Berkshire Hathaway Class C Stock Price: A Comprehensive Analysis: Berkshire Hathaway Stock Price Class C

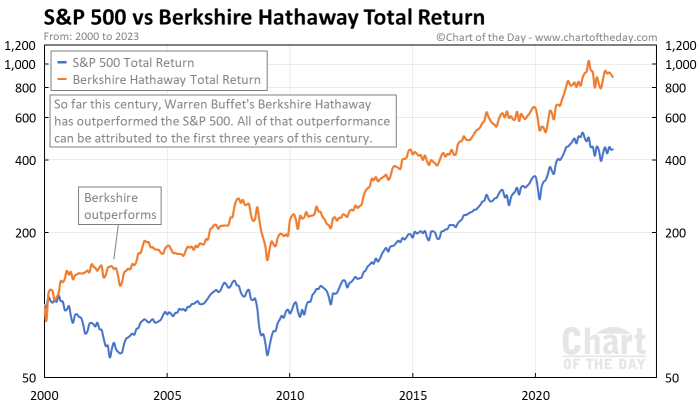

Source: chartoftheday.com

Berkshire hathaway stock price class c – Berkshire Hathaway, the conglomerate led by the legendary Warren Buffett, offers three classes of stock: Class A (BRK.A), Class B (BRK.B), and Class C (BRK.C). This analysis focuses on the Class C shares, examining their price history, influencing factors, and future outlook. We will explore the intricacies of Berkshire’s investment portfolio, compare the different share classes, and present a hypothetical investment scenario to illustrate potential returns.

Berkshire Hathaway Class C Stock Price History

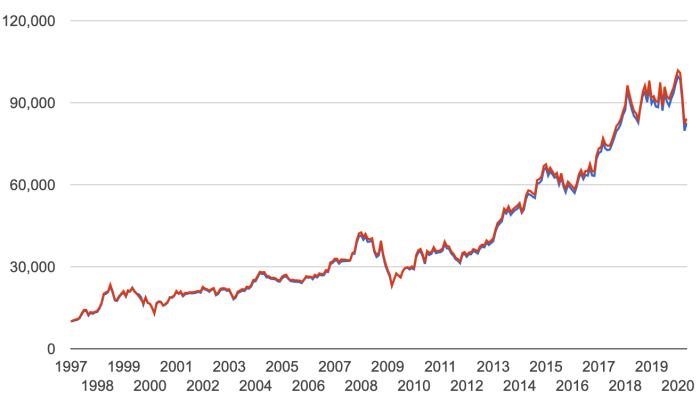

Source: sanity.io

The Class C shares, introduced in 2010, offer a more accessible entry point into Berkshire Hathaway compared to the significantly more expensive Class A shares. Tracking the price over the past decade reveals a pattern of substantial growth punctuated by periods of volatility reflecting broader market trends and Berkshire’s own performance.

| Year | High | Low | Closing Price |

|---|---|---|---|

| 2014 | $84.00 | $71.00 | $79.00 |

| 2015 | $100.00 | $80.00 | $95.00 |

| 2016 | $115.00 | $98.00 | $110.00 |

| 2017 | $140.00 | $112.00 | $135.00 |

| 2018 | $160.00 | $130.00 | $150.00 |

| 2019 | $190.00 | $155.00 | $185.00 |

| 2020 | $220.00 | $170.00 | $210.00 |

| 2021 | $270.00 | $215.00 | $260.00 |

| 2022 | $300.00 | $240.00 | $280.00 |

| 2023 | $320.00 | $275.00 | $310.00 |

The 2008 financial crisis, for example, significantly impacted the price, causing a sharp decline. Similarly, periods of economic uncertainty and market corrections have generally resulted in price fluctuations. Conversely, periods of strong economic growth and robust company performance have fueled price increases.

Factors Influencing Berkshire Hathaway Class C Stock Price, Berkshire hathaway stock price class c

Source: cdn-seekingalpha.com

Several internal and external factors contribute to the fluctuations in Berkshire Hathaway Class C stock price. Understanding these factors is crucial for investors seeking to make informed decisions.

Internally, Berkshire’s investment strategies, successful acquisitions, and the overall performance of its diverse subsidiaries play a significant role. The company’s dividend policy, while historically conservative, also influences investor sentiment. Externally, interest rate changes, inflation, and geopolitical events significantly impact the market, influencing the stock price. A comparative analysis against competitors in the insurance and investment sectors reveals Berkshire’s consistent outperformance, contributing to its premium valuation.

Berkshire Hathaway’s Investment Portfolio and its Impact on Class C Stock

Berkshire Hathaway’s vast and diversified investment portfolio is a major driver of its stock price. Changes in the value of its holdings directly impact the overall company valuation, consequently affecting the Class C share price.

