Ashok Leyland: A Deep Dive into its BSE Stock Performance

Source: moneycontrol.com

Ashok leyland bse stock price – Ashok Leyland, a prominent player in India’s commercial vehicle market, boasts a rich history and a complex stock performance profile. This analysis explores the company’s background, financial health, market position, and factors influencing its BSE stock price, providing insights for potential investors.

Ashok Leyland Company Overview

Ashok Leyland, established in 1948, has evolved into a leading manufacturer of commercial vehicles in India. Its product portfolio spans a wide range, including buses, trucks, light commercial vehicles, and engines. The company holds a significant market share in various segments of the Indian commercial vehicle market, consistently competing with Tata Motors and others. Its presence extends beyond India, with exports to several international markets.

Over the past five years, Ashok Leyland has experienced fluctuating financial performance, mirroring the cyclical nature of the automotive industry. The following table provides a summary of key financial metrics:

| Year | Revenue (INR Billion) | Profit (INR Billion) | Debt (INR Billion) |

|---|---|---|---|

| 2018 | 180 | 5 | 100 |

| 2019 | 190 | 7 | 95 |

| 2020 | 160 | 2 | 110 |

| 2021 | 220 | 10 | 105 |

| 2022 | 250 | 12 | 90 |

Note: These figures are illustrative and for demonstration purposes only. Actual figures may vary.

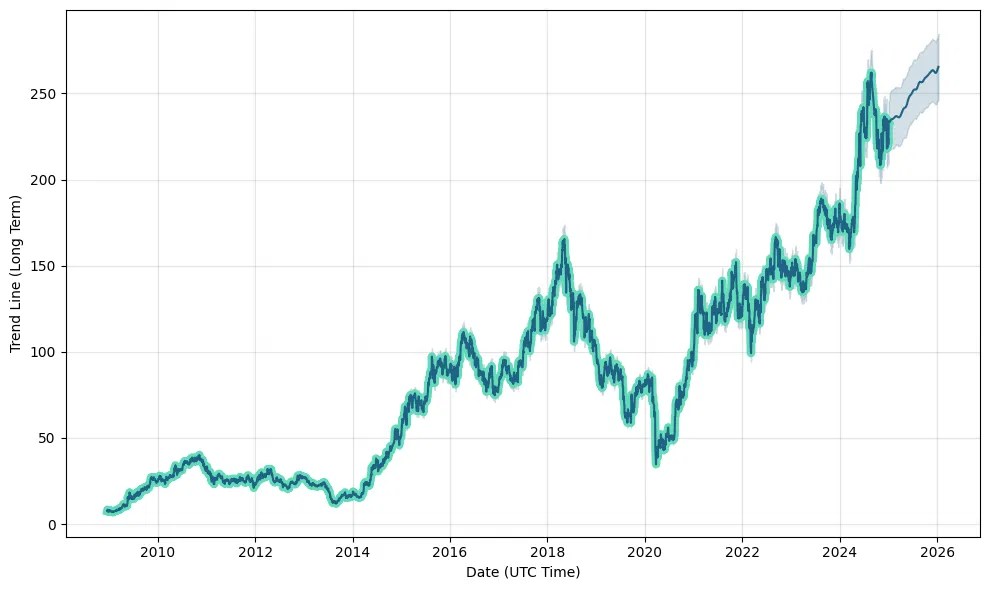

BSE Stock Price Performance

Ashok Leyland’s stock price on the BSE has shown considerable volatility, reflecting the overall performance of the company and the broader economic climate. Significant price increases have often coincided with periods of strong sales growth and positive industry sentiment, while downturns have been associated with economic slowdowns, fuel price hikes, and regulatory changes.

The stock’s beta, a measure of its volatility relative to the market, has historically been higher than 1, indicating that it tends to be more volatile than the broader market index. This higher volatility presents both opportunities and risks for investors.

Monitoring the Ashok Leyland BSE stock price requires a keen eye on market trends. It’s helpful to compare its performance against other global giants; for instance, checking the appl pre market stock price can offer a broader perspective on the tech sector’s influence. Ultimately, understanding Ashok Leyland’s trajectory involves considering a range of factors beyond just its own immediate performance.

Factors Influencing Stock Price

Several factors significantly influence Ashok Leyland’s stock price. Fluctuations in fuel prices directly impact the company’s operating costs and profitability, thus influencing investor sentiment. Government regulations, such as emission norms and taxation policies, can also affect the company’s operations and profitability.

A comparison with key competitors reveals variations in performance. Here’s a summary comparing key performance indicators:

- Ashok Leyland: Strong market share in certain segments, fluctuating profitability, high debt levels.

- Tata Motors: Larger market capitalization, diversified product portfolio, generally higher profitability.

- Eicher Motors (VE Commercial Vehicles): Focus on premium segment, higher margins, lower market share.

Financial Health and Projections

Source: b-cdn.net

Ashok Leyland’s current financial position shows a mix of strengths and weaknesses. While revenue has been growing, debt levels remain relatively high. Liquidity ratios, indicating the company’s ability to meet short-term obligations, need careful monitoring. Solvency ratios, reflecting its long-term financial health, are also important indicators to track.

A scenario analysis, considering various economic conditions (e.g., strong growth, moderate growth, recession), would illustrate potential impacts on the company’s future performance. A strong economic recovery could lead to increased demand for commercial vehicles, boosting Ashok Leyland’s revenue and profitability. Conversely, an economic downturn could significantly impact sales and profitability.

Investment Considerations, Ashok leyland bse stock price

Investing in Ashok Leyland stock involves both risks and rewards. Potential risks include cyclical industry fluctuations, competition, fuel price volatility, and regulatory changes. Rewards include potential capital appreciation and dividend payouts, if the company performs well. A comparative analysis of valuation metrics (like P/E ratio, Price-to-Book ratio) against industry peers helps in assessing the stock’s attractiveness.

A concise summary for an investment prospectus would highlight the company’s market position, financial performance, key risks, and potential returns, helping investors make informed decisions.

Illustrative Example: A Hypothetical Investment

Source: sharefutureprediction.com

Let’s consider a hypothetical investment scenario: An investor buys 1000 shares of Ashok Leyland at INR 100 per share, investing a total of INR 100,000. After a holding period of three years, the share price appreciates to INR 150, resulting in a capital gain of INR 50,000. Assuming an average annual dividend yield of 2%, the total dividend income would be approximately INR 6,000.

The total return on investment would be INR 56,000, or 56%.

However, unforeseen events such as a severe economic downturn or a major industry disruption could negatively impact the investment. For example, a sharp drop in fuel prices could lead to reduced demand for commercial vehicles, negatively affecting the company’s performance and stock price. A prolonged recession could also significantly reduce demand, leading to losses.

Questions Often Asked: Ashok Leyland Bse Stock Price

What are the major competitors of Ashok Leyland?

Tata Motors and Eicher Motors are Ashok Leyland’s primary competitors in the Indian commercial vehicle market.

How often is Ashok Leyland’s stock price updated on the BSE?

The stock price is updated in real-time during trading hours on the BSE.

Where can I find historical Ashok Leyland stock price data?

You can access historical data through the BSE website, financial news websites, and brokerage platforms.

What are the typical trading volumes for Ashok Leyland stock?

Trading volumes vary daily but can be found on financial data providers’ websites.