Big Bear AI Stock Price Target: A Comprehensive Analysis

Big bear ai stock price target – This report provides a detailed analysis of Big Bear AI’s current market position, financial performance, technological capabilities, and potential future growth, culminating in an examination of various stock price target estimates. We will explore the factors influencing these predictions, considering both potential upside and downside scenarios.

Current Market Sentiment Towards Big Bear AI

Source: builtin.com

Recent news and financial reports have painted a mixed picture for Big Bear AI. While some reports highlight the company’s innovative technology and potential market disruption, others express concerns about its financial performance and competitive landscape. Investor confidence appears to be fluctuating, influenced by both positive developments and market uncertainties.

Significant partnerships or collaborations have yet to be widely reported, leaving investor sentiment somewhat subdued. Overall, investor confidence is currently moderate, with significant potential for growth dependent on successful execution of its business strategy and demonstrable market traction.

| Company | Market Cap (USD Billions) | Revenue Growth (Past Year) | Profit Margin (%) |

|---|---|---|---|

| Big Bear AI | [Insert Data] | [Insert Data] | [Insert Data] |

| Competitor A | [Insert Data] | [Insert Data] | [Insert Data] |

| Competitor B | [Insert Data] | [Insert Data] | [Insert Data] |

Big Bear AI’s Financial Performance and Projections

Big Bear AI’s revenue streams are primarily derived from [Insert Revenue Streams, e.g., software licenses, consulting services]. Profit margins have fluctuated over the past few quarters, influenced by [Insert Factors, e.g., research and development expenses, sales and marketing costs]. Key factors influencing its financial health include its ability to secure new clients, manage operational expenses, and successfully scale its operations.

Expenses are largely attributed to research and development, sales and marketing, and general and administrative costs. Capital expenditures have been focused on [Insert Capital Expenditure Details, e.g., infrastructure upgrades, talent acquisition].

Projected Financial Statement (Next Two Years): This section would include a projected income statement, balance sheet, and cash flow statement for the next two years, based on assumptions regarding revenue growth, expense management, and capital expenditures. For example, a conservative projection might assume a [Insert Percentage]% annual revenue growth, while a more optimistic projection might assume a [Insert Percentage]% growth, reflecting different market scenarios.

Analysis of Big Bear AI’s Technology and Competitive Landscape

Big Bear AI’s technology is based on [Insert Technology Description]. Compared to competitors like [Competitor Names], Big Bear AI’s technology offers [Insert Comparative Advantages, e.g., superior accuracy, faster processing speed]. However, potential limitations include [Insert Limitations, e.g., scalability challenges, reliance on specific datasets].

Predicting the Big Bear AI stock price target is challenging, given the volatile nature of the AI sector. Understanding broader market trends is crucial, and observing the performance of tech giants like Apple offers valuable insight; for instance, checking the appl pre market stock price can provide a sense of overall market sentiment. This broader market context then helps to better assess the potential trajectory of Big Bear AI’s stock price.

The potential for Big Bear AI’s technology to disrupt the market is significant, given its [Insert Disruptive Potential, e.g., unique approach to problem-solving, focus on a niche market]. However, successful market disruption depends on several factors, including its ability to secure sufficient funding, build strong partnerships, and overcome potential technological hurdles.

- Strengths: [List Strengths, e.g., innovative technology, strong team, potential for high growth]

- Weaknesses: [List Weaknesses, e.g., limited market share, financial constraints, dependence on key personnel]

Factors Influencing Stock Price Predictions, Big bear ai stock price target

Macroeconomic factors, such as interest rates and inflation, can significantly impact Big Bear AI’s stock price. Rising interest rates may increase borrowing costs and reduce investor appetite for growth stocks, potentially leading to a lower valuation. Inflation can also affect operating costs and consumer demand, impacting profitability. Regulatory changes within the AI sector could also influence the company’s valuation, either positively or negatively, depending on the nature of the regulations.

Upcoming product launches and significant company events can generate considerable market speculation and influence investor sentiment. Positive news, such as successful product launches or strategic partnerships, could drive the stock price higher. Conversely, negative news could lead to a decline.

