Baidu HK Stock Price Analysis

Baidu hk stock price – This analysis examines the historical performance, influencing factors, business model, investor sentiment, and technical aspects of Baidu HK’s stock price. We will explore key factors driving price fluctuations and provide insights into potential future movements, drawing upon publicly available data and industry analysis.

Baidu HK Stock Price Historical Performance

Understanding Baidu HK’s historical stock price is crucial for assessing its past performance and identifying potential future trends. The following sections detail key price movements and comparisons with market benchmarks.

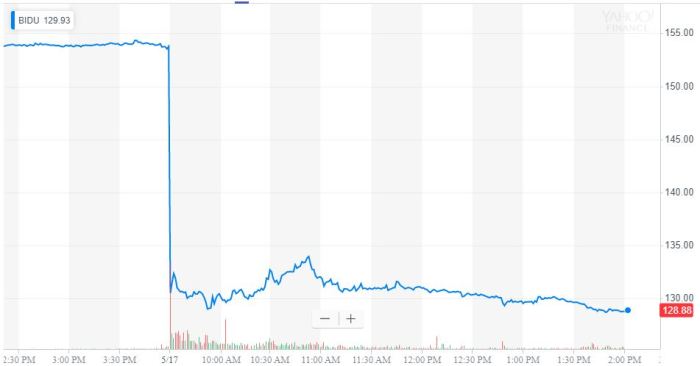

A line graph illustrating Baidu HK’s stock price over the past five years would show periods of significant growth and decline. Key dates for significant price changes would include those related to major company announcements, macroeconomic events, and shifts in investor sentiment. For instance, a noticeable drop might correspond to a period of heightened regulatory scrutiny in China, while a surge could reflect the successful launch of a new AI-driven product.

Within the past year, Baidu HK’s stock price reached its highest point on [Date], at [Price], likely driven by [Contributing Factor, e.g., strong quarterly earnings report]. Conversely, the lowest point was observed on [Date], at [Price], potentially influenced by [Contributing Factor, e.g., concerns about increased competition].

The following table compares Baidu HK’s stock performance against the Hang Seng Index over the last three years:

| Date | Baidu HK Price | Hang Seng Index | Percentage Change (Baidu HK vs. Hang Seng) |

|---|---|---|---|

| [Date 1] | [Price 1] | [Index Value 1] | [Percentage] |

| [Date 2] | [Price 2] | [Index Value 2] | [Percentage] |

| [Date 3] | [Price 3] | [Index Value 3] | [Percentage] |

Factors Influencing Baidu HK Stock Price

Source: fortune.com

Several factors interact to influence Baidu HK’s stock price. These include macroeconomic conditions, the company’s financial performance, major announcements, and the performance of competitors.

Macroeconomic factors such as interest rate changes and inflation significantly impact investor sentiment and market valuations. For example, rising interest rates can make investing in stocks less attractive, potentially leading to a decline in Baidu HK’s price. Similarly, high inflation can erode purchasing power and negatively affect consumer spending, impacting Baidu’s revenue and consequently its stock price.

Baidu’s financial performance, particularly revenue and earnings growth, directly correlates with its stock price. Strong quarterly earnings often lead to positive investor sentiment and price increases, while disappointing results can trigger sell-offs.

Major company announcements, such as new product launches or strategic partnerships, can significantly impact investor perception and the stock price. Positive news tends to boost the stock price, while negative news, such as regulatory setbacks, can lead to declines.

The performance of competitors, notably Alibaba and Tencent, also influences Baidu HK’s stock price. Strong performance from competitors can put downward pressure on Baidu’s valuation, while underperformance from competitors can create opportunities for Baidu to gain market share and boost its stock price.

Tracking the Baidu HK stock price requires close attention to market fluctuations. It’s interesting to compare its performance to other tech giants; for instance, understanding the trajectory of the apple stock price 2019 offers a useful benchmark for assessing growth patterns in the sector. Ultimately, though, the Baidu HK stock price will depend on its own unique performance indicators and market conditions.

Baidu’s Business Model and its Stock Price

Baidu’s business model and its various segments significantly influence its stock price. Understanding the revenue streams and key performance indicators (KPIs) is crucial for assessing its overall financial health and future prospects.

