Atyr Pharma Stock Price Analysis

Atyr pharma stock price – This analysis provides an overview of Atyr Pharma, its stock performance, influencing factors, and future prospects. We will examine the company’s business model, drug pipeline, financial performance, and analyst sentiment to offer a comprehensive perspective on its stock price trajectory.

Atyr Pharma’s stock price performance has been a topic of discussion lately, particularly in comparison to other companies in the biotech sector. It’s interesting to contrast its trajectory with that of other technology-focused businesses, such as the current arlo technologies stock price , which reflects a different market dynamic. Ultimately, understanding Atyr Pharma’s prospects requires a comprehensive analysis of its pipeline and market position.

Atyr Pharma Company Overview

Atyr Pharma is a biopharmaceutical company focused on developing novel therapies for various diseases. Its business model centers on internal research and development, leveraging its expertise in drug discovery and development to advance its pipeline of drug candidates. The company’s primary focus areas typically include [insert specific therapeutic areas based on Atyr Pharma’s current focus, e.g., neurodegenerative diseases, inflammatory conditions].

Atyr Pharma’s pipeline includes several drug candidates at various stages of development. [Provide a detailed list of drug candidates, including their target indications and current developmental phases (e.g., preclinical, Phase 1, Phase 2, Phase 3)]. For instance, [mention a specific drug candidate and its stage of development with a brief description of its intended use]. The success of these drug candidates is crucial to the company’s future growth and stock valuation.

Atyr Pharma’s recent financial performance reflects [summarize key financial metrics, including revenue, expenses, and profitability. Cite sources for financial data]. For example, revenue for the [specific period] was [amount], while expenses totaled [amount]. This resulted in a [profit/loss] of [amount]. These figures should be interpreted in the context of the company’s stage of development and its investment in research and development.

Factors Influencing Atyr Pharma Stock Price

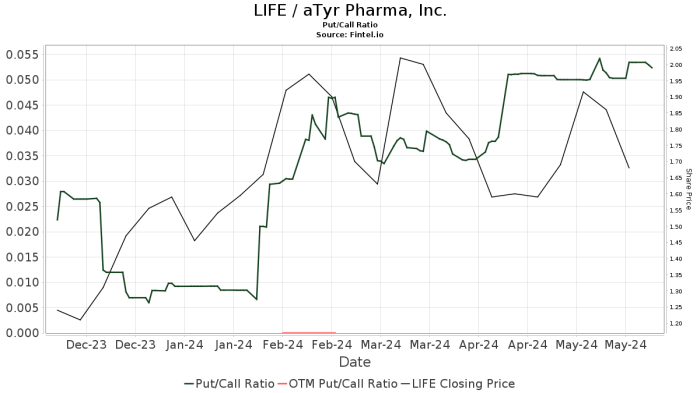

Source: fintel.io

Several factors influence Atyr Pharma’s stock price, creating volatility in its valuation. These factors include market trends, regulatory decisions, competitive landscape, and overall company performance.

Market trends in the pharmaceutical sector, such as increased investment in specific therapeutic areas or changes in regulatory environments, can significantly impact Atyr Pharma’s stock price. Regulatory approvals for its drug candidates are critical, with successful approvals typically leading to price increases and setbacks resulting in price declines. The competitive landscape, including the presence of similar drugs from other companies, influences market share and ultimately affects Atyr Pharma’s stock valuation.

A comparison with similar companies in the pharmaceutical sector, based on factors like market capitalization, pipeline progress, and financial performance, helps determine Atyr Pharma’s relative value.

