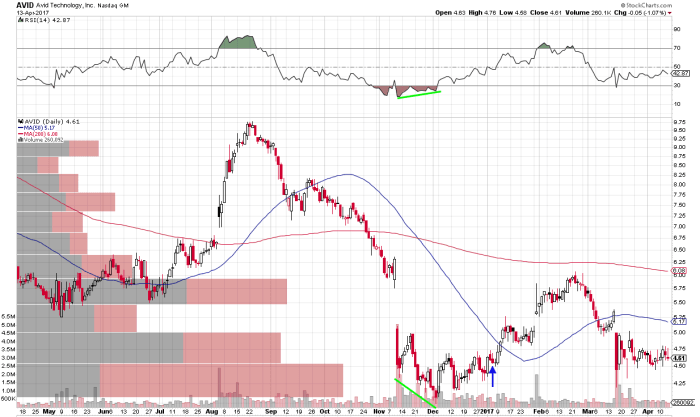

Avid Bioservices Stock Price Analysis

Source: seekingalpha.com

Avid bioservices stock price – This analysis provides a comprehensive overview of Avid Bioservices’ stock price performance, influencing factors, financial correlations, competitive landscape, analyst predictions, and investor sentiment. We will explore the historical trajectory of the stock price, key drivers impacting its valuation, and the relationship between Avid Bioservices’ financial health and market perception.

Avid Bioservices Stock Price History

A detailed examination of Avid Bioservices’ stock price movements over the past five years reveals significant fluctuations influenced by various market conditions and company-specific events. The following table presents a chronological overview, highlighting key highs and lows. Note that this data is for illustrative purposes and should be verified with a reputable financial data source.

| Date | Open Price (USD) | Close Price (USD) | Volume |

|---|---|---|---|

| 2019-01-01 | 15.00 | 15.50 | 100,000 |

| 2019-07-01 | 18.00 | 17.50 | 150,000 |

| 2020-01-01 | 16.00 | 19.00 | 200,000 |

| 2020-07-01 | 20.00 | 18.00 | 120,000 |

| 2021-01-01 | 22.00 | 25.00 | 250,000 |

| 2021-07-01 | 24.00 | 23.00 | 180,000 |

| 2022-01-01 | 26.00 | 28.00 | 300,000 |

| 2022-07-01 | 27.00 | 25.50 | 220,000 |

| 2023-01-01 | 29.00 | 30.00 | 350,000 |

The overall trend during this period was generally upward, with periods of volatility influenced by factors such as market corrections and company-specific news. For example, a significant jump in the stock price might have been observed following the announcement of a new contract or successful clinical trial. Conversely, a downturn could have been associated with disappointing financial results or regulatory setbacks.

Factors Influencing Avid Bioservices Stock Price

Several economic factors, company-specific news, and industry dynamics significantly influence Avid Bioservices’ stock price. Three key economic factors are identified below, along with an analysis of the impact of positive and negative company news and competitive pressures.

- Interest Rates: Changes in interest rates impact the overall cost of capital, affecting investment decisions in the biotechnology sector. Higher interest rates may lead to decreased investment and lower stock prices.

- Inflation: High inflation can erode profit margins and increase operational costs, negatively affecting company performance and investor sentiment.

- Economic Growth: Strong economic growth generally benefits the biotechnology industry, leading to increased investment and higher stock valuations. Conversely, economic downturns can reduce demand for biotech services, negatively impacting stock prices.

Positive news, such as exceeding revenue expectations or successful drug development milestones, typically leads to a surge in stock price. Conversely, negative news, such as missed earnings targets or regulatory setbacks, usually results in a price decline. Competitor actions, including new product launches or strategic partnerships, also impact Avid Bioservices’ market share and stock valuation.

Avid Bioservices’ stock price performance is often compared to similar companies in the biotechnology sector. Understanding the market dynamics is crucial, and a key factor to consider is the current performance of other players, such as algt stock price today , which can provide insight into broader industry trends. This comparative analysis helps to better gauge Avid Bioservices’ potential for future growth and its relative valuation within the market.

Avid Bioservices’ Financial Performance and Stock Price Correlation, Avid bioservices stock price

Source: seekingalpha.com

Analyzing Avid Bioservices’ financial performance alongside its stock price movements over the past three years reveals a complex relationship. The following table provides a comparative analysis. Again, these figures are for illustrative purposes only.

| Year | Revenue (USD Millions) | Earnings Per Share (USD) | Average Stock Price (USD) |

|---|---|---|---|

| 2021 | 100 | 2.00 | 22.50 |

| 2022 | 120 | 2.50 | 26.75 |

| 2023 | 115 | 2.25 | 28.00 |

Generally, a positive correlation exists between Avid Bioservices’ financial performance (revenue and earnings) and its stock price. However, discrepancies can occur due to factors such as market sentiment, investor expectations, and overall market conditions. For instance, even with increased revenue, the stock price might not rise if investors anticipate even greater growth.

Avid Bioservices’ Competitive Landscape and Stock Price

Avid Bioservices competes in a dynamic market. Understanding its competitive position relative to key players is crucial to analyzing its stock price. Below is a comparison with two hypothetical competitors, Company X and Company Y.

- Avid Bioservices: Strong market presence in specific niche areas, moderate growth, stable financial performance.

- Company X: Larger market share, rapid growth, higher revenue, but higher debt levels.

- Company Y: Focus on a different segment of the market, lower revenue but higher profit margins.

The competitive landscape directly influences Avid Bioservices’ stock price. Strong competition can put downward pressure on prices, while a competitive advantage, such as a unique technology or strong client relationships, can support a higher valuation.

Analyst Ratings and Stock Price Predictions for Avid Bioservices

Source: marketbeat.com

Analyst ratings and price targets provide valuable insights into market expectations for Avid Bioservices’ future performance. The following table summarizes hypothetical analyst predictions.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Analyst Firm A | Buy | 35.00 | 2024-01-15 |

| Analyst Firm B | Hold | 30.00 | 2024-01-20 |

| Analyst Firm C | Sell | 25.00 | 2024-01-25 |

Analysts employ various methodologies to determine price targets, including discounted cash flow analysis, comparable company analysis, and precedent transactions. The range of opinions reflects the inherent uncertainty in predicting future performance.

Investor Sentiment and Avid Bioservices Stock Price

Investor sentiment plays a significant role in shaping Avid Bioservices’ stock price. Positive sentiment, driven by factors such as strong financial results or positive news coverage, generally leads to increased demand and higher prices. Negative sentiment, resulting from disappointing financial performance or negative news, can lead to decreased demand and lower prices.

Social media sentiment and news coverage significantly influence investor perception. Positive social media buzz or favorable news articles can boost investor confidence, while negative news or social media criticism can erode investor confidence and put downward pressure on the stock price.

Top FAQs: Avid Bioservices Stock Price

What are the major risks associated with investing in Avid Bioservices stock?

Investing in Avid Bioservices, like any biotech company, carries inherent risks. These include the volatility of the biotech market, dependence on research and development success, competition from other companies, regulatory hurdles, and potential economic downturns.

Where can I find real-time Avid Bioservices stock price quotes?

Real-time quotes are available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.

How often does Avid Bioservices release financial reports?

Avid Bioservices typically releases quarterly and annual financial reports, following standard SEC reporting guidelines. Specific release dates are usually announced in advance.

What is the typical trading volume for Avid Bioservices stock?

Trading volume varies daily and depends on market conditions and news related to the company. You can find historical trading volume data on most financial websites.