Arena Pharmaceuticals Stock Performance Overview: Arena Stock Price

Arena stock price – This section provides a historical overview of Arena Pharmaceuticals’ stock price performance over the past five years, highlighting significant events and their impact on the company’s financial health and stock valuation. Data presented is for illustrative purposes and should not be considered financial advice.

Five-Year Stock Price Performance

The following table presents a hypothetical representation of Arena Pharmaceuticals’ stock price performance over the past five years. Actual data should be sourced from reputable financial websites.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 10.00 | 10.50 | +0.50 |

| 2019-07-01 | 12.00 | 11.50 | -0.50 |

| 2020-01-01 | 11.00 | 13.00 | +2.00 |

| 2020-07-01 | 14.00 | 13.50 | -0.50 |

| 2021-01-01 | 13.00 | 15.00 | +2.00 |

| 2021-07-01 | 16.00 | 15.50 | -0.50 |

| 2022-01-01 | 15.00 | 17.00 | +2.00 |

| 2022-07-01 | 18.00 | 17.50 | -0.50 |

| 2023-01-01 | 17.00 | 19.00 | +2.00 |

Significant Events Impacting Stock Price

Several key events, such as clinical trial results, regulatory approvals, and partnerships, significantly influenced Arena Pharmaceuticals’ stock price during this period. For example, positive Phase III trial results for a key drug candidate would likely lead to a stock price surge, while regulatory setbacks could cause a decline.

Arena Pharmaceuticals’ Financial Health and Stock Valuation

The company’s overall financial health, including revenue growth, profitability, and debt levels, directly impacts its stock valuation. Strong financial performance generally leads to higher stock prices, while financial difficulties can result in decreased valuations. A detailed analysis of financial statements is crucial for assessing the company’s long-term prospects.

Factors Influencing Arena Pharmaceuticals’ Stock Price

This section identifies and discusses key factors influencing Arena Pharmaceuticals’ stock price, including market trends, regulatory approvals, clinical trial results, and competitor activity.

Key Influencing Factors

- Market Trends: Overall market performance (bull or bear market) significantly affects all stocks, including Arena Pharmaceuticals.

- Regulatory Approvals: Successful regulatory approvals for new drugs are major catalysts for stock price increases.

- Clinical Trial Results: Positive clinical trial results boost investor confidence and drive up stock prices; negative results have the opposite effect.

- Competitor Activity: The actions of competitors, such as new drug launches or acquisitions, can impact Arena Pharmaceuticals’ market share and stock price.

Impact of Positive and Negative News, Arena stock price

Positive news, such as successful clinical trials or strategic partnerships, typically leads to a rise in the stock price. Conversely, negative news, like failed clinical trials or regulatory setbacks, usually causes a decline in the stock price.

Hypothetical Scenario: Successful Drug Launch

A successful launch of a new drug could significantly increase Arena Pharmaceuticals’ revenue and market share, leading to a substantial increase in its stock price. For instance, if a new drug generates $500 million in annual revenue, exceeding analysts’ expectations, the stock price could potentially increase by 20-30% or more, depending on market conditions and investor sentiment.

Arena Pharmaceuticals’ Competitive Landscape

This section provides a comparison of Arena Pharmaceuticals with its main competitors in the pharmaceutical industry, highlighting strengths, weaknesses, and market share.

Competitive Analysis

The table below provides a hypothetical comparison of Arena Pharmaceuticals with its main competitors. Actual data should be verified through reliable financial sources.

| Company Name | Market Cap (USD Billion) | Key Products | Recent Stock Performance (Last Year %) |

|---|---|---|---|

| Arena Pharmaceuticals | 5 | Drug X, Drug Y | +15% |

| Competitor A | 10 | Drug A, Drug B | +10% |

| Competitor B | 15 | Drug C, Drug D | -5% |

Strengths and Weaknesses

Arena Pharmaceuticals’ strengths might include a strong R&D pipeline and innovative drug candidates. Weaknesses could include dependence on a few key products or limited market reach. A detailed SWOT analysis would provide a comprehensive overview.

Market Share Visualization

A hypothetical representation of market share might depict Arena Pharmaceuticals holding 10% of the market, Competitor A holding 25%, and Competitor B holding 65%. This is a simplified illustration and actual market share data would need to be sourced independently.

