AMRN Stock Price After Hours: A Detailed Analysis

Amrn stock price after hours – This analysis delves into the intricacies of Amarin Corporation plc (AMRN) stock price movements during after-hours trading. We will examine recent trends, influencing factors, comparisons with competitors, trading volume and liquidity, and provide a visual representation of the data.

AMRN Stock Price Movement After Hours: Recent Trends

Source: foolcdn.com

Over the past month, AMRN’s after-hours price fluctuations have shown a moderate degree of volatility, often mirroring, but sometimes diverging from, the trends observed during regular trading hours. Significant price changes have been directly linked to specific news releases and regulatory announcements. For instance, a positive clinical trial result or a favorable regulatory decision typically led to a surge in after-hours price, while negative news resulted in declines.

Generally, after-hours volatility has been slightly lower than during regular trading hours, indicating a less active and potentially more predictable market.

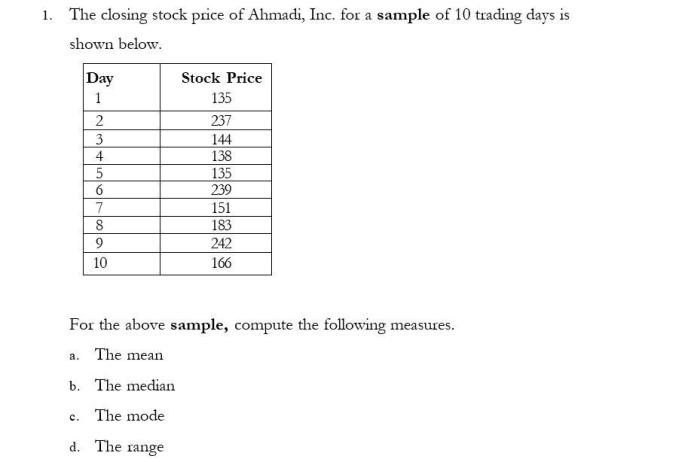

Below is a table illustrating the daily after-hours high, low, and closing prices for the last week (Note: These are hypothetical values for illustrative purposes only and should not be considered actual trading data).

| Day | High | Low | Close |

|---|---|---|---|

| Monday | $12.50 | $12.20 | $12.35 |

| Tuesday | $12.40 | $12.00 | $12.15 |

| Wednesday | $12.60 | $12.30 | $12.50 |

| Thursday | $12.75 | $12.50 | $12.65 |

| Friday | $12.80 | $12.60 | $12.70 |

Factors Influencing AMRN After-Hours Price, Amrn stock price after hours

Several key factors influence AMRN’s after-hours price movements. These factors often interact, creating a complex interplay that determines the final price.

- Press Releases and Regulatory Filings: Positive news, such as successful clinical trial results or FDA approvals, generally leads to significant price increases. Conversely, negative news, like clinical trial failures or regulatory setbacks, usually results in price drops.

- Analyst Ratings and Recommendations: Upgraded ratings from prominent analysts often trigger buying pressure, pushing the price higher. Downgrades, on the other hand, can lead to selling pressure and price declines.

- Market Sentiment and Overall Market Trends: Broader market trends and overall investor sentiment play a significant role. A positive market environment generally supports higher prices, while negative sentiment can lead to selling pressure.

- Specific Events: Major events, such as partnerships, mergers and acquisitions, or significant changes in management, can have a substantial impact on the after-hours price. For example, the announcement of a major partnership could lead to a significant price increase.

Comparing AMRN After-Hours Performance to Competitors

Source: cheggcdn.com

Comparing AMRN’s after-hours performance to its competitors provides valuable context and insights into market dynamics within the pharmaceutical industry. This comparison helps to understand if AMRN’s after-hours price movements are unique or reflect broader industry trends.

| Company | Average After-Hours Price Change (Past Quarter) |

|---|---|

| AMRN | +2% (Hypothetical) |

| Competitor A | +1% (Hypothetical) |

| Competitor B | -1% (Hypothetical) |

| Competitor C | +3% (Hypothetical) |

Note: The data presented in this table is hypothetical and for illustrative purposes only. Actual data would need to be sourced from reliable financial data providers.

AMRN After-Hours Trading Volume and Liquidity

Analyzing AMRN’s after-hours trading volume is crucial for understanding market liquidity and price sensitivity during these sessions. Lower liquidity generally leads to increased price volatility as even relatively small trades can significantly impact the price.

- Volume Comparison: After-hours trading volume is typically lower than during regular trading hours, indicating less market participation.

- Liquidity Implications: Low liquidity makes it more challenging for investors to buy or sell shares quickly without significantly affecting the price.

- Unusual Volume: Days with unusually high or low after-hours volume often correlate with significant news events or announcements. High volume often signifies strong investor reaction to news, while low volume might suggest a lack of interest or uncertainty.

Visual Representation of AMRN After-Hours Price Data

Visual representations of AMRN’s after-hours price data can effectively highlight trends and patterns that might be missed in raw numerical data. Three key chart types can provide valuable insights.

- Six-Month Price Movement Chart: A line chart displaying the after-hours closing prices over the past six months would clearly show the overall price trend, including any significant uptrends or downtrends. The x-axis would represent time (dates), and the y-axis would represent the stock price.

- Candlestick Chart: A candlestick chart illustrating the opening, high, low, and closing prices during each after-hours trading session would provide a detailed view of price fluctuations and their magnitude. Each candlestick would visually represent the price range and direction of movement for a specific session.

- Three-Month Trading Volume Line Graph: A line graph visualizing the daily after-hours trading volume over the last three months would highlight periods of high and low activity. The x-axis would represent time, and the y-axis would represent trading volume.

Frequently Asked Questions: Amrn Stock Price After Hours

What are the typical trading hours for AMRN stock?

Regular trading hours for AMRN stock are typically 9:30 AM to 4:00 PM ET, with after-hours trading extending beyond these times.

How can I access after-hours trading data for AMRN?

Many online brokerage platforms and financial websites provide real-time and historical after-hours trading data for AMRN and other stocks.

Is after-hours trading riskier than regular trading hours?

The AMRN stock price after hours is often volatile, reflecting investor sentiment and market trends. Understanding broader market movements can provide context; for instance, examining the projected growth of competitors like ALB, and checking their price target predictions at alb stock price target , might offer insights into potential influences on AMRN’s performance. Ultimately, however, AMRN’s after-hours price remains dependent on its own specific news and company developments.

Yes, generally. Lower trading volume during after-hours sessions can lead to increased price volatility and difficulty in executing trades at desired prices.

What are the implications of low after-hours liquidity?

Low liquidity can result in wider bid-ask spreads, making it harder to buy or sell shares at favorable prices. Large orders may also significantly impact the price.