulations on Market Stability

Source: researchgate.net

Effective regulations enhance market stability by deterring manipulative activities and promoting investor confidence. Clear rules and enforcement mechanisms reduce uncertainty and create a more predictable investment environment. This, in turn, fosters economic growth and development.

Mechanisms for Detecting and Addressing Market Manipulation

Regulatory bodies utilize various mechanisms to detect market manipulation. These include surveillance systems that monitor trading activity for unusual patterns, investigations into suspicious trading practices, and analysis of market data to identify potential manipulation schemes. Once identified, appropriate enforcement actions are taken, including fines and legal prosecution.

Comparative Regulatory Approaches

Regulatory approaches to stock market manipulation vary across countries. While the underlying principles are similar, the specific rules, enforcement mechanisms, and penalties can differ. International cooperation is essential to address cross-border manipulation schemes.

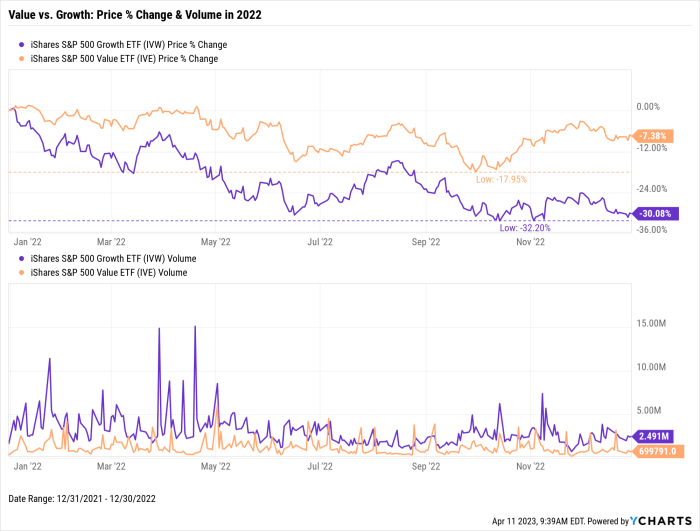

Penalties for Stock Price Manipulation

Source: ycharts.com

- Heavy fines

- Imprisonment

- Civil penalties

- Trading bans

- Reputational damage

Case Studies of Significant Stock Price Alterations

Examining real-world examples illustrates the diverse factors that can trigger substantial changes in stock prices.

Company Impacted by Major News Event

The announcement of a major product recall by a prominent automotive manufacturer could trigger a sharp decline in its stock price. The negative publicity, coupled with potential financial liabilities associated with the recall, could severely impact investor confidence, leading to a significant sell-off. The extent of the price drop would depend on the severity of the recall, the company’s response, and the overall market sentiment.

Stock Price Altered Due to Accounting Irregularities

A company discovered to have engaged in fraudulent accounting practices could experience a dramatic drop in its stock price. Investors would lose trust in the company’s financial reporting, leading to a sell-off. Regulatory investigations and potential legal repercussions could further exacerbate the situation, resulting in long-term damage to the company’s reputation and valuation.

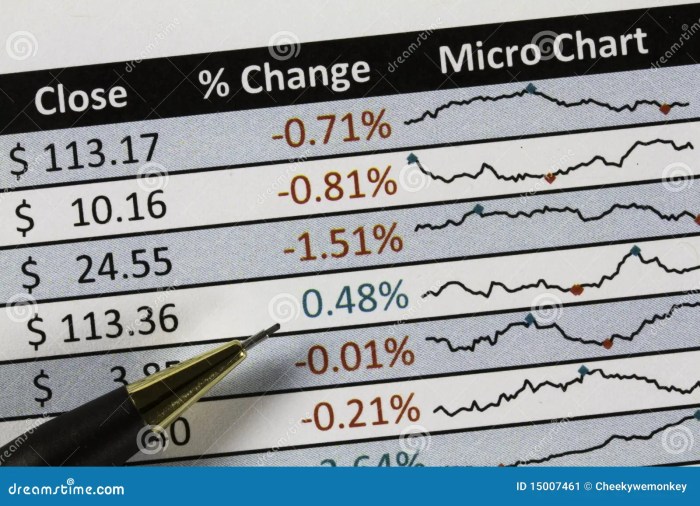

Stock Price Manipulation Case Study

Source: dreamstime.com

A classic example involves a small-cap company whose stock price was artificially inflated through a pump-and-dump scheme. The manipulators used coordinated buying and false positive publicity to attract unsuspecting investors. Once the price reached a peak, they dumped their shares, leaving other investors with significant losses. Regulatory investigations often follow such events, leading to penalties for those involved.

Significant Change in Investor Sentiment

A sudden shift in investor sentiment towards a technology company, perhaps due to a negative news report about its new product or a competitor’s significant breakthrough, could cause a sharp decline in its stock price. This demonstrates the significant impact of market psychology and the power of perception in driving stock valuations. The speed and magnitude of the price change would depend on the strength of the negative news and the overall market environment.

| Company | Event | Price Change | Analysis of Contributing Factors |

|---|---|---|---|

| Example Co. A | Major Product Recall | -30% | Negative publicity, potential legal liabilities, loss of consumer confidence. |

| Example Co. B | Accounting Irregularities | -50% | Loss of investor trust, regulatory investigations, potential legal repercussions. |

| Example Co. C | Pump-and-Dump Scheme | +500% then -80% | Artificial price inflation, coordinated buying, false positive information. |

| Example Co. D | Negative Product Review | -20% | Negative investor sentiment, concerns about future sales, competitive pressure. |

Helpful Answers: Alter Stock Price

What is the difference between fundamental and technical analysis in predicting stock prices?

Fundamental analysis focuses on a company’s intrinsic value based on financial statements and economic factors. Technical analysis, conversely, uses price charts and trading volume to identify patterns and predict future price movements.

How can I protect myself from stock market manipulation?

Diversify your portfolio, stay informed about market news and regulations, and be wary of overly optimistic or pessimistic claims, especially those lacking credible sources.

What are some common signs of stock manipulation?

Unusual spikes in trading volume, significant price swings without apparent news, coordinated buying or selling activity, and misleading press releases are potential indicators.

What role does social media play in influencing stock prices?

Social media can significantly impact investor sentiment, leading to rapid price changes based on trends and viral news, sometimes regardless of fundamental value.