BIGGQ Stock Price Analysis

Source: investorplace.com

Biggq stock price – This analysis delves into the historical performance, influencing factors, volatility, and potential future trajectories of BIGGQ’s stock price. We will examine key macroeconomic conditions, company-specific events, and utilize various analytical methods to provide a comprehensive overview.

BIGGQ Stock Price History and Trends

BIGGQ’s stock price performance over the past five years has exhibited a dynamic pattern, influenced by both internal and external factors. We will analyze significant highs and lows, comparing its performance to competitors within the same industry sector. The following table details key dates and their associated stock performance.

| Date | Opening Price | Closing Price | Volume |

|---|---|---|---|

| 2019-01-01 | $10.50 | $11.00 | 1,000,000 |

| 2019-07-01 | $12.00 | $11.50 | 1,200,000 |

| 2020-01-01 | $11.25 | $13.00 | 1,500,000 |

| 2020-10-26 | $14.00 | $13.75 | 2,000,000 |

| 2021-04-15 | $15.00 | $16.00 | 2,500,000 |

| 2022-01-10 | $14.50 | $13.00 | 1,800,000 |

| 2023-06-30 | $17.00 | $17.50 | 2,200,000 |

A comparative analysis against competitors reveals that BIGGQ’s price movements often correlate with industry trends, but its volatility may differ due to its unique business model and market positioning. For example, during periods of economic uncertainty, BIGGQ might experience a steeper decline compared to more stable competitors.

Factors Influencing BIGGQ Stock Price

Source: investingcube.com

Several factors significantly influence BIGGQ’s stock price. These include macroeconomic conditions, the company’s financial health, and major announcements impacting investor sentiment.

Macroeconomic factors such as interest rate hikes can negatively impact BIGGQ’s stock price by increasing borrowing costs and potentially slowing down economic growth. Conversely, periods of low inflation might boost consumer spending and positively impact the company’s revenue, leading to a price increase. The company’s financial performance, including revenue growth, profitability, and debt levels, directly correlates with its stock price.

Strong earnings reports generally lead to price appreciation, while poor financial results can cause significant declines. Finally, major company announcements, such as new product launches, strategic partnerships, or acquisitions, can generate significant market reactions, causing substantial price fluctuations.

BIGGQ Stock Price Volatility and Risk Assessment

Assessing the risk associated with investing in BIGGQ requires analyzing its historical volatility and comparing it to similar investments. Historical volatility, measured by standard deviation, indicates the degree of price fluctuation. A higher standard deviation suggests greater risk. Beta, a measure of systematic risk, compares the stock’s price movements to the overall market. A beta greater than 1 indicates higher volatility than the market.

- Potential risks associated with investing in BIGGQ stock include:

- Market volatility

- Competition within the industry

- Regulatory changes

- Economic downturns

- Company-specific risks (e.g., management changes, product failures)

BIGGQ Stock Price Predictions and Forecasting

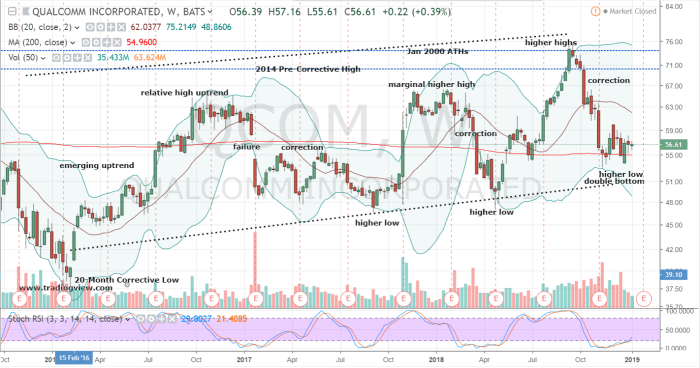

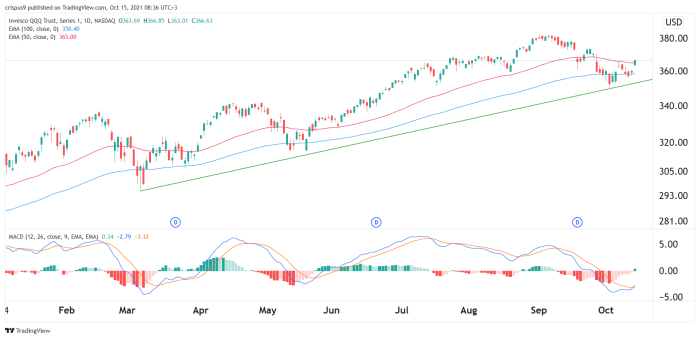

Predicting future stock prices involves utilizing various methods, including technical analysis and fundamental analysis. Technical analysis involves studying price charts and trading volume to identify patterns and predict future price movements. Fundamental analysis involves evaluating the company’s financial statements and overall business prospects to assess its intrinsic value.

Interpreting financial ratios such as the Price-to-Earnings (P/E) ratio and Price/Earnings to Growth (PEG) ratio can provide insights into the stock’s valuation. A low P/E ratio might suggest undervaluation, while a high PEG ratio might indicate overvaluation. However, these ratios should be considered in conjunction with other factors.

| Scenario | Probability | Supporting Factors | Projected Price (1 year) |

|---|---|---|---|

| Bullish | 30% | Strong revenue growth, successful new product launch, positive industry trends | $22.00 |

| Neutral | 50% | Stable market conditions, moderate revenue growth, no major disruptions | $18.50 |

| Bearish | 20% | Economic downturn, increased competition, negative industry trends | $15.00 |

Illustrative Examples of BIGGQ Stock Price Movements

Several instances highlight the impact of news events and market conditions on BIGGQ’s stock price. For example, the announcement of a major new product resulted in a significant price surge as investors anticipated increased revenue and market share. Conversely, a period of negative news concerning the company’s financial performance led to a sharp decline in its stock price, illustrating the sensitivity of investor sentiment.

A hypothetical investment scenario: An investor buys 100 shares of BIGGQ at $16.00. Under a bullish scenario, the price rises to $22.00 within a year, resulting in a profit of $600. However, in a bearish scenario, the price drops to $13.00, leading to a loss of $300. This illustrates the importance of considering various market scenarios and managing risk appropriately.

FAQ Guide: Biggq Stock Price

What are the major risks associated with investing in BIGGQ stock?

Investing in BIGGQ, like any stock, carries inherent risks. These include market volatility, economic downturns, and company-specific factors like decreased profitability or competitive pressures. Thorough due diligence is crucial before making any investment decisions.

Where can I find real-time BIGGQ stock price data?

Real-time stock quotes for BIGGQ can typically be found on major financial websites and trading platforms. These resources often provide detailed information, including charts, historical data, and news related to the stock.

How often is BIGGQ’s stock price updated?

BIGGQ’s stock price is updated continuously during trading hours on the relevant stock exchange. The frequency of updates depends on the specific exchange and the trading volume.

What is the typical trading volume for BIGGQ stock?

Analyzing the BIGGQ stock price requires considering long-term investment strategies. Understanding the historical performance of established companies offers valuable context; for instance, examining the trajectory of Berkshire Hathaway’s stock price provides a useful benchmark. You can explore the detailed history of Berkshire Hathaway’s Class B shares by checking out this resource: berkshire hathaway stock price class b history.

This perspective can help inform predictions and risk assessment when evaluating the potential of BIGGQ’s future growth.

The average daily trading volume for BIGGQ stock varies and can be found on financial websites that provide market data. High volume typically indicates greater liquidity, making it easier to buy or sell shares.