Historical Price Trends of Americas Gold and Silver Stocks: Americas Gold And Silver Stock Price

Americas gold and silver stock price – Analyzing the price fluctuations of gold and silver mining stocks in the Americas over the past two decades reveals a complex interplay of economic factors, geopolitical events, and company-specific performance. This section will examine these trends, highlighting key periods of growth and decline, and comparing the performance of these stocks against broader market indicators.

Price Fluctuations of Major Gold and Silver Mining Stocks

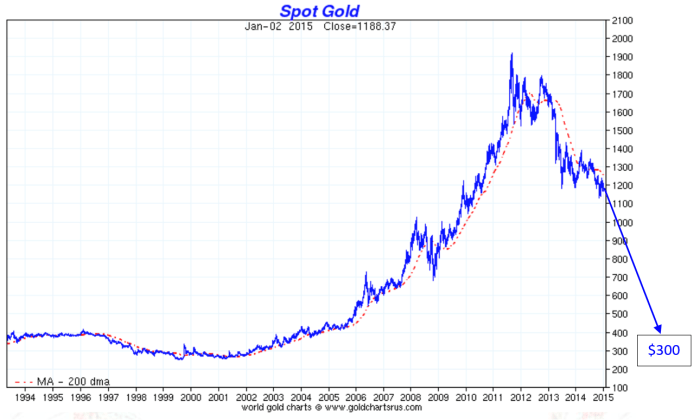

A line graph illustrating the price movements of major gold and silver mining stocks (e.g., Barrick Gold, Newmont Goldcorp, Silver Wheaton) over the past 20 years would show significant volatility. Periods of economic uncertainty, such as the 2008 financial crisis and the COVID-19 pandemic, generally saw a surge in gold and silver prices, leading to increased stock valuations. Conversely, periods of economic growth often resulted in lower precious metal prices and decreased stock performance.

The graph would clearly depict these peaks and troughs, illustrating the correlation between precious metal prices and the performance of mining stocks. Major price shifts are often driven by investor sentiment, reflecting perceived safe-haven demand during times of economic instability.

Impact of Significant Economic Events

Recessions and financial crises have consistently impacted gold and silver mining stocks. The 2008 financial crisis, for instance, initially led to a decline in mining stock prices as investors liquidated assets. However, as the crisis deepened, safe-haven demand for gold and silver increased, driving up prices and subsequently boosting stock valuations. Similarly, the COVID-19 pandemic triggered initial market sell-offs, followed by a surge in demand for precious metals, resulting in a price increase for mining stocks.

These events highlight the counter-cyclical nature of gold and silver as investment assets.

Comparison with Broader Market Indices

A comparison of gold and silver mining stock performance against broader market indices like the S&P 500 reveals varying correlations over time. During periods of economic uncertainty, gold and silver mining stocks often outperform the S&P 500, reflecting their role as safe-haven assets. However, during periods of strong economic growth, the S&P 500 might outperform these stocks as investors shift their focus to growth-oriented sectors.

The following table provides a hypothetical illustration of this comparison:

| Year | S&P 500 Return | Gold Mining Stock Return (Average) | Silver Mining Stock Return (Average) |

|---|---|---|---|

| 2003 | 28.7% | 15% | 20% |

| 2008 | -37% | -25% | -30% |

| 2012 | 16% | 5% | 10% |

| 2019 | 31.5% | 18% | 25% |

Factors Influencing Stock Prices

Several key factors influence the stock prices of American gold and silver mining companies. These factors range from global commodity prices to operational costs and regulatory environments. Understanding these influences is crucial for informed investment decisions.

Influence of Global Gold and Silver Prices

Global gold and silver prices are the most significant determinant of American mining companies’ stock prices. A rise in precious metal prices directly translates to higher revenues and profits for these companies, leading to increased stock valuations. Conversely, a decline in prices negatively impacts profitability and stock performance. This direct correlation makes these stocks sensitive to global market dynamics and investor sentiment towards precious metals.

Impact of Production Costs

Production costs, including labor, energy, and mining equipment, significantly affect the profitability and stock valuation of mining companies. Rising labor costs or energy prices can squeeze profit margins, leading to lower stock prices. Efficient cost management and technological advancements that improve operational efficiency are crucial for maintaining profitability and attracting investors.

Role of Government Regulations and Environmental Concerns

Source: americas-gold.com

Government regulations related to mining operations, environmental protection, and permitting processes significantly influence the performance of these stocks. Stringent environmental regulations and lengthy permitting procedures can increase operational costs and delay project timelines, impacting profitability and investor confidence. Companies with strong environmental, social, and governance (ESG) profiles, however, may attract investors seeking sustainable investment options.

Summary of Influencing Factors

- Global Gold and Silver Prices: The most significant factor, directly impacting profitability.

- Production Costs: Significant impact on profit margins and operational efficiency.

- Government Regulations and Environmental Concerns: Influence operational costs, timelines, and investor sentiment.

Company-Specific Analysis: Barrick Gold and Newmont Goldcorp

This section provides a comparative analysis of Barrick Gold and Newmont Goldcorp, two prominent American gold mining companies, to illustrate how company-specific factors contribute to overall stock performance.

