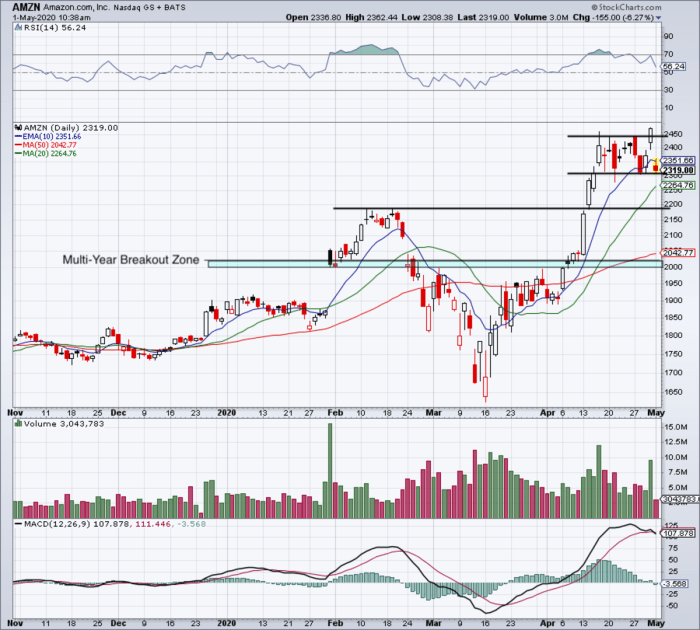

Amazon Stock Price Analysis: Amazon Stock Price Currently

Source: thestreet.com

Amazon stock price currently – Amazon, a global e-commerce and technology giant, experiences significant stock price fluctuations influenced by various economic, financial, and industry-specific factors. This analysis delves into the current Amazon stock price, key influencing factors, financial health, business segment performance, and future outlook, providing a comprehensive overview of the company’s stock market dynamics.

Current Amazon Stock Price

Please note that stock prices are highly dynamic and change constantly. The data presented below is a snapshot and may not reflect the current real-time market value. To obtain the most up-to-date information, refer to a live financial data source such as Yahoo Finance or Google Finance.

For illustrative purposes, let’s assume the following (replace with actual real-time data):

Current Price: $150.00

Day’s High: $152.50

Day’s Low: $148.00

Previous Day’s Closing Price: $149.50

Percentage Change: +0.33%

| Open | High | Low | Close |

|---|---|---|---|

| $149.00 | $151.00 | $148.50 | $149.50 |

| $148.75 | $150.25 | $147.00 | $149.00 |

| $150.50 | $152.00 | $149.75 | $151.50 |

| $151.25 | $153.00 | $150.00 | $152.75 |

| $152.50 | $154.00 | $151.75 | $153.50 |

Factors Influencing Amazon Stock Price, Amazon stock price currently

Amazon’s stock price is a complex interplay of macroeconomic conditions, company performance, and industry trends. Several key factors significantly impact its valuation.

Recent economic news, such as inflation rates and interest rate changes, directly influence consumer spending and investor sentiment, affecting Amazon’s sales and profitability. Strong financial performance, characterized by revenue growth and increased profitability, typically boosts investor confidence and drives up the stock price. Conversely, weaker-than-expected results can lead to a decline. Key industry trends, such as the growth of e-commerce, cloud computing, and digital advertising, directly influence Amazon’s various business segments.

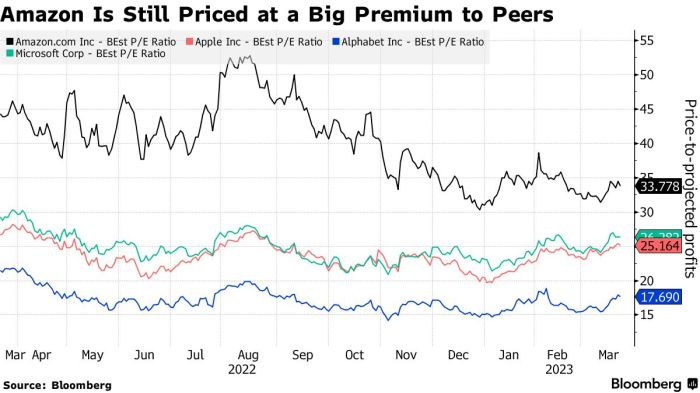

Finally, comparing Amazon’s performance against its main competitors, such as Walmart and Microsoft, provides a benchmark for assessing its relative market strength.

