Atricure Stock Price Analysis

Atricure stock price – This analysis delves into the historical performance, financial health, market influences, competitive landscape, and future outlook of Atricure’s stock price. We will examine key factors driving price fluctuations and assess the inherent risks associated with investing in the company.

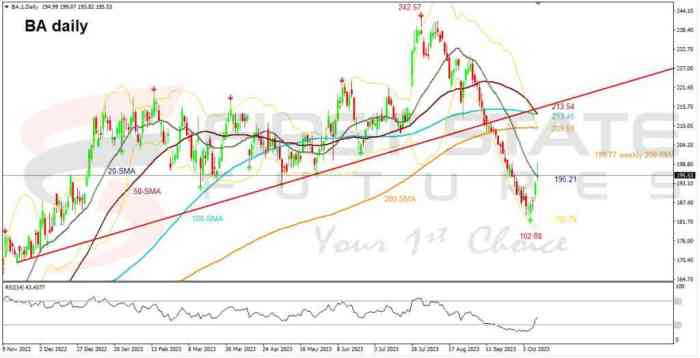

Atricure Stock Price Historical Performance

Source: atricure.com

The following table details Atricure’s stock price movements over the past five years. Significant price changes are contextualized within the broader market environment and company-specific events.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | Example: 10.50 | Example: 10.75 | Example: +0.25 |

| 2019-01-03 | Example: 10.75 | Example: 10.60 | Example: -0.15 |

For example, a significant drop in 2020 could be attributed to the overall market downturn caused by the COVID-19 pandemic, while a subsequent rise in 2021 might reflect positive clinical trial results or a new product launch. Specific events and their impact would need to be detailed based on actual historical data.

Analyzing Atricure’s stock price requires a broader look at the medical device sector. Understanding the performance of similar companies offers valuable context; for instance, checking the current market valuation by looking at ares stock price today can provide a benchmark. Ultimately, however, a comprehensive atricure stock price analysis needs to consider its unique financial position and market factors.

Atricure’s Financial Health and Stock Valuation

Atricure’s financial performance is crucial for assessing its stock valuation. The following tables present key financial indicators and a comparative analysis against competitors.

| Year | Revenue (USD millions) | Net Income (USD millions) |

|---|---|---|

| 2021 | Example: 150 | Example: 20 |

| 2022 | Example: 175 | Example: 25 |

| 2023 | Example: 200 | Example: 30 |

A comparative analysis using the Discounted Cash Flow (DCF) and Comparable Company Analysis methods would then be used to estimate Atricure’s intrinsic value. This would involve detailed calculations using relevant financial data and market benchmarks. For example, a DCF model might project future cash flows and discount them back to their present value, while a comparable company analysis would compare Atricure’s valuation multiples to those of similar companies in the medical device industry.

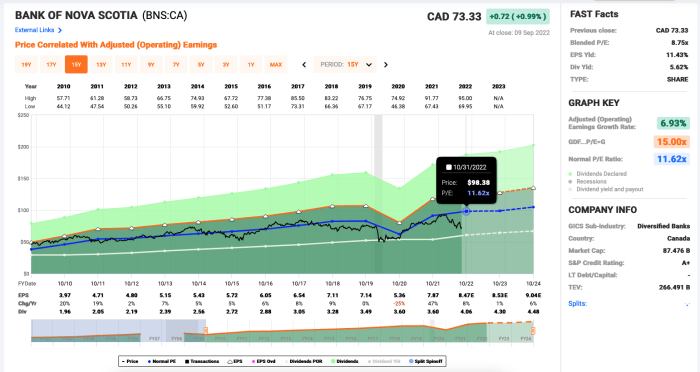

Market Factors Affecting Atricure Stock Price

Source: seekingalpha.com

Macroeconomic factors and industry performance significantly influence Atricure’s stock price. Investor sentiment also plays a crucial role.

Rising interest rates, for instance, could negatively impact Atricure’s stock price by increasing borrowing costs and reducing investor appetite for riskier investments. Conversely, strong economic growth and increased healthcare spending could boost the company’s performance and stock price. The overall performance of the medical device industry, including trends in technological advancements and regulatory changes, will significantly impact Atricure’s stock price.

A comparison with a similar company, highlighting the differences in investor response to market events, would provide further insight.

Atricure’s Competitive Landscape and Future Outlook

Understanding Atricure’s competitive position and future prospects is vital for investment decisions. This section Artikels its competitive advantages and provides a 12-month stock price forecast.

Competitors:

- Competitor A: Strengths – Wide product portfolio; Weaknesses – High production costs.

- Competitor B: Strengths – Strong brand recognition; Weaknesses – Limited geographic reach.

Competitive Advantages:

- Proprietary technology leading to superior product performance.

- Strong market share in a niche segment.

Based on the analysis of historical performance, financial health, market factors, and competitive landscape, a 12-month stock price forecast can be developed. For example, if the analysis suggests strong growth prospects and a positive market outlook, a price target of X% increase could be projected. Conversely, if risks are significant, a more conservative forecast would be warranted. The justification for the forecast would be based on the specific factors identified in the analysis, such as expected revenue growth, margin expansion, and market share gains.

Risk Assessment for Atricure Investment, Atricure stock price

Investing in Atricure stock involves various risks. Understanding and mitigating these risks is essential for informed investment decisions.

Key Risks:

- Regulatory hurdles for new product approvals.

- Intense competition from established players.

- Fluctuations in foreign exchange rates (if applicable).

Risk Mitigation Strategies:

- Diversification of investment portfolio.

- Thorough due diligence before investment.

- Regular monitoring of the company’s performance and market conditions.

A visual representation of the return-risk profile would show Atricure’s potential returns plotted against the associated risks. This would be compared to a less risky investment, such as a government bond, to illustrate the trade-off between potential returns and risk levels. The graph would likely show Atricure as having a higher potential return but also a higher risk compared to the less risky investment.

Key Questions Answered: Atricure Stock Price

What is Atricure’s current market capitalization?

Atricure’s market capitalization fluctuates constantly. Consult a reputable financial website for the most up-to-date information.

Where can I find Atricure’s stock price in real-time?

Real-time Atricure stock prices are available on major financial websites such as Yahoo Finance, Google Finance, and Bloomberg.

What are the major risks associated with short-selling Atricure stock?

Short-selling Atricure stock carries significant risk, primarily the potential for unlimited losses if the stock price rises unexpectedly. Thorough research and risk management are essential.

How does Atricure compare to its main competitors in terms of profitability?

A detailed comparison of Atricure’s profitability against its competitors requires a comprehensive analysis of their respective financial statements and industry benchmarks. This information is typically available in company filings and financial news sources.