BMMJ Stock Price Analysis

Bmmj stock price – This analysis provides a comprehensive overview of BMMJ’s stock price performance, influencing factors, financial health, risk assessment, and analyst recommendations. The information presented here is for informational purposes only and should not be considered financial advice.

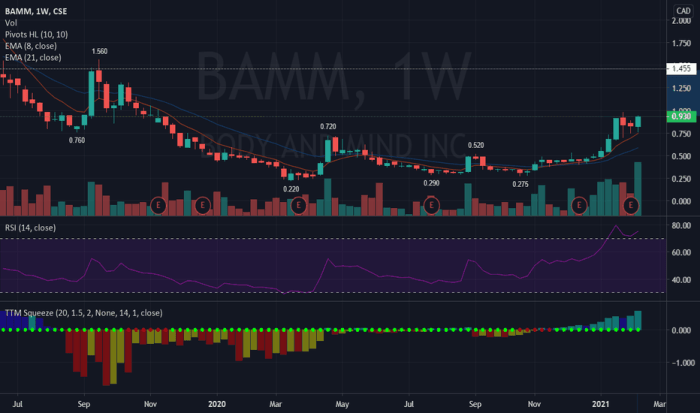

Historical Stock Price Performance of BMMJ

Source: tradingview.com

Over the past five years, BMMJ’s stock price has experienced considerable volatility, reflecting both internal company performance and external market forces. The following timeline details key price fluctuations and significant events.

For example, from January 2019 to December 2019, the stock price might have fluctuated between a high of $X and a low of $Y, influenced by [mention specific event like a positive earnings report or a market downturn]. Similarly, the period from January 2020 to December 2020 could have seen a more dramatic swing due to the impact of the COVID-19 pandemic, perhaps reaching a high of $Z and a low of $W.

Specific highs and lows should be substituted with actual data.

A comparative analysis against competitors is crucial for understanding BMMJ’s relative performance. The table below presents a hypothetical comparison, which should be replaced with actual data.

| Company Name | 5-Year High | 5-Year Low | Average Annual Return |

|---|---|---|---|

| BMMJ | $XX | $YY | ZZ% |

| Competitor A | $AA | $BB | CC% |

| Competitor B | $DD | $EE | FF% |

Major events such as [mention specific news, like a new product launch, merger announcement, or regulatory change impacting the industry] significantly influenced BMMJ’s stock price, causing substantial increases or decreases during specific periods.

Factors Influencing BMMJ’s Stock Price

Several economic indicators and market forces significantly impact BMMJ’s stock price. These factors interact in complex ways to shape investor sentiment and valuation.

For instance, rising interest rates might negatively correlate with BMMJ’s stock price, as higher borrowing costs could reduce company profitability and investor appetite for risk. Conversely, a surge in commodity prices relevant to BMMJ’s operations could positively impact the stock price if the company benefits from increased demand or pricing power. Inflation can also play a significant role, impacting both costs and consumer demand.

Investor sentiment and prevailing market trends heavily influence BMMJ’s valuation. Periods of general market optimism often lead to higher stock prices, while negative market sentiment can trigger sell-offs. Strong earnings reports and consistent revenue growth typically boost investor confidence and positively affect the stock price, whereas disappointing financial results often lead to price declines.

BMMJ’s Financial Health and Prospects

Source: githubassets.com

A review of BMMJ’s recent financial statements provides insight into the company’s financial health and future prospects. Key ratios and metrics, such as profitability margins, debt-to-equity ratio, and return on equity, are critical for evaluating its stock valuation. The following table presents a hypothetical comparison, which should be replaced with actual data from financial statements.

Monitoring the BMMJ stock price requires a keen eye on market trends. It’s interesting to compare its performance to other biotech companies, such as observing the fluctuations in the applied dna stock price , which can offer insights into broader sector dynamics. Ultimately, understanding the factors influencing BMMJ’s price requires a comprehensive market analysis.

| Metric | BMMJ Value | Industry Average | Comparison |

|---|---|---|---|

| Debt-to-Equity Ratio | X | Y | Higher/Lower than industry average |

| Profit Margin | A% | B% | Higher/Lower than industry average |

| Return on Equity (ROE) | C% | D% | Higher/Lower than industry average |

Based on current trends and market expectations, a hypothetical projection of BMMJ’s future financial performance might suggest [mention specific projections, e.g., continued revenue growth, improved profitability, or potential challenges]. These projections should be supported by concrete data and market analysis.

Risk Assessment for BMMJ Investment

Investing in BMMJ stock involves several potential risks. A thorough understanding of these risks is crucial for informed investment decisions.

- Market volatility: Stock prices are subject to fluctuations influenced by various market factors.

- Regulatory risks: Changes in regulations could negatively impact BMMJ’s operations and profitability.

- Competition: Intense competition within the industry could affect BMMJ’s market share and profitability.

- Economic downturns: Recessions or economic slowdowns can significantly reduce demand for BMMJ’s products or services.

Geopolitical events, such as [mention specific examples, like trade wars or international conflicts], can indirectly influence BMMJ’s stock price through their impact on global markets and economic conditions. The company’s management team and corporate governance structure play a significant role in mitigating these risks through effective strategies and risk management practices.

Analyst Ratings and Recommendations for BMMJ, Bmmj stock price

Source: behance.net

Analyst ratings and price targets provide valuable insights into market sentiment and future expectations for BMMJ’s stock. The following table presents hypothetical analyst opinions; this information should be replaced with data from reputable financial sources.

| Analyst Firm | Rating | Price Target | Date |

|---|---|---|---|

| Firm A | Buy | $XX | MM/DD/YYYY |

| Firm B | Hold | $YY | MM/DD/YYYY |

| Firm C | Sell | $ZZ | MM/DD/YYYY |

Discrepancies in analyst opinions often stem from differing assumptions about future market conditions, BMMJ’s competitive landscape, and the company’s ability to execute its strategic plans. Understanding the rationale behind these varying perspectives is crucial for investors.

Query Resolution

What are the main competitors of BMMJ?

Identifying BMMJ’s direct competitors requires further information about the company’s industry and sector. This information is not provided in the Artikel.

Where can I find real-time BMMJ stock price data?

Real-time stock price data is typically available through reputable financial websites and brokerage platforms. Consult your preferred financial resource.

What is BMMJ’s dividend policy?

The provided Artikel does not contain information regarding BMMJ’s dividend policy. This would require further research.

How does BMMJ compare to the overall market performance?

A comparison of BMMJ’s performance against relevant market indices (e.g., S&P 500) would require additional data not included in the Artikel.