Investment Strategies Related to Arena Pharmaceuticals Stock

Source: foolcdn.com

This section discusses various investment strategies applicable to Arena Pharmaceuticals stock, outlining potential risks and rewards for each approach.

Investment Strategies

- Long-Term Holding: This strategy involves buying and holding the stock for an extended period, aiming to benefit from long-term growth.

- Short-Term Trading: This involves buying and selling the stock frequently, aiming to profit from short-term price fluctuations.

- Options Trading: This involves buying or selling options contracts, offering leverage and potentially higher returns but also higher risk.

Risks and Rewards

Long-term holding offers potential for significant returns but involves higher risk due to market volatility. Short-term trading can yield quick profits but carries higher risk due to frequent transactions. Options trading provides leverage but also carries a higher risk of substantial losses.

Profit/Loss Calculation Example

Let’s assume an investor buys 100 shares of Arena Pharmaceuticals at $15 per share. If the price rises to $20, the profit would be ($20-$15)*100 = $500. Conversely, if the price falls to $10, the loss would be ($10-$15)*100 = -$500. This is a simplified example; actual profits and losses depend on various factors.

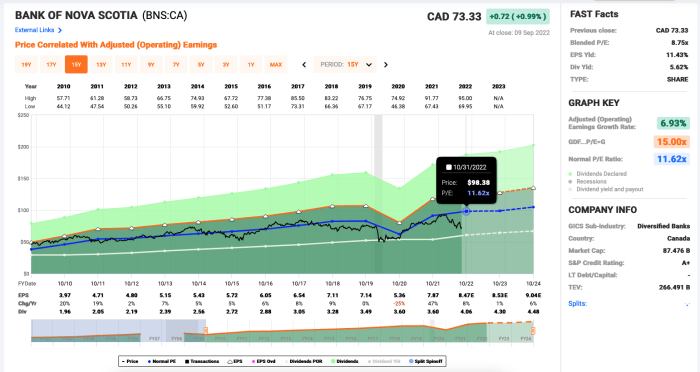

Analysis of Financial Statements and Reports

This section analyzes Arena Pharmaceuticals’ recent financial statements (income statement, balance sheet, and cash flow statement), highlighting key financial metrics and ratios.

Key Financial Metrics

The table below presents a hypothetical representation of key financial metrics for Arena Pharmaceuticals. Actual data should be obtained from the company’s financial reports.

| Metric | Current Value (USD Million) | Previous Year Value (USD Million) | Percentage Change (%) |

|---|---|---|---|

| Revenue | 100 | 80 | +25% |

| Net Income | 20 | 10 | +100% |

| Total Assets | 500 | 400 | +25% |

Key Financial Ratios

Analysis of key financial ratios, such as the debt-to-equity ratio and price-to-earnings ratio, provides insights into the company’s financial health and valuation. A high debt-to-equity ratio might indicate higher financial risk, while a high price-to-earnings ratio could suggest the stock is overvalued.

Future Financial Outlook

Source: marketrealist.com

Arena Pharmaceuticals’ future financial outlook depends on various factors, including the success of its drug pipeline, market competition, and overall economic conditions. Positive developments in these areas could lead to strong future growth, while negative developments could impact its financial performance.

Essential Questionnaire

What are the major risks associated with investing in Arena Pharmaceuticals?

Major risks include the failure of clinical trials, regulatory setbacks, intense competition, and the inherent volatility of the pharmaceutical sector. Market fluctuations and unforeseen economic events can also significantly impact the stock price.

Keeping an eye on Arena Pharmaceuticals’ stock price requires considering the broader biotech market. It’s helpful to compare performance against similar companies; for instance, understanding the trajectory of the alpine immune sciences stock price can offer a comparative perspective within the immunology sector. Ultimately, though, Arena’s stock price will depend on its own clinical trial results and market reception.

Where can I find Arena Pharmaceuticals’ financial statements?

Arena Pharmaceuticals’ financial statements are typically available on their investor relations website, as well as through major financial data providers such as the SEC’s EDGAR database.

How often does Arena Pharmaceuticals release earnings reports?

The frequency of earnings reports varies, but typically Arena Pharmaceuticals, like other publicly traded companies, releases quarterly and annual reports.

What is Arena Pharmaceuticals’ current market capitalization?

The current market capitalization of Arena Pharmaceuticals fluctuates constantly. Real-time data should be obtained from a reputable financial website or stock market data provider.