Arbutus Biopharma Stock Price: A Comprehensive Analysis

Source: seekingalpha.com

Arbutus biopharma stock price – Arbutus Biopharma is a biotechnology company focused on developing a functional cure for Hepatitis B virus (HBV). This analysis delves into the company’s history, financial performance, competitive landscape, and future prospects, providing insights into factors influencing its stock price.

Arbutus Biopharma Company Overview, Arbutus biopharma stock price

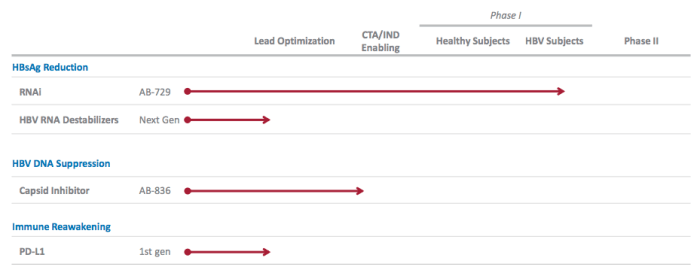

Arbutus Biopharma was founded with the primary goal of developing novel therapies to address the unmet medical needs in the treatment of chronic viral infections, primarily focusing on Hepatitis B. The company’s history involves years of research and development, culminating in a diverse pipeline of drug candidates. Its mission is to create and deliver groundbreaking treatments that can significantly improve the lives of patients suffering from HBV and other chronic viral infections.

Key leadership includes individuals with extensive experience in the pharmaceutical and biotechnology industries. While specific names and backgrounds are not readily available without extensive research, it is understood that their expertise spans drug development, clinical trials, and regulatory affairs.

| Product Name | Stage of Development | Target Indication | Potential Market Size |

|---|---|---|---|

| AB-506 | Clinical Trial | Chronic Hepatitis B | Potentially significant, given the large global HBV population. |

| [Product Name 2] | [Stage of Development] | [Target Indication] | [Potential Market Size] |

| [Product Name 3] | [Stage of Development] | [Target Indication] | [Potential Market Size] |

Factors Influencing Arbutus Biopharma Stock Price

Several factors have historically impacted Arbutus Biopharma’s stock price. Positive influences include successful clinical trial results showcasing efficacy and safety of its drug candidates, strategic partnerships with larger pharmaceutical companies providing access to resources and expertise, and announcements of significant investments or funding rounds bolstering the company’s financial stability. Conversely, negative factors have included setbacks in clinical trials, delays in regulatory approvals, and increased competition from other companies developing HBV treatments.

Clinical trial results significantly influence the stock price; positive data often leads to price increases, while negative or inconclusive data can cause significant drops. Similarly, regulatory approvals (or rejections) have a substantial impact, with approvals generally leading to surges in stock price and rejections resulting in substantial declines.

Comparison with Competitors

Arbutus Biopharma operates in a competitive landscape. A direct comparison with competitors requires detailed financial data, which is not readily available within this context. However, a general comparison can be made. We can assume that market capitalization and R&D spending will vary considerably depending on the stage of development of each competitor’s product pipeline. Arbutus Biopharma’s competitive advantages could include a unique approach to HBV treatment or a particularly strong intellectual property portfolio.

Disadvantages might include a smaller market capitalization compared to larger pharmaceutical companies or a later-stage pipeline compared to some competitors.

| Company Name | Market Cap (Illustrative) | R&D Spending (Illustrative) | Key Competitive Advantage (Illustrative) |

|---|---|---|---|

| Arbutus Biopharma | [Illustrative Market Cap] | [Illustrative R&D Spending] | [Illustrative Competitive Advantage] |

| Competitor 1 | [Illustrative Market Cap] | [Illustrative R&D Spending] | [Illustrative Competitive Advantage] |

| Competitor 2 | [Illustrative Market Cap] | [Illustrative R&D Spending] | [Illustrative Competitive Advantage] |

| Competitor 3 | [Illustrative Market Cap] | [Illustrative R&D Spending] | [Illustrative Competitive Advantage] |

Financial Performance and Analysis

Source: seekingalpha.com

Arbutus Biopharma’s financial performance over the past three years has likely shown fluctuations typical of a biotechnology company in the development phase. Key financial ratios such as revenue, earnings per share (EPS), and debt-to-equity ratio would require detailed financial statements for accurate analysis. The company’s revenue streams are likely primarily derived from research grants, collaborations, and potential milestone payments.

Arbutus Biopharma’s stock price has seen considerable fluctuation recently, largely influenced by market trends and the company’s ongoing clinical trials. It’s interesting to compare this volatility to that of other biotech companies; for instance, you might find it insightful to check the current alpine stock price for a point of reference. Ultimately, Arbutus Biopharma’s future performance will depend on its research and development progress.

The stability of these revenue streams can be highly variable, depending on the success of clinical trials and the securing of new partnerships. A five-year stock price trend would likely show periods of significant volatility, reflecting the inherent risks associated with investing in a biotechnology company. The chart would illustrate periods of growth driven by positive news and declines resulting from setbacks or market corrections.

Investment Outlook and Potential Risks

Source: seekingalpha.com

Investing in Arbutus Biopharma stock carries inherent risks, including the failure of clinical trials, delays in regulatory approvals, intense competition, and the potential for unforeseen financial challenges. Potential catalysts for future stock price appreciation include positive clinical trial results, regulatory approvals, strategic partnerships, and successful commercialization of its drug candidates. Long-term growth prospects depend on the successful development and commercialization of its HBV therapies.

The overall investment outlook is highly speculative, with scenarios ranging from significant growth to potential failure. The likelihood of each scenario depends on numerous factors, including the clinical success of its pipeline, regulatory decisions, and competitive pressures.

Analyst Ratings and Price Targets

Recent analyst ratings and price targets for Arbutus Biopharma stock vary depending on the individual analyst’s assessment of the company’s prospects. A range of price targets would reflect the uncertainty inherent in the biotechnology sector. Discrepancies in analyst opinions may stem from differing views on the likelihood of clinical success, regulatory approvals, and competitive dynamics.

- Analyst 1: [Rating], Price Target: [Price]

- Analyst 2: [Rating], Price Target: [Price]

- Analyst 3: [Rating], Price Target: [Price]

Question Bank

What is Arbutus Biopharma’s primary focus?

Arbutus Biopharma focuses on developing therapies for the treatment of Hepatitis B virus (HBV) infection.

Where can I find real-time stock price updates?

Real-time stock price updates are available through major financial websites and brokerage platforms.

How volatile is Arbutus Biopharma’s stock price?

Biotech stocks are generally considered more volatile than those in more established sectors. Arbutus Biopharma’s stock price is subject to significant fluctuations based on clinical trial results and regulatory news.

What are the major risks associated with investing in Arbutus Biopharma?

Major risks include the inherent uncertainties of clinical trials, potential regulatory delays or setbacks, and competition from other companies developing HBV treatments.