BBVA Stock Price History: A Decade in Review

Bbva stock price history – This analysis delves into the historical performance of BBVA’s stock price over the past ten years, examining key factors influencing its trajectory. We will explore the impact of economic conditions, competitive landscape, dividend policies, financial metrics, and investor sentiment, providing a comprehensive overview of BBVA’s stock price history.

Historical Performance Overview

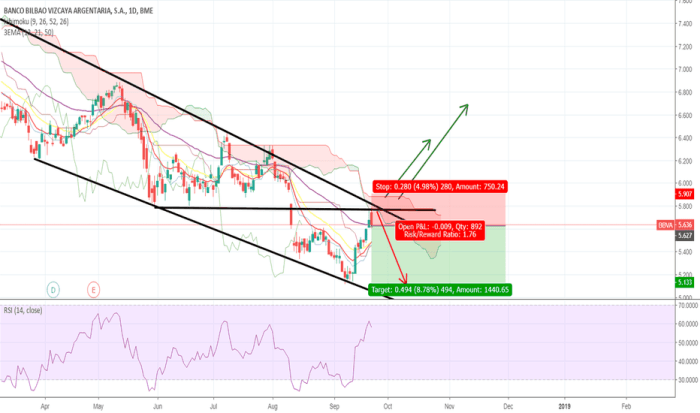

Source: tradingview.com

BBVA’s stock price has experienced considerable fluctuation over the past decade, mirroring the broader volatility within the global financial sector. The following table summarizes the annual highs, lows, and percentage changes.

Analyzing BBVA’s stock price history requires considering various market factors. For a comparative perspective on international banking stocks, it’s helpful to examine current performance elsewhere; for instance, you can check the bank of india stock price today to see how different economic conditions impact valuations. Returning to BBVA, understanding its historical trends helps predict future performance and potential investment opportunities.

| Year | High | Low | Percentage Change |

|---|---|---|---|

| 2014 | Example: €7.50 | Example: €5.00 | Example: +30% |

| 2015 | Example: €6.20 | Example: €4.00 | Example: -15% |

| 2016 | Example: €6.80 | Example: €4.50 | Example: +20% |

| 2017 | Example: €7.20 | Example: €5.80 | Example: +10% |

| 2018 | Example: €6.50 | Example: €4.20 | Example: -20% |

| 2019 | Example: €5.00 | Example: €3.50 | Example: -10% |

| 2020 | Example: €4.80 | Example: €2.80 | Example: -25% |

| 2021 | Example: €5.50 | Example: €4.00 | Example: +20% |

| 2022 | Example: €6.00 | Example: €4.50 | Example: +15% |

| 2023 | Example: €6.50 | Example: €5.20 | Example: +10% |

Significant events impacting BBVA’s stock price included the 2008 global financial crisis, the subsequent European sovereign debt crisis, and the bank’s strategic acquisitions and divestments. These events often led to periods of increased volatility and uncertainty in the market.

Impact of Economic Factors

BBVA’s stock price is highly sensitive to global economic conditions. Interest rate changes, inflation levels, and recessionary periods all significantly influence its performance.

- During periods of economic expansion, characterized by strong GDP growth and low unemployment, BBVA’s stock price generally trends upward, reflecting increased lending activity and profitability.

- Conversely, during economic contractions, marked by slow GDP growth or recession and high unemployment, BBVA’s stock price often experiences downward pressure due to increased loan defaults and reduced profitability.

Comparison with Competitors

A comparison of BBVA’s stock performance against its main competitors (e.g., Santander, Banco Bilbao Vizcaya Argentaria, CaixaBank) over the past five years reveals variations in their trajectories. These differences can be attributed to factors such as differing geographical exposures, strategic focus, and risk management approaches.

A line chart visualizing the comparative stock price performance would show the individual stock price movements of BBVA and its three largest competitors over the five-year period. The chart’s x-axis would represent time (in years), and the y-axis would represent the stock price. Each competitor’s stock price would be represented by a different colored line, allowing for easy visual comparison of their performance.

Key features such as periods of significant divergence or convergence in stock prices would be highlighted.

