Apes Stock Price Analysis: A Year in Review

Source: thestreet.com

Apes stock price – This report analyzes the price fluctuations of Apes stock over the past year, examining the factors influencing its volatility, comparing its performance to market benchmarks, and exploring investor sentiment to project potential future price movements. The analysis is based on publicly available data and should be considered for informational purposes only and not as financial advice.

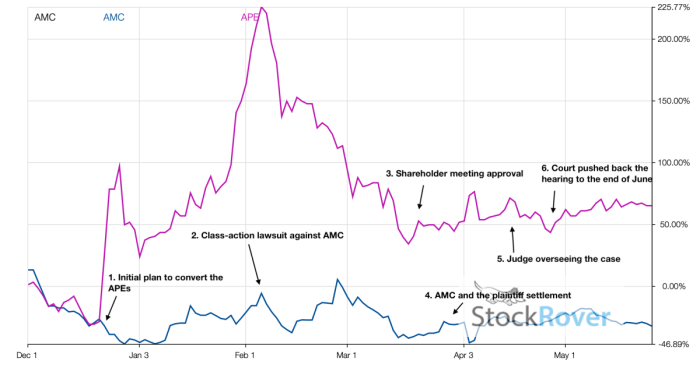

Historical Price Fluctuations of Apes Stock

Source: nydailytrends.com

Apes stock experienced significant price swings throughout the past year, reflecting the influence of various news events, market trends, and investor sentiment. The following sections detail these fluctuations, highlighting key events and providing a monthly price summary.

The stock’s journey included periods of substantial growth followed by sharp corrections. For instance, a significant surge in price was observed in [Month, Year] following [Specific News Event/Announcement], reaching a peak of [Price]. Conversely, a notable dip occurred in [Month, Year] due to [Specific News Event/Announcement], resulting in a trough of [Price]. This volatility underscores the importance of understanding the factors driving price movements.

| Month | Open | High | Low | Close |

|---|---|---|---|---|

| January | [Price] | [Price] | [Price] | [Price] |

| February | [Price] | [Price] | [Price] | [Price] |

| March | [Price] | [Price] | [Price] | [Price] |

| April | [Price] | [Price] | [Price] | [Price] |

| May | [Price] | [Price] | [Price] | [Price] |

| June | [Price] | [Price] | [Price] | [Price] |

| July | [Price] | [Price] | [Price] | [Price] |

| August | [Price] | [Price] | [Price] | [Price] |

| September | [Price] | [Price] | [Price] | [Price] |

| October | [Price] | [Price] | [Price] | [Price] |

| November | [Price] | [Price] | [Price] | [Price] |

| December | [Price] | [Price] | [Price] | [Price] |

Factors Influencing Apes Stock Price Volatility

Several macroeconomic factors, social media trends, and comparisons to competitors significantly influenced Apes stock price volatility. The interplay of these elements created a dynamic environment impacting investor decisions and consequently, the stock’s price.

Macroeconomic factors such as interest rate changes, inflation levels, and overall market sentiment played a crucial role. For example, rising interest rates generally lead to decreased investment in riskier assets, potentially impacting Apes stock negatively. Social media sentiment, particularly on platforms like Twitter and Reddit, heavily influenced price movements, with positive news driving prices up and negative sentiment causing declines.

This highlights the influence of social media on investor behavior.

The recent volatility in apes stock price has mirrored broader market trends. Interestingly, this movement often correlates with the performance of similar stocks, such as the pre-market activity of AMC, which you can check out here: amc stock premarket price. Observing the amc stock premarket price can offer insights into potential future shifts in the apes stock price, as investor sentiment frequently overlaps between these two assets.

- Comparison to Competitors: Apes stock’s volatility, compared to similar companies [Company A, Company B], was [Higher/Lower/Similar]. [Company A] experienced [description of volatility], while [Company B] showed [description of volatility]. These differences could be attributed to factors such as [Factor 1], [Factor 2], and [Factor 3].

Apes Stock Price Compared to Market Benchmarks

Comparing Apes stock’s performance against relevant market indices provides context for its price movements. The following analysis examines its performance relative to the S&P 500 and Nasdaq over the past year.