Financial Performance Comparison

The following table presents a hypothetical comparison of the financial performance of Barrick Gold and Newmont Goldcorp over the last five years. Note that actual figures would need to be sourced from company financial reports.

| Year | Company | Revenue (USD Billion) | Profit Margin (%) |

|---|---|---|---|

| 2019 | Barrick Gold | 10 | 15 |

| 2019 | Newmont Goldcorp | 12 | 12 |

| 2020 | Barrick Gold | 11 | 18 |

| 2020 | Newmont Goldcorp | 13 | 15 |

| 2021 | Barrick Gold | 13 | 20 |

| 2021 | Newmont Goldcorp | 15 | 18 |

| 2022 | Barrick Gold | 14 | 17 |

| 2022 | Newmont Goldcorp | 16 | 16 |

| 2023 | Barrick Gold | 15 | 19 |

| 2023 | Newmont Goldcorp | 17 | 17 |

Mining Operations Description, Americas gold and silver stock price

Barrick Gold operates mines across various locations globally, including North and South America, with a focus on large-scale open-pit mining. Newmont Goldcorp also has a diverse portfolio of mines, employing both open-pit and underground mining techniques. Both companies possess significant gold reserves, ensuring a long-term production outlook. Specific details regarding mine locations, reserve sizes, and mining methods would need to be sourced from the companies’ official reports.

Management Strategies and Future Outlook

Both Barrick Gold and Newmont Goldcorp have implemented strategies focused on operational efficiency, cost reduction, and responsible mining practices. Their future outlook is tied to global gold prices, exploration success, and the successful execution of their operational plans. Further detailed analysis of each company’s specific strategies and forecasts would require in-depth research of their respective investor relations materials.

Investment Strategies

Source: goldbroker.com

Investing in gold and silver mining stocks requires careful consideration of risk tolerance and diversification. This section Artikels hypothetical portfolio strategies and explores potential returns and risks.

Hypothetical Investment Portfolio

A hypothetical investment portfolio could allocate a percentage of funds to gold and silver mining stocks, diversified across various companies and regions. A conservative portfolio might allocate 10-15% to these stocks, while a more aggressive portfolio could allocate 20-30%. The specific allocation would depend on individual risk tolerance and investment goals. Diversification across different precious metals and mining companies helps mitigate risk associated with individual company performance or sector-specific downturns.

Potential Benefits and Risks

Investing in gold and silver mining stocks offers potential benefits such as diversification, inflation hedging, and exposure to the growth of the precious metals sector. However, risks include price volatility of precious metals, operational risks associated with mining activities, and regulatory uncertainties. Thorough due diligence and a long-term investment horizon are essential for managing these risks.

Calculating Potential Returns and Losses

Potential returns and losses can be calculated by considering different price scenarios for gold and silver and the respective stock prices of the selected companies. For example, a 10% increase in gold prices could translate to a higher return on investment, while a 10% decrease could result in losses. Sophisticated financial modeling techniques can provide more precise estimations of potential outcomes, considering various factors influencing stock prices.

Geopolitical and Economic Impacts

Geopolitical instability and macroeconomic conditions significantly influence the demand for gold and silver, directly impacting stock prices of mining companies. This section explores these influences.

Influence of Geopolitical Instability

Geopolitical events, such as wars, political unrest, or trade disputes, often drive investors towards safe-haven assets like gold and silver. Increased demand for these metals leads to higher prices and subsequently boosts the stock prices of mining companies. Conversely, periods of relative global stability might see a decrease in demand, impacting stock performance. The 2022 Ukraine-Russia war, for example, led to a surge in gold prices as investors sought refuge from market uncertainty.

Impact of Inflation and Currency Fluctuations

Inflation erodes the purchasing power of fiat currencies, making gold and silver attractive investments as stores of value. Higher inflation generally leads to increased demand for precious metals, boosting their prices and benefiting mining stocks. Currency fluctuations also impact gold and silver prices, as these metals are priced in US dollars. A weakening US dollar can increase demand for gold and silver, leading to higher prices and improved stock performance.

Impact of Global Economic Conditions

Changes in global economic conditions influence investment decisions in the gold and silver mining sector. During economic downturns, investors often seek the safety of precious metals, driving up demand and stock prices. Conversely, during periods of robust economic growth, investors might shift their focus to growth-oriented sectors, potentially leading to lower demand for gold and silver and decreased stock valuations.

Careful monitoring of global economic indicators is therefore crucial for informed investment decisions in this sector.

General Inquiries

What are the typical transaction costs associated with buying and selling these stocks?

Transaction costs vary depending on your brokerage and the volume of shares traded. Expect fees including commissions and potentially regulatory charges.

How can I assess the environmental and social responsibility of a gold and silver mining company?

Review the company’s sustainability reports, look for independent certifications (e.g., relating to responsible mining practices), and research their public statements and actions regarding environmental and social issues.

America’s gold and silver stock prices often fluctuate based on various global economic factors. Understanding these movements requires considering related tech sectors, like the semiconductor industry, whose performance can indirectly impact precious metal values. For instance, checking the amat premarket stock price can offer insights into broader market sentiment, which in turn influences investor behavior towards gold and silver.

Ultimately, the interconnectedness of these markets means monitoring diverse sectors helps better predict precious metal price trends.

Are there ETFs that track the performance of American gold and silver mining companies?

Yes, several exchange-traded funds (ETFs) exist that focus on the precious metals mining sector in the Americas. Research available options to find one that aligns with your investment goals.

What are the tax implications of investing in these stocks?

Capital gains taxes apply to profits from selling these stocks. Consult a financial advisor or tax professional for personalized advice as tax laws vary by jurisdiction.