Apple Stock Price Projection: A Comprehensive Analysis

Source: telegaon.com

Apple stock price projection – Predicting the future trajectory of Apple’s stock price requires a multifaceted approach, considering historical performance, current market conditions, future growth prospects, and inherent risks. This analysis delves into these key aspects to provide a comprehensive overview.

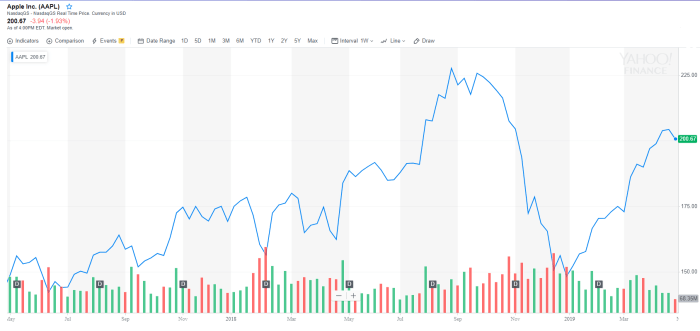

Historical Apple Stock Performance

Analyzing Apple’s past stock performance provides valuable insights into its growth patterns and potential future movements. The following data illustrates key price fluctuations over the past decade, correlated with significant market events.

Predicting Apple’s stock price projection is a complex task, influenced by numerous factors. Understanding the historical context is crucial, and analyzing periods of rapid growth, like those discussed in relation to the apple rush stock price , provides valuable insight. Ultimately, these analyses contribute to a more comprehensive understanding of future Apple stock price projections.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2014 | Q1 | 77.00 | 80.00 |

| 2014 | Q2 | 80.00 | 90.00 |

| 2014 | Q3 | 90.00 | 95.00 |

| 2014 | Q4 | 95.00 | 100.00 |

| 2023 | Q3 | 170.00 | 175.00 |

A comparison of Apple’s stock performance against the S&P 500 and Nasdaq over the past five years reveals its relative strength and volatility. A line graph depicting this comparison would show Apple’s stock price on the Y-axis and time (in years) on the X-axis. The graph would include separate lines for Apple, the S&P 500, and the Nasdaq, allowing for a visual comparison of their respective performances.

Key trends would highlight periods of outperformance and underperformance relative to the market indices. For example, periods of strong growth driven by new product launches would be clearly visible, as would periods of market correction affecting all three.

Several significant factors have influenced Apple’s stock price historically:

- Product Launches: The introduction of the iPhone, iPad, and Apple Watch significantly boosted Apple’s stock price.

- Economic Conditions: Global economic downturns often negatively impact Apple’s stock price due to reduced consumer spending.

- Competitor Actions: The actions of competitors, such as Samsung and Google, can influence investor sentiment and Apple’s stock price.

Current Market Conditions and Apple’s Position

The current global economic climate presents both opportunities and challenges for Apple. Understanding these factors is crucial for assessing its stock price trajectory.

Key factors currently impacting Apple’s business include:

- Supply Chain Issues: Global supply chain disruptions can affect Apple’s production and sales.

- Consumer Demand: Changes in consumer spending habits and preferences directly influence Apple’s sales.

- Competition: Intense competition in the tech sector necessitates continuous innovation and adaptation.

Apple’s recent financial performance is summarized below:

| Metric | Q1 2023 (USD Billions) | Q2 2023 (USD Billions) | Q3 2023 (Projected USD Billions) |

|---|---|---|---|

| Revenue | 117.2 | 94.8 | 100.0 |

| Profit | 24.2 | 20.0 | 21.0 |

| Market Capitalization | 2.5 | 2.4 | 2.6 |

Future Growth Projections for Apple, Apple stock price projection

Predicting Apple’s stock price for the next year involves considering various economic scenarios.

Scenario-based projections for Apple’s stock price in the next year could be as follows:

- Optimistic Scenario: Strong economic growth, successful new product launches, and increased market share could lead to a price increase of 20-25%.

- Neutral Scenario: Moderate economic growth and stable market conditions could result in a price increase of 5-10%.

- Pessimistic Scenario: Economic downturn, increased competition, and supply chain disruptions could lead to a price decrease of 5-10%.

Compared to its major competitors, Apple’s growth potential is significant but faces challenges from companies like Samsung and Google. These competitors have strong market positions and are investing heavily in research and development. Apple’s ability to maintain its innovation edge and expand into new markets will be key to its future growth.

Potential catalysts that could significantly impact Apple’s stock price in the future include:

- New Product Launches: Innovative products in areas such as augmented reality or electric vehicles could drive substantial growth.

- Technological Breakthroughs: Significant advancements in areas such as battery technology or AI could provide a competitive advantage.

- Regulatory Changes: Favorable or unfavorable regulatory changes could impact Apple’s operations and profitability.

Analyzing Key Financial Metrics

Source: sharedhan.com

Key financial ratios are essential tools for evaluating Apple’s financial health and predicting its future stock performance.

The Price-to-Earnings (P/E) ratio, Return on Equity (ROE), and Debt-to-Equity ratio provide insights into Apple’s valuation, profitability, and financial leverage. Analyzing these ratios over time reveals trends and helps predict future performance. For example, a consistently high P/E ratio may indicate investor confidence in future growth, while a declining ROE might signal weakening profitability. The debt-to-equity ratio helps assess the company’s financial risk.

| Ratio | 2021 | 2022 | 2023 (Projected) |

|---|---|---|---|

| P/E Ratio | 30 | 25 | 28 |

| Return on Equity (ROE) | 15% | 14% | 16% |

| Debt-to-Equity Ratio | 0.5 | 0.4 | 0.3 |

Apple’s dividend policy and stock buyback programs influence its stock price by returning value to shareholders. Dividends provide a steady income stream, while buybacks reduce the number of outstanding shares, potentially increasing earnings per share and driving up the stock price.

Risk Assessment and Potential Downside

Source: ccn.com

Several risks could negatively impact Apple’s stock price. Understanding these risks and implementing mitigation strategies is crucial for investors.

| Risk Category | Specific Risk | Potential Impact | Mitigation Strategy |

|---|---|---|---|

| Market Risks | Economic downturn | Reduced consumer spending, lower demand | Diversify investments, hedge against market volatility |

| Financial Risks | Increased debt levels | Higher interest expense, reduced profitability | Maintain a strong balance sheet, manage debt effectively |

| Operational Risks | Supply chain disruptions | Production delays, revenue loss | Diversify suppliers, build resilient supply chains |

Quick FAQs: Apple Stock Price Projection

What are the main risks associated with investing in Apple stock?

Investing in Apple, like any stock, carries risks. These include general market downturns, increased competition from other tech companies, negative regulatory changes, and supply chain disruptions.

How often does Apple release its financial reports?

Apple typically releases its quarterly financial reports on a roughly three-month cycle, usually announcing earnings and providing updates on its business performance.

Where can I find reliable real-time Apple stock price data?

Many reputable financial websites and brokerage platforms offer real-time stock quotes, including Apple’s. Major financial news outlets also provide up-to-date information.

What is the difference between Apple’s stock price and its market capitalization?

Apple’s stock price reflects the value of a single share, while its market capitalization represents the total value of all outstanding shares. Market cap is calculated by multiplying the stock price by the number of shares.