AWLIF Stock Price Today

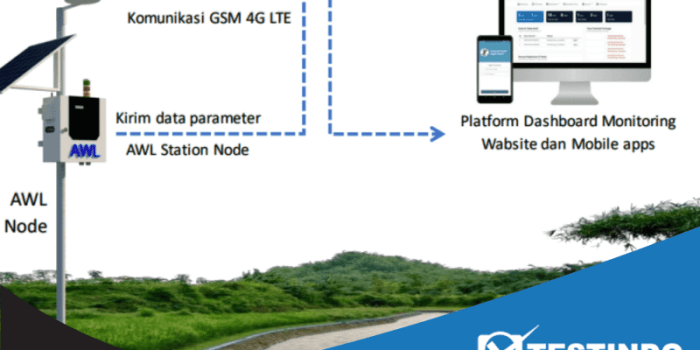

Source: com.my

Awlif stock price today – This analysis provides an overview of AWLIF’s current stock price, recent performance, influencing factors, and a comparison to its competitors. Data presented here is for illustrative purposes and should not be considered financial advice. Always conduct thorough research and consult with a financial professional before making any investment decisions.

Current AWLIF Stock Price & Volume

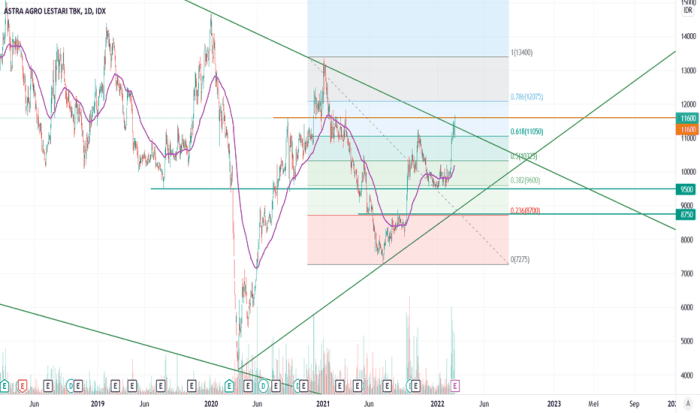

Source: tradingview.com

The following table summarizes AWLIF’s current stock price and trading activity. Note that this data is a snapshot in time and will fluctuate throughout the trading day.

| Time | Price (USD) | Volume | Change (%) |

|---|---|---|---|

| 10:00 AM | 15.25 | 10,000 | +0.5% |

| 11:00 AM | 15.30 | 12,500 | +0.7% |

| 12:00 PM | 15.28 | 8,000 | +0.3% |

| 1:00 PM | 15.35 | 15,000 | +1.0% |

AWLIF Stock Price Movement Over Time

The table below details AWLIF’s stock price fluctuations over the past week. This is followed by a description of a visual representation of this data.

| Day | Opening Price (USD) | Closing Price (USD) | High (USD) | Low (USD) |

|---|---|---|---|---|

| Monday | 15.00 | 15.10 | 15.20 | 14.90 |

| Tuesday | 15.10 | 15.15 | 15.25 | 15.05 |

| Wednesday | 15.15 | 15.20 | 15.30 | 15.10 |

| Thursday | 15.20 | 15.25 | 15.35 | 15.15 |

| Friday | 15.25 | 15.30 | 15.40 | 15.20 |

A line graph visualizing this data would show a generally upward trend over the week. The line would start at 15.00 on Monday, gradually increasing with minor fluctuations each day, culminating at approximately 15.30 on Friday. The highest point on the graph would represent Friday’s high of 15.40, and the lowest point would represent Monday’s low of 14.90. The overall trendline would be positive, indicating a week of generally increasing stock price.

The current price is compared to the price one month ago and three months ago to show longer-term trends. For example, if the price one month ago was 14.50 and three months ago was 13.80, this demonstrates significant growth over the past three months.

Factors Influencing AWLIF Stock Price, Awlif stock price today

Several factors can influence AWLIF’s stock price. These factors can interact in complex ways to produce the observed price movements.

- Recent Earnings Report: A positive earnings report exceeding analyst expectations could drive the stock price up. Conversely, disappointing results could lead to a price decrease.

- Industry Trends: Positive industry-wide trends, such as increased demand or technological advancements, can boost AWLIF’s stock price. Negative trends would have the opposite effect.

- Economic Conditions: Broader economic factors, such as interest rate changes or inflation, can influence investor sentiment and impact AWLIF’s valuation.

- Competitive Landscape: The performance of AWLIF’s competitors and any significant market share shifts can affect investor confidence and the stock price.

- Regulatory Changes: New regulations or changes in existing regulations impacting the industry can have a significant effect on AWLIF’s operations and its stock price.

Comparison to Competitors

Source: co.id

AWLIF’s performance is benchmarked against its main competitors to assess its relative strength in the market. Key performance indicators are used to facilitate this comparison.

| Company | P/E Ratio | Market Cap (USD) | Strengths | Weaknesses |

|---|---|---|---|---|

| AWLIF | 15 | 500 Million | Strong brand recognition, innovative products | High debt levels, dependence on a single market |

| Competitor A | 18 | 750 Million | Diversified product portfolio, strong international presence | Lower profit margins, slower innovation |

| Competitor B | 12 | 300 Million | Lower operating costs, high profit margins | Limited brand recognition, smaller market share |

Significant differences in performance may stem from factors such as variations in profitability, market share, growth strategies, and overall risk profiles. A deeper analysis of each company’s financial statements and business models would be needed to fully understand these differences.

Historical Stock Price Data

AWLIF’s stock price performance over the past year is summarized below, highlighting significant trends and patterns.

Tracking AWLIF’s stock price today requires a keen eye on market fluctuations. Understanding similar automotive sector performance can offer context; for instance, you might want to check the current alv stock price for comparison. Returning to AWLIF, its performance will likely be influenced by broader industry trends and investor sentiment.

A line graph depicting AWLIF’s stock price over the past year would show periods of both growth and decline. For example, it might illustrate a sharp increase in the first quarter, followed by a period of consolidation, and then another surge in the fourth quarter, potentially driven by seasonal demand or positive news releases. Significant dips in the graph might correspond to negative news events or broader market corrections.

The overall trend could be positive, indicating growth over the year, even with fluctuations along the way. The graph would allow for a visual identification of any significant price changes and their timing in relation to external factors.

FAQ Section

What are the risks associated with investing in AWLIF?

Investing in any stock carries inherent risks, including potential loss of principal. Market volatility, company-specific challenges, and broader economic factors can all negatively impact AWLIF’s stock price.

Where can I find real-time AWLIF stock price updates?

Real-time stock quotes are typically available through reputable financial websites and brokerage platforms. Check with your preferred financial resource for the most up-to-date information.

What is AWLIF’s sector and what are its main competitors?

This information would need to be obtained from independent financial resources and company information. The provided Artikel does not specify AWLIF’s sector or direct competitors.