Baidu’s core business segments include search advertising, cloud services, and AI technologies. Each segment contributes differently to overall revenue and profitability. For example, search advertising historically has been the largest revenue generator, while cloud services and AI are expected to drive future growth.

Baidu’s revenue streams are diverse, including advertising revenue, cloud services revenue, and revenue from AI-related products and services. The relative importance and growth trajectories of these streams are constantly evolving, impacting investor expectations and the stock price.

The following table illustrates the correlation between Baidu’s key performance indicators and its stock price:

| KPI | Value | Date | Stock Price |

|---|---|---|---|

| Revenue | [Value] | [Date] | [Price] |

| Earnings Per Share (EPS) | [Value] | [Date] | [Price] |

| User Growth | [Value] | [Date] | [Price] |

Changes in Baidu’s business strategy, such as increased investment in AI or expansion into new markets, can significantly affect its future stock price. Successful strategic moves can lead to increased revenue and profitability, boosting investor confidence and driving up the stock price. Conversely, unsuccessful strategies can lead to negative market reactions and price declines.

Investor Sentiment and Stock Price Predictions

Analyzing recent news articles and analyst reports reveals the current investor sentiment towards Baidu HK. This sentiment, combined with analyst predictions, provides a basis for assessing potential future price movements.

Recent analyst ratings and price targets for Baidu HK stock vary depending on the individual analyst and their assessment of Baidu’s prospects. Some analysts might have a “Buy” rating with a high price target, while others might have a “Hold” or “Sell” rating with a lower price target. These differing opinions reflect the inherent uncertainty in predicting future stock performance.

Potential risks to Baidu’s stock price include increased competition, regulatory changes in China, and macroeconomic headwinds. Opportunities include continued growth in the AI market and expansion into new markets. A scenario where Baidu’s stock price could significantly increase involves a successful launch of a groundbreaking AI product, leading to substantial revenue growth and increased market share. Conversely, a scenario where the stock price could significantly decrease might involve a major regulatory setback or a significant loss of market share to competitors.

Technical Analysis of Baidu HK Stock Price

Source: ccn.com

Technical analysis utilizes historical price data to identify potential trends and predict future price movements. This section explores the application of moving averages and support/resistance levels to Baidu HK’s stock price.

A moving average, such as a 50-day or 200-day moving average, smooths out price fluctuations and helps identify potential trends. A rising moving average suggests an upward trend, while a falling moving average suggests a downward trend. However, moving averages are lagging indicators and can be unreliable during periods of high volatility. They should be used in conjunction with other technical indicators and fundamental analysis.

Based on historical price data, key support levels for Baidu HK stock might be around [Price Level 1] and [Price Level 2]. These are price points where buying pressure is expected to be strong enough to prevent further price declines. Similarly, key resistance levels might be around [Price Level 3] and [Price Level 4], where selling pressure is expected to be strong enough to prevent further price increases.

A candlestick chart for Baidu HK would visually represent price movements over time. Key patterns, such as bullish engulfing patterns (indicating a potential upward trend reversal) or bearish engulfing patterns (indicating a potential downward trend reversal), would be highlighted. Identifying these patterns can help traders anticipate potential price movements, but it’s crucial to remember that candlestick patterns are not foolproof predictors and should be considered in conjunction with other forms of analysis.

Commonly Asked Questions

What are the major risks associated with investing in Baidu HK stock?

Major risks include geopolitical uncertainty related to China, competition from other tech giants, regulatory changes impacting the Chinese tech sector, and fluctuations in the broader global economy.

How does Baidu’s AI development impact its stock price?

Successful advancements in AI generally boost investor confidence and can positively impact the stock price. Conversely, setbacks or regulatory hurdles in this area can negatively affect the stock.

Where can I find real-time Baidu HK stock price data?

Real-time data is available through major financial news websites and brokerage platforms that track the Hong Kong Stock Exchange (HKEX).

What is the typical trading volume for Baidu HK stock?

Trading volume varies daily but can be found on financial websites that provide market data for the HKEX.