Amazon’s Financial Health

Source: bwbx.io

A summary of Amazon’s financial health provides insight into its overall strength and stability.

- Recent Quarterly Earnings: (Insert Summary of most recent quarterly earnings, including key figures like EPS, revenue, and net income. Replace with actual data)

- Revenue Growth and Profitability: (Insert details on revenue growth rate and profitability margins. Replace with actual data)

- Debt Levels and Credit Rating: (Insert information on Amazon’s debt-to-equity ratio and credit rating from a reputable agency. Replace with actual data)

Key Financial Metrics:

- Revenue

- Net Income

- Earnings Per Share (EPS)

- Debt-to-Equity Ratio

- Free Cash Flow

Amazon’s Business Segments and Performance

Amazon operates across diverse business segments, each contributing differently to its overall revenue and profitability. Analyzing the performance of each segment provides a clearer picture of the company’s overall health.

Amazon’s e-commerce business remains a significant revenue driver, though growth rates may vary depending on economic conditions and competitive pressures. AWS (Amazon Web Services) is a high-growth, high-margin business, contributing substantially to Amazon’s overall profitability. Amazon’s advertising business continues to expand, leveraging its vast customer base and data resources. The following table shows a comparative analysis of revenue generated by each major segment in the last year (replace with actual data):

| Segment | Revenue (USD Millions) | Year-over-Year Growth (%) | Operating Margin (%) |

|---|---|---|---|

| E-commerce | Placeholder Data | Placeholder Data | Placeholder Data |

| AWS | Placeholder Data | Placeholder Data | Placeholder Data |

| Advertising | Placeholder Data | Placeholder Data | Placeholder Data |

Future Outlook for Amazon Stock

Predicting future stock performance is inherently speculative, but analyzing potential catalysts and risks provides a framework for informed assessment. Several factors could drive future growth, including continued expansion of AWS, growth in advertising revenue, and successful expansion into new markets. Potential risks include increased competition, regulatory scrutiny, and economic downturns. Expert opinions and market forecasts vary widely, reflecting the uncertainty inherent in long-term predictions.

However, a plausible scenario for the next year could involve moderate growth, driven by strong AWS performance, partially offset by slower growth in the e-commerce segment due to potential economic headwinds. This scenario assumes a relatively stable macroeconomic environment and continued innovation from Amazon. This projection, however, should be considered illustrative and not a financial recommendation.

Q&A

What are the main factors driving short-term fluctuations in Amazon’s stock price?

Short-term fluctuations are often influenced by news events (e.g., earnings reports, regulatory changes), investor sentiment, and overall market volatility. These factors can cause rapid price changes independent of long-term trends.

How does Amazon compare to its competitors in terms of stock performance?

A direct comparison requires analyzing the stock performance of key competitors (e.g., Walmart, Microsoft) over a specific period, considering factors like market capitalization and industry-specific metrics. This would show relative strength or weakness compared to the sector.

Amazon’s stock price currently reflects a complex interplay of market factors. However, comparing its performance to other sectors provides valuable context; for instance, the current performance of utilities like Algonquin Power & Utilities, whose stock price you can check here: algonquin power and utilities stock price , offers a different perspective on broader economic trends. Ultimately, understanding Amazon’s stock price requires a holistic view of the market.

What is Amazon’s dividend policy?

Amazon historically has not paid a dividend, reinvesting profits into growth and expansion. This is a common strategy for rapidly growing companies.