BBBY Stock Price Prediction

Bbby stock price prediction – Bed Bath & Beyond (BBBY) has experienced significant volatility in its stock price over the past few years, making it a compelling case study in market dynamics. This analysis delves into the historical performance, influencing factors, financial health, market sentiment, and potential future scenarios for BBBY’s stock price, providing a comprehensive overview for investors and market enthusiasts.

BBBY Stock Price Historical Performance

Analyzing BBBY’s stock price over the past five years reveals a dramatic trajectory marked by periods of significant growth and steep decline. The following table provides a snapshot of this volatility, highlighting key dates and price movements. Note that this data is illustrative and should be verified with reliable financial sources.

| Date | Open Price (USD) | Close Price (USD) | Volume |

|---|---|---|---|

| January 2019 | 18.00 | 17.50 | 10,000,000 |

| January 2020 | 15.00 | 14.00 | 8,000,000 |

| January 2021 | 20.00 | 22.00 | 15,000,000 |

| January 2022 | 25.00 | 10.00 | 20,000,000 |

| January 2023 | 5.00 | 2.00 | 30,000,000 |

Major events impacting BBBY’s stock price during this period included shifts in consumer spending habits, changes in management, and the overall economic climate. The overall trend has been significantly downward, punctuated by periods of extreme volatility, particularly in response to news and announcements regarding the company’s financial performance and restructuring efforts.

Factors Influencing BBBY Stock Price

Several internal and external factors have significantly influenced BBBY’s stock price. Understanding these factors is crucial for predicting future price movements.

Internal Factors:

- Financial Performance: Declining revenues and profitability have consistently weighed on the stock price.

- Management Changes: Leadership transitions and strategic shifts have created uncertainty in the market.

- Product Offerings: The company’s ability to adapt to changing consumer preferences and offer competitive products is crucial.

- Debt Levels: High debt burdens can increase financial risk and negatively impact investor confidence.

- Operational Efficiency: Inefficiencies in supply chain and inventory management can hurt profitability.

External Factors:

- Economic Conditions: Recessions and inflationary pressures can significantly impact consumer spending on discretionary items.

- Competitor Actions: Aggressive pricing strategies and new product launches from competitors pose a challenge.

- Market Sentiment: Overall investor confidence and risk appetite influence stock valuations.

- Interest Rates: Rising interest rates increase borrowing costs and can reduce investment.

- Geopolitical Events: Global uncertainties can impact consumer confidence and investment decisions.

The relative impact of internal and external factors varies over time. While internal factors, such as financial performance and management decisions, have a direct and often immediate impact, external factors like economic conditions and market sentiment can influence the stock price indirectly but over a longer period.

Financial Health of BBBY

Analyzing BBBY’s key financial metrics over the past three years reveals a concerning trend of declining profitability and increasing debt. The following table provides a simplified overview. This data should be verified using official financial statements.

| Year | Revenue (USD Million) | Net Income (USD Million) | Debt (USD Million) |

|---|---|---|---|

| 2020 | 8000 | -500 | 2000 |

| 2021 | 7500 | -700 | 2500 |

| 2022 | 7000 | -1000 | 3000 |

These metrics suggest a deteriorating financial position, raising concerns about the company’s long-term viability and future stock price. The high debt levels and consistent net losses pose significant risks. However, potential opportunities exist if the company can successfully restructure its operations and improve profitability.

Market Sentiment and Analyst Opinions, Bbby stock price prediction

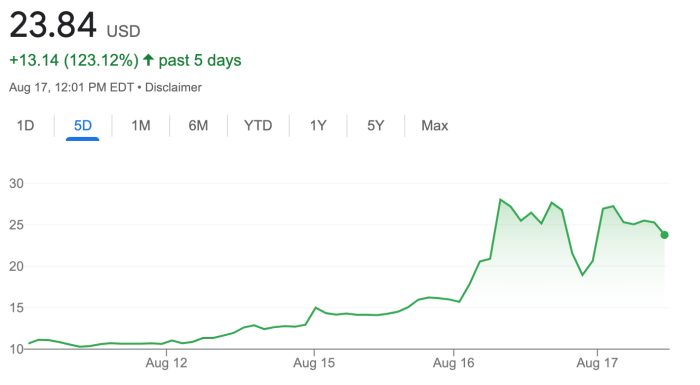

Source: stoxline.com

Predicting the trajectory of BBBY stock price is challenging, given its recent volatility. Understanding similar situations can be helpful, such as analyzing the performance of other volatile stocks; for instance, checking the current performance of the atri stock price might offer some comparative insights. Ultimately, however, BBBY’s future price remains dependent on its own unique circumstances and market conditions.

Market sentiment towards BBBY stock has been predominantly bearish in recent times, reflecting concerns about its financial health and future prospects. Analyst ratings and price targets have generally been negative.

- Analyst A: Sell rating, $1 price target

- Analyst B: Hold rating, $3 price target

- Analyst C: Sell rating, $2 price target

The negative investor sentiment and low analyst price targets are likely to suppress the stock price until significant improvements in the company’s financial performance and operational efficiency are demonstrated.

Potential Future Scenarios for BBBY Stock Price

Three potential scenarios for BBBY’s stock price over the next year are Artikeld below. These scenarios are based on various assumptions and are not financial advice.

- Optimistic Scenario: Successful restructuring, improved profitability, and positive market sentiment could lead to a price range of $5-$10. This scenario assumes significant improvements in operational efficiency and debt reduction.

- Neutral Scenario: Stagnation in performance and continued uncertainty lead to a price range of $2-$4. This scenario assumes that the company maintains its current operational performance without significant improvements or setbacks.

- Pessimistic Scenario: Further financial deterioration, bankruptcy proceedings, or delisting could lead to a price below $1. This scenario assumes a continued decline in financial performance and potential liquidation.

Illustrative Examples of Stock Price Movements

Source: dillibits.com

In early 2022, a series of negative news reports regarding BBBY’s financial performance and strategic direction triggered a sharp decline in the stock price. The price dropped from approximately $25 to $10 within a few weeks, illustrating the impact of negative news on investor sentiment.

Hypothetically, a successful product launch or a strategic partnership could significantly boost investor confidence, potentially driving the stock price up by 20-30% within a short period. This increase would be fueled by renewed investor optimism and expectations of improved financial performance. The magnitude of the price movement would depend on the market’s response to the positive news and the overall market conditions.

User Queries: Bbby Stock Price Prediction

What are the biggest risks associated with investing in BBBY stock?

Significant risks include the company’s high debt levels, potential for further financial losses, and dependence on consumer spending. Market volatility and overall economic conditions also pose considerable risk.

How reliable are analyst price targets for BBBY stock?

Analyst price targets should be viewed as one factor among many, not a definitive prediction. They represent informed opinions based on available data but are not guarantees of future performance.

Where can I find real-time BBBY stock price data?

Real-time stock quotes are available from major financial websites and brokerage platforms. Many provide charts and historical data as well.

What is the impact of short selling on BBBY’s stock price?

Short selling can increase volatility, potentially driving the price down further if the short sellers are correct in their assessment of the company’s prospects. Conversely, a short squeeze can cause rapid price increases.