Historical Stock Price Performance, Atyr pharma stock price

The following table summarizes Atyr Pharma’s stock price performance over the past year. Significant price fluctuations are discussed below the table.

| Date | Open | High | Low |

|---|---|---|---|

| [Date 1] | [Open Price] | [High Price] | [Low Price] |

| [Date 2] | [Open Price] | [High Price] | [Low Price] |

| [Date 3] | [Open Price] | [High Price] | [Low Price] |

During the past year, Atyr Pharma’s stock price experienced [describe significant price fluctuations, e.g., a sharp increase following positive clinical trial results, a decline due to regulatory setbacks, or a period of stability]. For example, the announcement of [specific news event] led to a [percentage]% change in the stock price within [timeframe]. This highlights the sensitivity of the stock price to news related to the company’s pipeline and operational performance.

Analyst Ratings and Predictions

Financial analysts offer varying perspectives on Atyr Pharma’s stock prospects. A consensus rating among analysts provides a general market sentiment, while individual price targets reflect different expectations regarding the company’s future performance.

The consensus rating for Atyr Pharma stock is currently [insert consensus rating, e.g., “Buy,” “Hold,” “Sell”]. Analyst price targets range from [lowest price target] to [highest price target], reflecting the diversity of opinions on the company’s potential. The differing opinions often stem from varying assessments of the likelihood of successful drug development, market penetration, and competitive dynamics.

Investor Sentiment and News Impact

Source: hughesmarino.com

Investor sentiment towards Atyr Pharma is currently [describe the prevailing sentiment, e.g., cautiously optimistic, bearish, bullish]. This sentiment is influenced by various factors, including the company’s recent performance, news events, and market conditions. Recent news events have significantly impacted the stock price. For example, [mention a specific news event and its impact on the stock price].

Social media and online forums play a significant role in shaping investor perception. Discussions on platforms like [mention relevant platforms] can influence investor sentiment and potentially lead to price fluctuations. Positive or negative news circulating on these platforms can quickly impact the stock price, highlighting the importance of monitoring online sentiment.

Risk Factors and Potential Challenges

Atyr Pharma faces several risks that could negatively affect its stock price. These include potential setbacks in clinical trials, competition from other pharmaceutical companies, and regulatory hurdles.

Clinical trial failures are a major risk, as they could halt the development of promising drug candidates and significantly impact investor confidence. The company faces competition from established players and emerging biotech firms, which could affect market share and profitability. Regulatory delays or rejections can also negatively impact the stock price. To mitigate these risks, Atyr Pharma employs strategies such as [describe the company’s risk mitigation strategies, e.g., diversification of its pipeline, robust regulatory planning, and competitive market analysis].

These risks are reflected in the stock’s current valuation, with the price reflecting the inherent uncertainty associated with the biotech industry.

Long-Term Growth Prospects

Atyr Pharma’s long-term growth prospects depend on several factors, including the successful development and commercialization of its drug candidates, market adoption, and competitive landscape. The company’s pipeline holds potential for significant growth, but the success of its drug candidates is not guaranteed.

Factors contributing to sustained growth include [mention factors like successful clinical trials, regulatory approvals, market acceptance, and strategic partnerships]. However, factors that could hinder future expansion include [mention factors like clinical trial failures, increased competition, regulatory setbacks, and financial constraints]. A potential future scenario for Atyr Pharma’s stock price could involve [describe a plausible future scenario, e.g., a gradual increase in price driven by successful clinical trial results and regulatory approvals, or a more volatile trajectory depending on the outcome of key milestones].

Query Resolution: Atyr Pharma Stock Price

What are the major risks associated with investing in Atyr Pharma?

Major risks include clinical trial failures, regulatory setbacks, intense competition, and the inherent volatility of the pharmaceutical sector. Success is not guaranteed.

Where can I find real-time Atyr Pharma stock quotes?

Real-time quotes are available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

How does Atyr Pharma compare to its competitors?

A comparative analysis requires a detailed look at competitors’ pipelines, market capitalization, and financial performance. This would be a subject for a separate, in-depth study.

What is Atyr Pharma’s primary focus area?

Atyr Pharma’s primary focus is on the development of novel therapies, though the specifics should be researched for the most current information.