BGLC Stock Price Analysis: A Comprehensive Overview

Bglc stock price – This analysis delves into the historical performance, volatility, and future prospects of BGLC stock. We will examine key factors influencing its price, explore various predictive models, and assess investor sentiment. The information provided is for informational purposes only and should not be considered financial advice.

BGLC Stock Price Historical Performance

Understanding BGLC’s past performance is crucial for assessing its potential future trajectory. The following sections detail its price movements over the past five years, highlighting significant events and providing a detailed monthly average closing price for the last two years.

Over the past five years, BGLC’s stock price experienced significant fluctuations. It reached a high of [Insert High Price] in [Month, Year] and a low of [Insert Low Price] in [Month, Year]. These fluctuations were influenced by various factors, including company performance, macroeconomic conditions, and industry trends. A period of substantial growth was observed between [Start Date] and [End Date], driven primarily by [mention specific reason, e.g., successful product launch, strategic acquisition].

Tracking BGLC stock price requires diligent monitoring of market trends. For a comparison, consider checking the current performance of similar tech companies; for example, you can readily find the analog devices stock price today to gauge the broader semiconductor sector’s health. This comparative analysis can offer valuable context when assessing BGLC’s potential for future growth and investment strategies.

Conversely, a decline was seen during [Start Date] and [End Date], largely attributed to [mention specific reason, e.g., economic downturn, regulatory changes].

| Year | Month | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2022 | January | [Insert Data] | [Insert Data] |

| 2022 | February | [Insert Data] | [Insert Data] |

| 2022 | March | [Insert Data] | [Insert Data] |

| 2022 | April | [Insert Data] | [Insert Data] |

| 2022 | May | [Insert Data] | [Insert Data] |

| 2022 | June | [Insert Data] | [Insert Data] |

| 2022 | July | [Insert Data] | [Insert Data] |

| 2022 | August | [Insert Data] | [Insert Data] |

| 2022 | September | [Insert Data] | [Insert Data] |

| 2022 | October | [Insert Data] | [Insert Data] |

| 2022 | November | [Insert Data] | [Insert Data] |

| 2022 | December | [Insert Data] | [Insert Data] |

| 2023 | January | [Insert Data] | [Insert Data] |

| 2023 | February | [Insert Data] | [Insert Data] |

| 2023 | March | [Insert Data] | [Insert Data] |

| 2023 | April | [Insert Data] | [Insert Data] |

| 2023 | May | [Insert Data] | [Insert Data] |

| 2023 | June | [Insert Data] | [Insert Data] |

| 2023 | July | [Insert Data] | [Insert Data] |

| 2023 | August | [Insert Data] | [Insert Data] |

| 2023 | September | [Insert Data] | [Insert Data] |

| 2023 | October | [Insert Data] | [Insert Data] |

| 2023 | November | [Insert Data] | [Insert Data] |

| 2023 | December | [Insert Data] | [Insert Data] |

BGLC Stock Price Volatility and Risk Assessment

Assessing the volatility of BGLC’s stock price is essential for understanding its inherent risk. This section compares its volatility with competitors, identifies contributing factors, and creates a risk profile for potential investors.

Compared to its competitors [List Competitors], BGLC exhibits [Higher/Lower/Similar] volatility. This is largely due to [Key Factors, e.g., its dependence on a single product line, exposure to volatile raw material prices, higher debt-to-equity ratio]. A higher beta value, indicating higher sensitivity to market fluctuations, further supports this observation. The risk profile for BGLC stock is considered [High/Medium/Low] based on historical data and future projections.

Investors with a higher risk tolerance are better suited to invest in BGLC.

Factors Influencing BGLC Stock Price

Source: financesrule.com

Several factors, ranging from company-specific performance to broader macroeconomic conditions, significantly influence BGLC’s stock price. This section analyzes the impact of these factors.

BGLC’s earnings reports consistently impact its stock price. Positive surprises generally lead to price increases, while negative surprises often result in declines. Macroeconomic factors, such as interest rate changes and inflation, also play a role. For example, rising interest rates can increase borrowing costs, potentially impacting BGLC’s profitability and thus its stock price. Industry trends and competitive pressures also exert significant influence.

