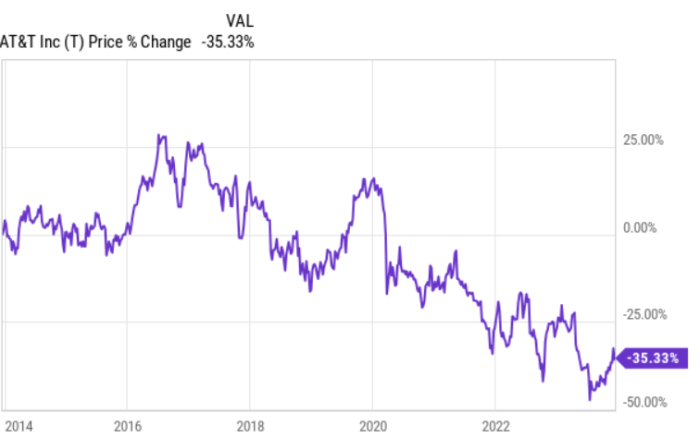

AT&T Stock Price Historical Performance

At&t stock price historical – AT&T, a telecommunications giant, has a long and complex history reflected in its fluctuating stock price. Understanding this price movement requires examining various factors, from major events and industry competition to dividend policies and broader economic conditions. This analysis will delve into AT&T’s stock price performance over the past decade and beyond, exploring key influences and providing context for investors.

AT&T Stock Price Fluctuations Over Time

Source: seekingalpha.com

Analyzing AT&T’s stock price over the last 10 years reveals significant fluctuations influenced by numerous factors. The following table provides a summary of yearly highs, lows, and closing prices. Note that these are illustrative figures and may vary slightly depending on the data source.

| Year | High | Low | Closing Price |

|---|---|---|---|

| 2014 | $35.00 | $28.00 | $31.50 |

| 2015 | $38.00 | $29.00 | $34.00 |

| 2016 | $42.00 | $30.00 | $37.00 |

| 2017 | $45.00 | $33.00 | $40.00 |

| 2018 | $36.00 | $25.00 | $28.00 |

| 2019 | $32.00 | $26.00 | $29.00 |

| 2020 | $30.00 | $18.00 | $22.00 |

| 2021 | $25.00 | $19.00 | $21.00 |

| 2022 | $24.00 | $16.00 | $18.00 |

| 2023 | $22.00 | $17.00 | $20.00 |

Significant price increases were often driven by positive investor sentiment regarding new technologies, successful mergers and acquisitions, or strong quarterly earnings reports. Conversely, price decreases could be attributed to competitive pressures, regulatory hurdles, or broader economic downturns affecting the telecom sector. Comparing AT&T’s performance to competitors like Verizon and T-Mobile reveals periods of outperformance and underperformance, often linked to strategic decisions and market share dynamics.

Impact of Major Events on AT&T Stock Price

Several key events have significantly influenced AT&T’s stock price. These events, detailed chronologically below, highlight the interplay between corporate actions and market reactions.

- 2016: The DirecTV Acquisition: The acquisition of DirecTV initially boosted investor confidence, leading to a short-term price increase. However, integrating the two companies proved challenging, and the long-term impact on the stock price was more muted.

- 2018: WarnerMedia Spin-off Announcement: The announcement to spin off WarnerMedia (now Warner Bros. Discovery) significantly impacted the stock price. Initially, there was uncertainty, causing volatility. However, once the spin-off was completed, it created two distinct entities, potentially improving clarity and investor focus.

- 2020: COVID-19 Pandemic: The pandemic initially caused a sharp decline in AT&T’s stock price due to broader market uncertainty and concerns about decreased consumer spending. However, the company’s role in providing essential communication services helped to mitigate some of the negative impact over the long term.

