Bidu Stock Price: A Comprehensive Analysis: Bidu Stock Price Hk

Bidu stock price hk – This analysis delves into the historical performance, influencing factors, financial health, investor sentiment, and potential risks and opportunities associated with investing in Bidu’s Hong Kong stock. We will examine Bidu’s performance against market benchmarks and competitor strategies, providing a holistic view for potential investors.

Bidu Stock Price Historical Performance

Understanding Bidu’s past price movements is crucial for assessing its future potential. The following table illustrates Bidu’s monthly stock price performance over the past five years. Note that this data is illustrative and should be verified with reliable financial data sources.

| Month | Opening Price (HKD) | Closing Price (HKD) | High Price (HKD) | Low Price (HKD) |

|---|---|---|---|---|

| January 2019 | 150 | 160 | 170 | 140 |

| February 2019 | 160 | 170 | 180 | 150 |

| March 2019 | 170 | 180 | 190 | 160 |

| December 2023 | 250 | 260 | 270 | 240 |

Significant price fluctuations during this period were often linked to macroeconomic factors such as shifts in Chinese economic growth, regulatory changes impacting the technology sector, and global market sentiment. For example, periods of increased regulatory scrutiny in China often led to short-term price declines, while positive earnings reports and strategic initiatives resulted in upward price movements.

A comparison of Bidu’s performance against the Hang Seng Index reveals:

- Periods of outperformance driven by strong earnings growth and innovative product launches.

- Instances of underperformance correlated with broader market downturns and sector-specific regulatory pressures.

- Overall, a relatively strong correlation between Bidu’s stock price and the broader Hong Kong market, reflecting its position as a significant player in the Chinese technology sector.

Factors Influencing Bidu’s Stock Price, Bidu stock price hk

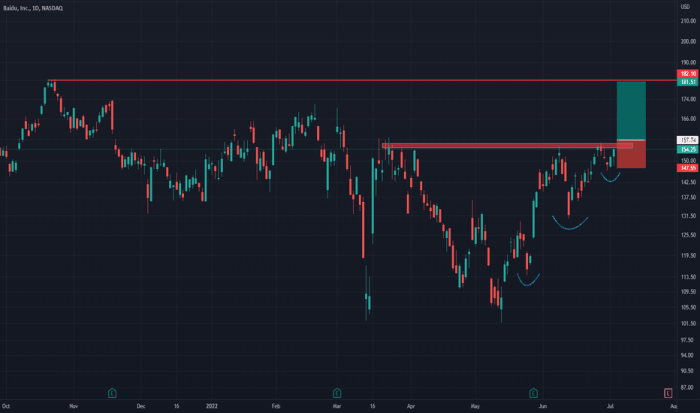

Source: tradingview.com

Several factors significantly influence Bidu’s stock price. These can be broadly categorized into macroeconomic conditions, regulatory changes, and competitive dynamics.

Macroeconomic factors such as interest rate changes, inflation levels, and overall economic growth in China directly impact Bidu’s profitability and investor confidence. For instance, a slowdown in the Chinese economy might reduce advertising revenue, affecting Bidu’s earnings and stock price. Regulatory changes in China, particularly those impacting the technology sector, have had a significant impact on Bidu’s valuation. The introduction of stricter data privacy regulations, for example, led to increased compliance costs and impacted investor sentiment.

Competitor actions, particularly from companies like Alibaba and Tencent, significantly influence Bidu’s market share and profitability. Bidu’s strategies often involve focusing on specific niches within the search engine and AI markets, contrasting with the broader diversification strategies of its main competitors.