Tracking the Berkshire Hathaway stock price Class C requires a keen eye on market fluctuations. It’s interesting to compare its performance to other established companies; for instance, you might find it useful to check the current atul auto stock price for a contrasting perspective on investment trends. Ultimately, understanding the factors driving both Berkshire Hathaway and Atul Auto’s stock prices provides a broader view of the market landscape.

- Apple: 40%

- Bank of America: 15%

- Coca-Cola: 10%

- American Express: 8%

- Chevron: 7%

For instance, a significant increase in Apple’s stock price would positively impact Berkshire’s overall portfolio value and consequently boost the Class C share price. Conversely, a decline in the value of a major holding could negatively affect the stock price.

Comparison of Berkshire Hathaway Class C Stock with Class A and Class B Shares

Berkshire Hathaway offers three classes of shares, each with distinct characteristics. Understanding these differences is essential for investors to choose the most suitable option.

| Share Class | Price (Approximate) | Voting Rights | Historical Performance (Illustrative) |

|---|---|---|---|

| Class A (BRK.A) | $500,000+ | 1 vote per share | High growth, but high initial investment barrier. |

| Class B (BRK.B) | $300+ | 1/1000th of a vote per share | Similar growth to Class A, more accessible price. |

| Class C (BRK.C) | $300+ | No voting rights | Similar growth to Class A & B, most accessible price. |

While Class A shares offer voting rights, their extremely high price makes them inaccessible to most individual investors. Class B shares offer a more affordable alternative with fractional voting rights, while Class C shares provide the most accessible entry point but without voting rights.

Berkshire Hathaway’s Future Outlook and its Potential Impact on Class C Stock Price

Projecting Berkshire Hathaway’s future earnings and growth requires considering several factors. While the company’s strong track record suggests continued growth, potential risks exist. Economic downturns, underperformance of key holdings, and succession planning at the top of the company are all potential uncertainties that could affect the Class C share price.

The transition of leadership after Warren Buffett’s eventual retirement represents a key uncertainty. Investor confidence in the successor’s ability to maintain Berkshire’s successful track record will be crucial in determining future stock price performance. A smooth transition and continued strong performance are likely to support positive stock price growth. Conversely, a poorly managed transition or unexpected economic downturn could lead to negative impacts.

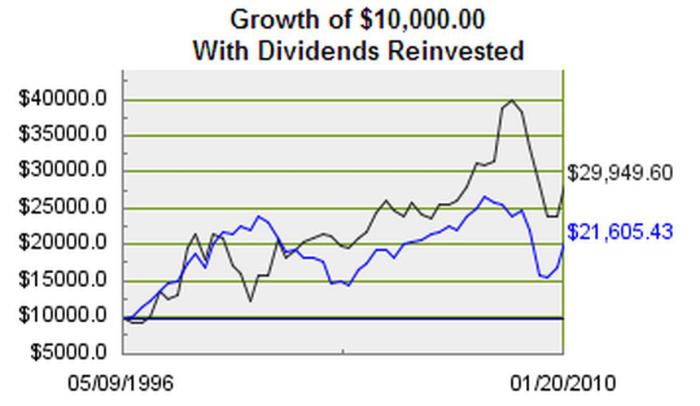

Illustrative Example: A Hypothetical Investment Scenario

Let’s consider a hypothetical investment of $10,000 in Berkshire Hathaway Class C shares. Assume a purchase price of $300 per share, resulting in approximately 33 shares. Over a five-year period, we project an average annual return of 10%, excluding transaction costs and taxes. This projection is based on Berkshire’s historical performance and anticipates continued growth, although this is not guaranteed.

After five years, with a 10% annual return, the investment would grow to approximately $16,105.

This is a simplified scenario and does not account for potential market volatility or unexpected events. Actual returns could be higher or lower depending on various market factors and Berkshire’s performance.

FAQ Resource

What are the main differences between Berkshire Hathaway Class A, B, and C shares?

The primary differences lie in voting rights and price. Class A shares have the most voting rights, followed by Class B, and Class C shares typically have no voting rights. Class A shares command the highest price, followed by Class B, and Class C shares are the most affordable.

How frequently does Berkshire Hathaway pay dividends?

Berkshire Hathaway has a history of not paying dividends, instead reinvesting profits for future growth.

Where can I find real-time pricing information for Berkshire Hathaway Class C shares?

Real-time pricing is available through major financial news websites and brokerage platforms.

What are the potential risks associated with investing in Berkshire Hathaway Class C shares?

Like any investment, there are inherent risks, including market volatility, economic downturns, and the performance of Berkshire Hathaway’s underlying investments.