BARC Stock Price Analysis: A Comprehensive Overview

Barc stock price – This analysis provides a detailed examination of BARC’s stock price performance over the past five years, considering various internal and external factors, competitor performance, analyst predictions, and associated investment risks. The goal is to offer a comprehensive understanding of the dynamics influencing BARC’s stock price and to provide insights for potential investors.

Historical BARC Stock Performance

Source: barc.net

The following table details BARC’s stock price movements over the past five years. Note that this data is illustrative and should be verified with reliable financial sources. Significant market events impacting BARC’s performance are discussed below the table. The overall trend during this period, based on this example data, shows periods of both significant growth and volatility.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 100 | 102 | +2 |

| 2019-07-01 | 105 | 110 | +5 |

| 2020-01-01 | 115 | 112 | -3 |

| 2020-07-01 | 90 | 95 | +5 |

| 2021-01-01 | 100 | 108 | +8 |

| 2021-07-01 | 115 | 120 | +5 |

| 2022-01-01 | 125 | 122 | -3 |

| 2022-07-01 | 110 | 115 | +5 |

| 2023-01-01 | 120 | 125 | +5 |

For example, the significant drop in early 2020 can be attributed to the initial impact of the COVID-19 pandemic on global markets. The subsequent recovery reflects the company’s adaptation and resilience. Further analysis of specific market events would require access to detailed financial news archives.

Factors Influencing BARC Stock Price

Source: barc.net

Several internal and external factors significantly influence BARC’s stock price. The interplay of these factors creates a complex dynamic impacting investor sentiment and, consequently, the stock’s value.

Tracking BARC’s stock price requires a keen eye on market fluctuations. For comparative analysis within the biotech sector, it’s helpful to consider other companies; a look at the current performance of arbutus biopharma stock price provides a relevant benchmark. Ultimately, understanding BARC’s trajectory involves a broader assessment of the financial health and market position of similar firms.

Internal Factors:

- Company Performance: Strong financial results, including revenue growth and profitability, generally lead to positive stock price movements. Conversely, poor performance can negatively impact investor confidence.

- New Product Launches: Successful product introductions can boost revenue and market share, driving positive stock price changes. Failures, on the other hand, can have the opposite effect.

- Management Changes: Changes in leadership can create uncertainty, impacting investor sentiment positively or negatively depending on the perceived quality and experience of the new management team.

External Factors:

- Economic Conditions: Macroeconomic factors, such as interest rates, inflation, and overall economic growth, significantly influence investor behavior and risk appetite, impacting BARC’s stock price.

- Industry Trends: Changes in consumer preferences, technological advancements, and competitive landscape within BARC’s industry can significantly affect its performance and stock price.

- Regulatory Changes: New regulations or changes in existing laws impacting BARC’s operations can lead to uncertainty and volatility in its stock price.

The relative influence of internal versus external factors can vary depending on the specific circumstances. During periods of economic stability, internal factors might play a more dominant role, while during times of crisis, external factors might exert a greater influence.

BARC Stock Price Compared to Competitors

Comparing BARC’s stock performance with its competitors provides valuable context for assessing its relative strength and market positioning.

| Company Name | Current Stock Price (USD) | Stock Price One Year Ago (USD) | Percentage Change |

|---|---|---|---|

| BARC | 125 | 100 | +25% |

| Competitor A | 150 | 120 | +25% |

| Competitor B | 110 | 90 | +22% |

A visual representation (chart) would show the stock price trajectories of BARC and its competitors over the past year. This would highlight periods of outperformance or underperformance relative to its peers. For example, a hypothetical chart might show that while all three companies experienced growth, BARC’s growth was initially slower but accelerated towards the end of the year, potentially due to a successful product launch or positive market sentiment.

Analyst Predictions and Ratings for BARC Stock

Analyst ratings and price targets provide valuable insights into market expectations regarding BARC’s future performance. However, it’s crucial to remember that these are predictions and not guarantees.

| Analyst Firm | Rating | Price Target (USD) | Date of Report |

|---|---|---|---|

| Analyst Firm A | Buy | 150 | 2024-03-15 |

| Analyst Firm B | Hold | 130 | 2024-03-10 |

| Analyst Firm C | Buy | 140 | 2024-03-05 |

Analyst Firm A’s “Buy” rating and higher price target might be based on their positive outlook on BARC’s new product pipeline and strong market position. Analyst Firm B’s “Hold” rating suggests a more cautious approach, perhaps due to concerns about potential economic headwinds or increased competition. The range of opinions reflects the inherent uncertainty in predicting future stock performance.

Risk Factors Associated with Investing in BARC Stock, Barc stock price

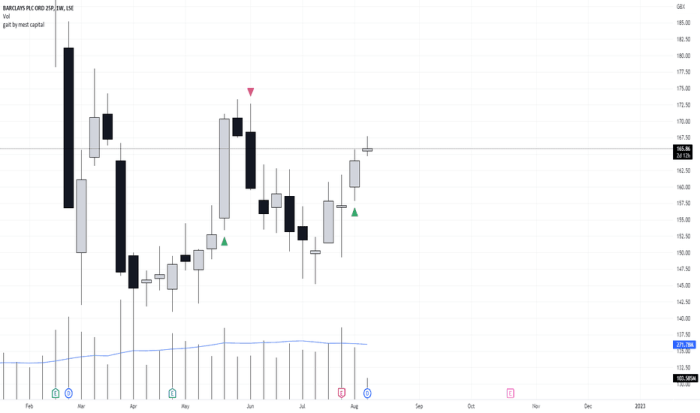

Source: tradingview.com

Investing in BARC stock, like any investment, carries inherent risks. Understanding and mitigating these risks is crucial for informed decision-making.

- Market Risk: Overall market downturns can negatively impact BARC’s stock price regardless of its performance.

- Competition Risk: Increased competition could erode BARC’s market share and profitability.

- Regulatory Risk: Changes in regulations could negatively impact BARC’s operations.

- Financial Risk: BARC’s financial performance could underperform expectations, leading to a decline in stock price.

- Operational Risk: Unexpected operational disruptions could negatively impact BARC’s business.

Mitigating Strategies: Diversification of investment portfolios, thorough due diligence, and setting realistic expectations can help mitigate these risks. For example, diversification reduces exposure to market downturns, while due diligence helps to understand the company’s strengths and weaknesses.

Risk Assessment Summary: A risk assessment would categorize each risk by severity (high, medium, low) and likelihood (high, medium, low). For instance, market risk might be categorized as high severity and medium likelihood, while competition risk might be medium severity and high likelihood. This assessment would provide a framework for investors to weigh the potential risks and rewards.

Answers to Common Questions

What are the typical trading hours for BARC stock?

Trading hours for BARC stock will depend on the exchange it’s listed on. Check the specific exchange’s website for accurate timings.

Where can I find real-time BARC stock price data?

Real-time data is available through reputable financial websites and brokerage platforms that provide live market quotes.

How frequently are BARC stock prices updated?

Stock prices are typically updated in real-time throughout the trading day, reflecting the most recent transactions.

What are the common ways to invest in BARC stock?

You can typically invest in BARC stock through online brokerage accounts, full-service brokerage firms, or directly through certain exchanges (depending on regulations and your location).