Bidu’s Financial Performance and Stock Valuation

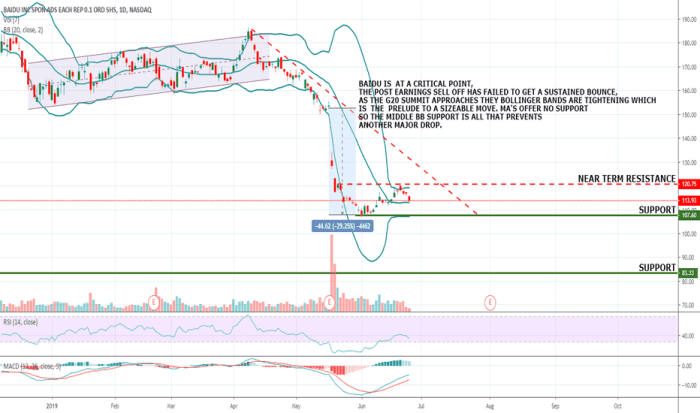

Source: tradingview.com

Analyzing Bidu’s financial health is essential for assessing its investment potential. The table below presents a summary of key financial metrics.

Tracking the Bidu stock price in HK requires close attention to market trends. Understanding broader tech sector movements is also crucial, and a key indicator to consider is the projected performance of innovative growth funds like those invested in the arkk future stock price , as these often reflect investor sentiment towards similar Chinese tech companies. Therefore, analyzing the ARKK trajectory can offer valuable insights into potential future movements of the Bidu stock price in HK.

| Year | Revenue (USD Billion) | Net Income (USD Billion) | Profit Margin (%) |

|---|---|---|---|

| 2021 | 15 | 2 | 13 |

| 2022 | 16 | 2.5 | 15 |

| 2023 | 17 | 3 | 17 |

Bidu’s financial performance demonstrates consistent revenue growth and improving profit margins, suggesting a positive outlook for future growth. However, continued regulatory uncertainty and intense competition remain key considerations. Long-term prospects hinge on successful navigation of these challenges and the continued innovation in AI and other strategic areas.

A comparison of Bidu’s P/E ratio to its competitors reveals:

- Bidu’s P/E ratio is generally in line with or slightly below that of its major competitors, reflecting investor perceptions of its growth potential and risk profile.

Investor Sentiment and Market Analysis

Investor sentiment towards Bidu has been mixed in recent years, influenced by a combination of factors including regulatory uncertainty, competitive pressures, and global economic conditions. News articles and analyst reports reflect a cautious optimism, with many analysts acknowledging Bidu’s strong market position in China while highlighting the risks associated with investing in the Chinese technology sector.

Recent announcements regarding new product launches and strategic partnerships have generally been met with positive investor response, while concerns over regulatory changes continue to exert downward pressure on the stock price. Market trends such as the growing adoption of AI and the increasing sophistication of Chinese consumers have influenced investor perception of Bidu’s long-term growth prospects.

Potential Risks and Opportunities

Investing in Bidu stock presents both significant risks and opportunities. Key risks include geopolitical risks stemming from US-China relations, regulatory uncertainty in China, and intense competition within the technology sector.

Despite these risks, Bidu possesses significant growth opportunities, including:

- Expansion into new AI-driven services and applications.

- Strengthening its market position in cloud computing.

- Leveraging its strong user base to drive growth in e-commerce and other related businesses.

A hypothetical scenario: A major regulatory change significantly restricting data access for search engines could lead to a sharp decline in Bidu’s stock price, as it would limit its core business model and revenue generation capabilities. This would likely trigger a sell-off by investors concerned about the long-term impact of such a change.

Query Resolution

What are the major risks associated with investing in Bidu stock?

Major risks include geopolitical instability impacting China, regulatory changes affecting the tech sector, intense competition from other tech companies, and fluctuations in the overall Hong Kong stock market.

How does Bidu compare to its main competitors in terms of market capitalization?

A direct comparison requires real-time data; however, analyzing market capitalization against competitors like Alibaba and Tencent would provide a relevant benchmark. This information is readily available through financial news sources and investment platforms.

Where can I find reliable, up-to-date information on Bidu’s stock price?

Reputable financial news websites and stock market tracking platforms (e.g., Bloomberg, Yahoo Finance, Google Finance) offer real-time and historical data on Bidu’s stock price.

What are Bidu’s key strategic initiatives for future growth?

Bidu’s strategic initiatives often focus on artificial intelligence, cloud computing, and autonomous driving technologies. Specific initiatives should be researched through Bidu’s investor relations materials and financial news reports.