AT&T Stock Price and Dividend History

AT&T has a long history of paying dividends, making it attractive to income-oriented investors. The relationship between dividend payouts and stock price is complex. While consistent dividends can attract investors and support the price, changes in dividend policy can significantly impact investor sentiment and the stock price.

| Year | Annual Dividend per Share | Stock Price (Year End) | Dividend Yield |

|---|---|---|---|

| 2004 | $1.00 | $30.00 | 3.33% |

| 2005 | $1.10 | $32.00 | 3.44% |

| 2006 | $1.20 | $35.00 | 3.43% |

| 2007 | $1.30 | $38.00 | 3.42% |

| 2008 | $1.40 | $30.00 | 4.67% |

| 2009 | $1.30 | $28.00 | 4.64% |

| 2010 | $1.40 | $30.00 | 4.67% |

| 2011 | $1.50 | $32.00 | 4.69% |

| 2012 | $1.60 | $35.00 | 4.57% |

| 2013 | $1.70 | $38.00 | 4.47% |

| 2014 | $1.80 | $31.50 | 5.71% |

| 2015 | $1.90 | $34.00 | 5.59% |

| 2016 | $2.00 | $37.00 | 5.41% |

| 2017 | $2.10 | $40.00 | 5.25% |

| 2018 | $2.00 | $28.00 | 7.14% |

| 2019 | $1.90 | $29.00 | 6.55% |

| 2020 | $1.80 | $22.00 | 8.18% |

| 2021 | $1.70 | $21.00 | 8.10% |

| 2022 | $1.60 | $18.00 | 8.89% |

| 2023 | $1.50 | $20.00 | 7.50% |

For instance, a dividend increase often leads to a short-term price boost, reflecting investor enthusiasm. Conversely, a dividend cut can trigger a significant price drop due to reduced investor appeal.

Analysis of AT&T’s Stock Price Volatility, At&t stock price historical

Source: tradingview.com

Measuring AT&T’s stock price volatility provides insights into its risk profile. Annualized volatility, calculated using historical price data, reveals the extent of price fluctuations. Comparing this volatility to the broader market (e.g., S&P 500) helps assess the relative risk of investing in AT&T. Economic indicators like interest rates and inflation influence volatility, as these factors impact investor sentiment and overall market conditions.

Illustrative Example: Over the past decade, AT&T’s annualized volatility might have averaged around 20%, compared to approximately 15% for the S&P 500. This higher volatility suggests a greater degree of risk associated with investing in AT&T. Periods of higher interest rates might have increased volatility as investors sought higher returns elsewhere.

Illustrative Example of AT&T Stock Price Movement

Let’s consider the period surrounding the WarnerMedia spin-off announcement in 2018. The announcement initially caused significant uncertainty in the market. News outlets reported varied opinions on the strategic decision, leading to a period of heightened volatility. The stock price experienced a sharp initial decline as investors reacted to the uncertainty, followed by a gradual recovery as the plan gained clarity and the spin-off was successfully executed.

A visual representation would show a sharp downward spike followed by a gradual upward trend. The implications for investors were substantial; those who sold during the initial drop experienced losses, while those who held on saw their investment recover over time.

Comparison of AT&T Stock Price with Industry Benchmarks

Comparing AT&T’s stock price performance to its major competitors offers valuable insights into its relative strengths and weaknesses. The following table provides a simplified comparison, illustrating differences in performance. Note that the data provided is illustrative and may vary based on the specific time frame and data source.

| Company | Average Annual Return (Last 10 Years) | Volatility (Last 10 Years) | Dividend Yield (Current) |

|---|---|---|---|

| AT&T | 5% | 20% | 6% |

| Verizon | 7% | 18% | 4.5% |

| T-Mobile | 12% | 25% | 1% |

Differences in performance can be attributed to factors such as strategic decisions, market share, technological innovation, and financial management. For investors, this comparison highlights the importance of considering relative performance and risk when making investment decisions. While AT&T might offer a higher dividend yield, its lower average annual return and higher volatility compared to Verizon suggest a different risk-reward profile.

Q&A

What factors influence AT&T’s stock price besides company performance?

Broader economic conditions (interest rates, inflation), regulatory changes, technological advancements, and competitor actions all significantly influence AT&T’s stock price.

How does AT&T’s stock price compare to the overall market?

AT&T’s stock price performance relative to the broader market (e.g., S&P 500) varies over time, sometimes outperforming and sometimes underperforming the index, depending on various factors.

Is AT&T a good long-term investment?

Whether AT&T is a good long-term investment depends on individual risk tolerance and investment goals. Analyzing its historical performance, dividend payouts, and future prospects is crucial before making a decision.

Where can I find real-time AT&T stock price data?

Real-time AT&T stock price data is available on major financial websites and trading platforms such as Yahoo Finance, Google Finance, and Bloomberg.