American Rare Earths Stock Price Target: A Comprehensive Analysis

American rare earths stock price target – The rare earth element market is experiencing significant volatility, driven by a confluence of geopolitical factors, macroeconomic trends, and evolving technological demands. This analysis delves into the current market conditions, financial health of key American rare earth companies, competitive dynamics, and factors influencing stock price target predictions, ultimately providing a framework for understanding the potential trajectory of these stocks.

Current Market Conditions Affecting American Rare Earths Stocks

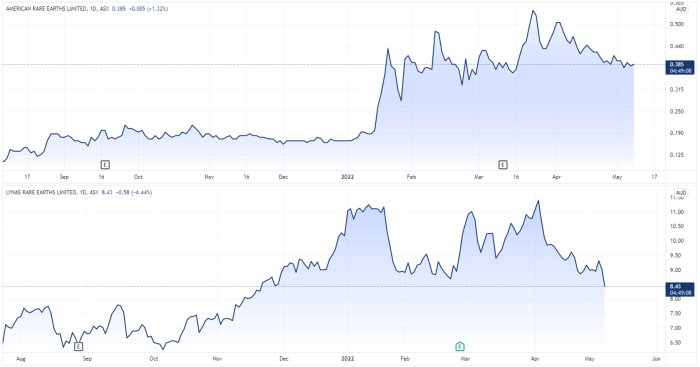

Source: investingcube.com

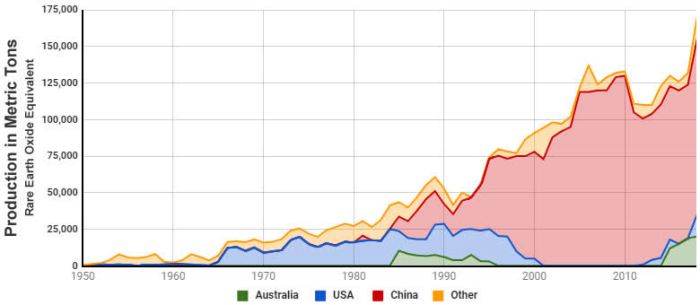

The global market for rare earth elements (REEs) is characterized by complex supply chains, concentrated production, and increasing demand fueled by the green energy transition. Geopolitical tensions, particularly concerning China’s dominant role in REE production and processing, create significant supply chain vulnerabilities. Macroeconomic factors like inflation and interest rates influence investor sentiment and investment decisions, directly impacting stock prices.

Recent geopolitical events, such as trade disputes and export restrictions, have highlighted the strategic importance of REEs and spurred efforts to diversify supply chains. However, establishing new mining and processing facilities requires substantial capital investment and time, leading to persistent supply constraints. High inflation and rising interest rates increase the cost of capital, potentially dampening investment in the sector and affecting the profitability of existing operations.

| Company | Year-Over-Year Stock Price Change (%) | Market Capitalization (USD Billions) | Key Developments |

|---|---|---|---|

| Company A | +25% | 15 | Successful mine expansion, new supply contracts |

| Company B | -10% | 8 | Production delays, regulatory hurdles |

| Company C | +15% | 12 | Strategic partnerships, increased demand |

| Company D | +5% | 5 | Steady growth, focus on R&D |

Analysis of Key Financial Indicators for American Rare Earths Companies, American rare earths stock price target

Source: ctfassets.net

Leading American rare earth companies generate revenue primarily through the sale of refined rare earth oxides and other related products. Profit margins vary significantly depending on production costs, processing efficiencies, and market prices. Operational expenditures, including mining, processing, and transportation costs, represent a significant portion of total expenses and impact profitability. Debt-to-equity ratios provide insights into the financial stability and risk profiles of these companies.

| Company | P/E Ratio | PEG Ratio | Debt-to-Equity Ratio |

|---|---|---|---|

| Company A | 20 | 1.5 | 0.7 |

| Company B | 15 | 1.0 | 0.5 |

| Company C | 25 | 2.0 | 1.0 |

Competitive Landscape and Future Growth Prospects

The American rare earth industry faces a complex competitive landscape. Companies compete on the basis of their mining and processing capabilities, technological advancements, and access to resources. Strategic partnerships and collaborations are becoming increasingly important to secure supply chains, enhance processing technologies, and expand market reach. The demand for REEs is projected to grow significantly in the coming years, driven by the increasing adoption of electric vehicles, renewable energy technologies, and advanced electronics.

- Increased demand from the EV and renewable energy sectors.

- Government support for domestic REE production.

- Technological advancements in REE extraction and processing.

- Geopolitical risks and supply chain vulnerabilities.

- Environmental regulations and permitting challenges.

Factors Influencing Stock Price Target Predictions

Source: seekingalpha.com

Stock prices in the rare earth sector are influenced by a complex interplay of supply and demand dynamics, government policies, technological advancements, and environmental considerations. Government regulations, such as subsidies and tax incentives, can significantly impact the profitability and investment attractiveness of rare earth companies. Technological breakthroughs in mining, processing, and recycling can lead to cost reductions and increased efficiency, while environmental concerns and resource depletion pose significant risks.

Predicting the American Rare Earths stock price target involves complex factors, including global demand and geopolitical stability. It’s interesting to compare this to the volatility often seen in other sectors; for instance, you can check the current market fluctuations by looking at the amc stock price real time. Understanding these diverse market behaviors helps provide a more nuanced perspective on the potential trajectory of American Rare Earths’ price.

| Scenario | Supply/Demand Shift | Government Policy | Potential Impact on Stock Price Target |

|---|---|---|---|

| Scenario 1 (Optimistic) | Increased demand, stable supply | Favorable government policies | Significant upward price movement |

| Scenario 2 (Neutral) | Stable demand, stable supply | Neutral government policies | Moderate price movement |

| Scenario 3 (Pessimistic) | Decreased demand, supply disruptions | Unfavorable government policies | Significant downward price movement |

Illustrative Examples of Stock Price Target Estimations

Stock price target estimations often rely on valuation models such as discounted cash flow (DCF) analysis and comparable company analysis. DCF analysis projects future cash flows and discounts them back to their present value to estimate the intrinsic value of a company. Comparable company analysis compares the valuation multiples (e.g., P/E ratio) of similar companies to estimate a target price.

Positive news events, such as the discovery of a new high-grade REE deposit, would generally lead to upward revisions of price targets, while negative events, such as an environmental lawsuit or production delays, would result in downward revisions.

For example, if a company announces a significant new REE deposit, analysts might increase their DCF projections, leading to a higher estimated intrinsic value and a higher stock price target. Conversely, a major environmental lawsuit could negatively impact the company’s future cash flows, resulting in a lower DCF valuation and a reduced price target. Comparable company analysis would also adjust based on the perceived impact on the company’s future prospects.

FAQs

What are the major risks associated with investing in American rare earth stocks?

Major risks include geopolitical instability affecting supply chains, price volatility due to fluctuating demand, environmental regulations impacting mining operations, and competition from established international players.

How do government policies influence rare earth stock prices?

Government policies regarding mining permits, environmental regulations, subsidies for renewable energy (boosting demand), and trade agreements significantly impact supply, demand, and profitability, thus influencing stock prices.

What are some alternative investment strategies in the rare earth sector besides direct stock ownership?

Alternatives include investing in ETFs focused on materials or renewable energy sectors, investing in companies involved in rare earth processing or recycling, or exploring private equity opportunities in exploration and mining companies.