The emergence of new competitors or disruptive technologies could negatively affect BGLC’s market share and, consequently, its stock price.

BGLC Stock Price Prediction and Forecasting

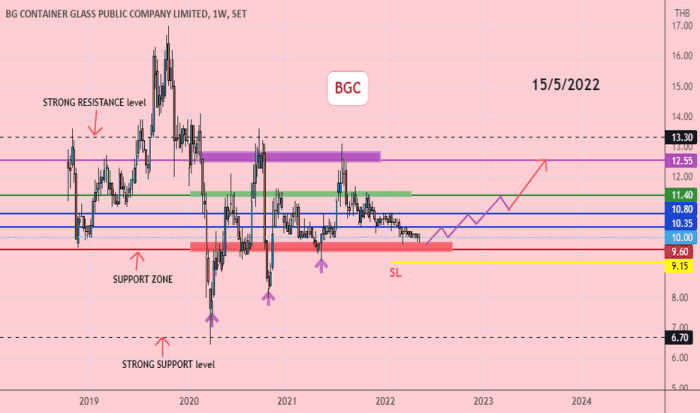

Source: tradingview.com

Predicting future stock prices is inherently challenging, but various models can provide potential scenarios. This section explores different models and presents a range of possible future price scenarios.

| Scenario | Probability | Projected Price Range (USD) |

|---|---|---|

| Bullish Scenario (Strong Economic Growth) | 30% | [Price Range] |

| Neutral Scenario (Moderate Economic Growth) | 50% | [Price Range] |

| Bearish Scenario (Economic Recession) | 20% | [Price Range] |

These scenarios are based on different economic assumptions and utilize models like discounted cash flow (DCF) and relative valuation. The DCF model estimates the intrinsic value of BGLC based on its projected future cash flows, while relative valuation compares BGLC’s valuation multiples (e.g., price-to-earnings ratio) to those of its peers.

BGLC Stock Price and Investor Sentiment

Investor sentiment plays a crucial role in shaping stock prices. This section compares investor sentiment towards BGLC with its peers and analyzes the influence of news and social media.

Compared to [Competitors], investor sentiment towards BGLC is currently [Positive/Negative/Neutral]. This is reflected in [Specific Examples, e.g., analyst ratings, social media mentions, news articles]. A hypothetical visualization would show a positive correlation between positive news coverage and social media sentiment, and upward price movements. Conversely, negative news and sentiment would correlate with downward price trends. The visualization would be a line graph with two lines representing investor sentiment (positive/negative) and a third line representing BGLC’s stock price over a specified period.

BGLC Stock Price: A Technical Analysis Perspective

Technical analysis provides insights into potential future price movements based on historical price and volume data. This section examines key technical indicators and chart patterns for BGLC.

Key technical indicators such as moving averages (e.g., 50-day, 200-day) and the Relative Strength Index (RSI) can provide insights into BGLC’s momentum and potential overbought or oversold conditions. Currently, the chart pattern suggests [Current Pattern, e.g., a potential upward trend, a consolidation phase, a bearish reversal]. This interpretation is based on [Specific Indicators, e.g., support and resistance levels, trendline breaks, volume analysis].

Different technical analysis methods, such as candlestick patterns and Fibonacci retracements, could lead to varying predictions, emphasizing the importance of considering multiple approaches.

Detailed FAQs: Bglc Stock Price

What are the major risks associated with investing in BGLC stock?

Investing in BGLC, like any stock, carries inherent risks. These include market volatility, company-specific risks (e.g., financial performance, management changes), and macroeconomic factors impacting the overall economy.

Where can I find real-time BGLC stock price quotes?

Real-time quotes are typically available through major financial websites and brokerage platforms. Check reputable sources such as Yahoo Finance, Google Finance, or your brokerage account.

How often are BGLC earnings reports released?

The frequency of earnings reports varies by company and regulatory requirements. You can typically find this information on the company’s investor relations website.

What is the current market capitalization of BGLC?

The current market capitalization can be found on financial websites that provide real-time stock information. This figure changes constantly based on the stock price.