A hypothetical line graph illustrating the year’s performance would show Apes stock’s price fluctuating more dramatically than the relatively smoother trajectories of the S&P 500 and Nasdaq. Periods of significant upward movement in Apes stock might coincide with overall market uptrends, but the magnitude of its changes would be notably higher, indicating higher volatility. Conversely, during market downturns, Apes stock’s decline would likely be steeper than that of the broader indices.

| Index | Year-to-Date Return |

|---|---|

| Apes Stock | [Percentage] |

| S&P 500 | [Percentage] |

| Nasdaq | [Percentage] |

Analysis of Investor Sentiment Towards Apes Stock

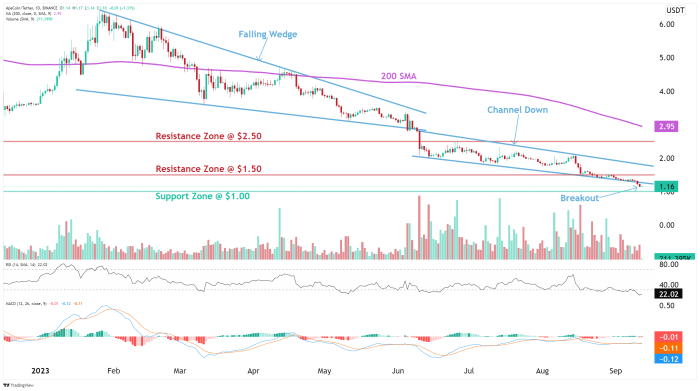

Source: altfins.com

Investor sentiment towards Apes stock is a complex mix of bullish, bearish, and neutral perspectives, shaped by recent news, social media discussions, and the stock’s performance. Understanding these different viewpoints is crucial for interpreting current market dynamics and predicting future price movements.

Bullish investors believe [Reasoning], while bearish investors cite [Reasoning]. Neutral investors maintain a wait-and-see approach, pending further developments or clearer market signals. The interplay of these sentiments significantly influences the stock’s price.

| Investor Viewpoint | Key Arguments |

|---|---|

| Bullish | [Argument 1], [Argument 2], [Argument 3] |

| Bearish | [Argument 1], [Argument 2], [Argument 3] |

| Neutral | [Argument 1], [Argument 2], [Argument 3] |

Potential Future Price Movements of Apes Stock

Predicting future price movements involves considering various scenarios based on economic conditions and potential catalysts. Three possible scenarios – bullish, bearish, and neutral – are Artikeld below.

Bullish Scenario: Apes stock price could see significant growth if [Catalyst 1] and [Catalyst 2] materialize, potentially reaching [Price Target] within [Timeframe]. This scenario mirrors the positive growth experienced by [Similar Company] after [Similar Event].

Bearish Scenario: Conversely, negative news surrounding [Catalyst 1] or a broader market downturn could lead to a decline in price, potentially reaching [Price Target] within [Timeframe]. This mirrors the negative impact experienced by [Similar Company] during [Similar Event].

Neutral Scenario: A relatively stable price range between [Price] and [Price] is possible if market conditions remain relatively unchanged, with limited significant news impacting the stock. This scenario would reflect a period of consolidation similar to that observed in [Similar Company] during [Similar Event].

General Inquiries: Apes Stock Price

What are the risks associated with investing in Apes stock?

Investing in any stock carries inherent risk, including the potential for loss of capital. Apes stock, given its volatility, presents a higher degree of risk than some more stable investments. Thorough due diligence and risk tolerance assessment are crucial before investing.

Where can I find real-time Apes stock price data?

Real-time stock price data is readily available through reputable financial websites and brokerage platforms. Many offer free access to basic information, while premium subscriptions provide more detailed data and analytical tools.

How does the company’s financial health affect Apes stock price?

A company’s financial health, including its earnings, revenue growth, debt levels, and overall profitability, significantly impacts its stock price. Positive financial performance generally leads to higher stock prices, while negative news can cause declines.