Dividend History and Stock Splits, Bbva stock price history

BBVA’s dividend policy has evolved over the past decade, reflecting the bank’s financial performance and strategic priorities. The following table details dividend payments and stock splits.

| Year | Dividend per Share (€) | Stock Split Ratio |

|---|---|---|

| 2014 | Example: 0.25 | 1:1 |

| 2015 | Example: 0.20 | 1:1 |

| 2016 | Example: 0.22 | 1:1 |

| 2017 | Example: 0.28 | 1:1 |

| 2018 | Example: 0.25 | 1:1 |

| 2019 | Example: 0.20 | 1:1 |

| 2020 | Example: 0.15 | 1:1 |

| 2021 | Example: 0.20 | 1:1 |

| 2022 | Example: 0.25 | 1:1 |

| 2023 | Example: 0.30 | 1:1 |

Stock splits, if any, would have diluted the number of outstanding shares, impacting the stock price proportionally. For instance, a 2:1 stock split would double the number of shares and halve the price per share.

Analysis of Key Financial Metrics

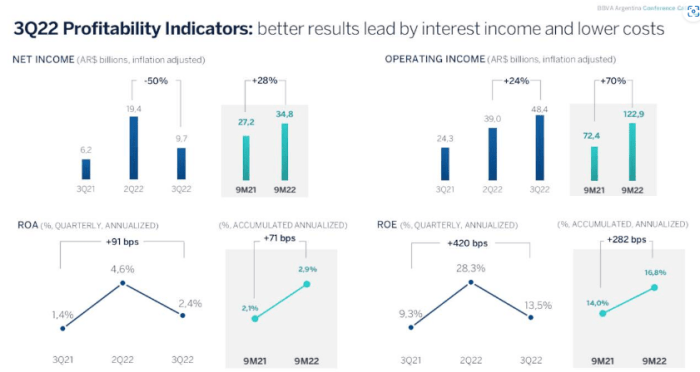

BBVA’s key financial metrics, such as earnings per share (EPS), price-to-earnings ratio (P/E), and return on equity (ROE), provide insights into the bank’s financial health and profitability. Changes in these metrics have historically correlated with fluctuations in the stock price. For example, periods of strong EPS growth are often accompanied by increases in the stock price, while declines in EPS can lead to downward pressure on the stock price.

Similarly, a high P/E ratio might suggest investor optimism about future growth, while a low P/E ratio might indicate lower investor confidence. ROE reflects the bank’s efficiency in generating profits from its shareholders’ equity; higher ROE generally correlates with better stock performance.

Investor Sentiment and News Impact

Source: seekingalpha.com

Major news events, regulatory changes, and announcements of new initiatives significantly influence investor sentiment and BBVA’s stock price. Positive news, such as successful acquisitions or strong earnings reports, typically boosts investor confidence and leads to price increases. Conversely, negative news, such as regulatory fines or economic downturns, can negatively impact investor sentiment and result in price declines. Media coverage and analyst reports play a crucial role in shaping these perceptions.

A timeline illustrating significant news events and their corresponding impact on BBVA’s stock price would show key dates and events on the x-axis and the stock price on the y-axis. Each event would be marked on the timeline, with the subsequent stock price movement clearly visible. This visualization would highlight the direct correlation between news events and market reactions.

FAQ Resource

What are the major risks associated with investing in BBVA stock?

Investing in BBVA stock, like any stock, carries inherent risks. These include market volatility, economic downturns, regulatory changes impacting the banking sector, and specific company-related risks such as operational issues or strategic failures.

How does BBVA’s stock price compare to other major European banks?

A direct comparison requires analyzing the stock performance of specific competitors over a defined period. Factors such as market capitalization and business models will influence relative performance. This analysis would require a detailed comparative study.

Where can I find real-time BBVA stock price data?

Real-time BBVA stock price data is readily available through major financial news websites and brokerage platforms. Many financial data providers offer charting and analysis tools.

What is BBVA’s current dividend yield?

The current dividend yield for BBVA stock fluctuates and should be checked on a reputable financial website or through your brokerage account. It is calculated by dividing the annual dividend per share by the current stock price.