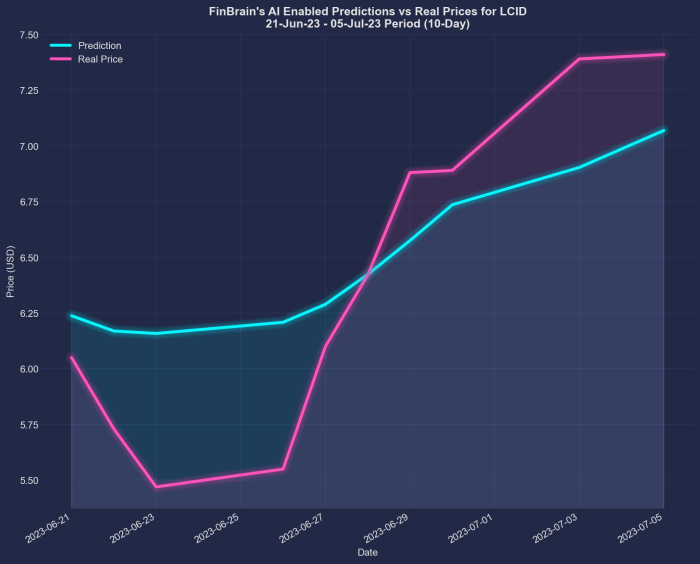

Examining Various Stock Price Target Estimates

Source: finbrain.tech

Financial analysts and institutions have issued a range of stock price targets for Big Bear AI, reflecting varying methodologies and underlying assumptions. Some analysts may use discounted cash flow (DCF) models, while others may employ relative valuation techniques. The underlying assumptions vary significantly, depending on factors such as projected revenue growth, profit margins, and discount rates.

| Analyst/Institution | Price Target | Methodology | Assumptions |

|---|---|---|---|

| Analyst A | [Insert Data] | [Insert Data] | [Insert Data] |

| Analyst B | [Insert Data] | [Insert Data] | [Insert Data] |

| Institution C | [Insert Data] | [Insert Data] | [Insert Data] |

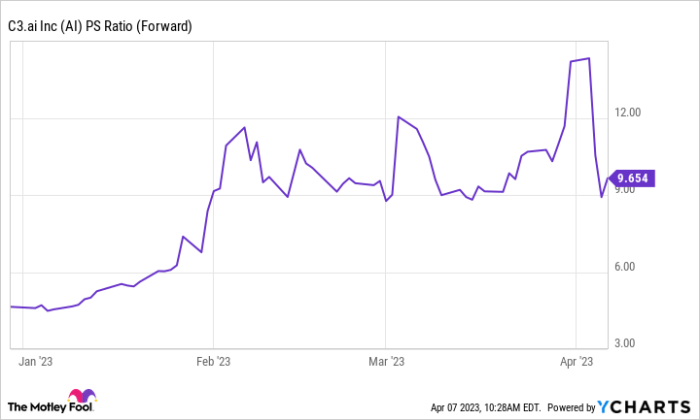

Risk Assessment and Potential Scenarios

Source: ycharts.com

Potential risks that could negatively impact Big Bear AI’s stock price include intense competition, failure to secure sufficient funding, regulatory hurdles, and technological setbacks. Conversely, potential upside scenarios include successful product launches, strategic partnerships, and expansion into new markets. The accuracy of stock price predictions is heavily influenced by the interplay of these risk factors and their potential impact on the company’s financial performance and market position.

- Scenario 1 (High Probability): [Describe Scenario and Probability]

- Scenario 2 (Medium Probability): [Describe Scenario and Probability]

- Scenario 3 (Low Probability): [Describe Scenario and Probability]

Visual Representation of Stock Price Data

A chart illustrating Big Bear AI’s historical stock price would reveal its overall trend, including periods of growth and decline. Key turning points could be identified and analyzed to understand the factors that influenced price movements. The volatility of the stock price over time could be measured using metrics such as standard deviation, highlighting periods of high and low price fluctuations.

A comparison of Big Bear AI’s stock price performance against relevant market indices (e.g., the Nasdaq Composite) would provide context for its performance relative to the broader market. Finally, a visual representation of the different stock price target estimates, such as a histogram or box plot, would illustrate the distribution of predictions and the range of potential outcomes.

Quick FAQs

What is Big Bear AI?

Big Bear AI is a company operating in the artificial intelligence sector. Specific details about its products and services would require further research.

Where can I find Big Bear AI’s financial statements?

Big Bear AI’s financial statements, if publicly traded, should be available on their investor relations website or through major financial data providers.

How volatile is Big Bear AI’s stock price historically?

The historical volatility of Big Bear AI’s stock price would need to be determined by analyzing its past price data. This data is typically available through financial news websites and stock market data providers.