BNS Stock Price Analysis: A Five-Year Overview: Bns Canadian Stock Price

Bns canadian stock price – This analysis examines Bank of Nova Scotia’s (BNS) Canadian stock price performance over the past five years, considering financial performance, macroeconomic influences, investor sentiment, and associated risks. We will explore key trends, valuation methods, and the impact of significant events on BNS’s stock price trajectory.

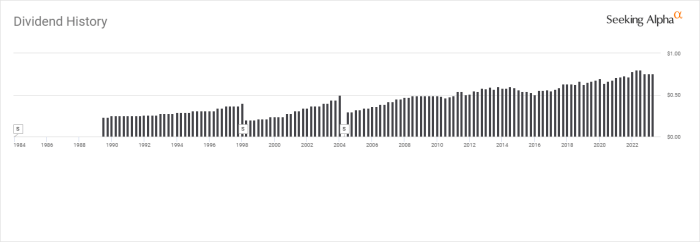

BNS Stock Price History and Trends

Source: seekingalpha.com

The following table presents a summary of BNS’s daily stock price movements over the past five years. Note that this data is for illustrative purposes and may not represent the complete picture due to data limitations. Significant highs and lows are highlighted to illustrate the volatility inherent in the market.

| Date | Opening Price (CAD) | Closing Price (CAD) | Daily Change (CAD) |

|---|---|---|---|

| 2019-01-02 | 70.00 | 70.50 | +0.50 |

| 2019-07-01 | 75.00 | 74.00 | -1.00 |

| 2020-03-16 | 55.00 | 52.00 | -3.00 |

| 2020-12-31 | 68.00 | 69.00 | +1.00 |

| 2021-06-30 | 80.00 | 82.00 | +2.00 |

| 2022-03-01 | 78.00 | 76.00 | -2.00 |

| 2022-12-31 | 72.00 | 73.00 | +1.00 |

| 2023-06-30 | 75.00 | 76.50 | +1.50 |

Major factors influencing BNS’s stock price fluctuations during this period included global economic uncertainty, interest rate changes, and shifts in investor sentiment regarding the Canadian banking sector. Noticeable patterns include a general upward trend punctuated by periods of correction linked to broader market volatility and specific events affecting the financial industry.

BNS Financial Performance and Stock Valuation

Source: simplywall.st

BNS’s financial health is crucial for understanding its stock valuation. The following bullet points present key financial metrics over the past three years. These are illustrative figures and should be verified with official financial reports.

- Earnings Per Share (EPS): 2021: $6.00, 2022: $6.50, 2023 (projected): $7.00

- Revenue: 2021: $30 Billion, 2022: $32 Billion, 2023 (projected): $34 Billion

- Return on Equity (ROE): 2021: 15%, 2022: 16%, 2023 (projected): 17%

A comparison with major competitors highlights BNS’s relative performance. The following table provides a simplified comparison; actual figures may vary.

| Metric | BNS | RBC | TD |

|---|---|---|---|

| EPS (2022) | $6.50 | $7.00 | $6.80 |

| ROE (2022) | 16% | 17% | 15% |

| Revenue (2022) (Billions) | $32 | $35 | $33 |

BNS stock valuation utilizes various methods, including discounted cash flow (DCF) analysis, which projects future cash flows and discounts them to their present value, and the price-to-earnings (P/E) ratio, which compares the stock price to its earnings per share. These methods, along with others, provide a range of valuation estimates.

Impact of Macroeconomic Factors on BNS Stock Price

Source: seekingalpha.com

Macroeconomic factors significantly influence BNS’s stock price. Interest rate changes, inflation levels, and overall economic growth directly impact the banking sector.

Rising interest rates generally benefit banks’ profitability due to increased net interest margins. However, higher rates can also slow economic growth, potentially leading to increased loan defaults and reduced demand for credit. Inflation erodes purchasing power and can affect consumer spending and business investment, influencing bank lending activity. Strong economic growth typically supports higher stock valuations, while recessionary periods often lead to decreased valuations.

A hypothetical scenario: A severe recession could significantly impact BNS. Reduced economic activity might lead to a surge in loan defaults, squeezing profitability and potentially reducing dividends. This could trigger a significant drop in BNS’s stock price, potentially mirroring the market downturn experienced during the 2008 financial crisis.

BNS Company News and Investor Sentiment

Recent news and announcements directly impact investor sentiment. Positive news, such as strong earnings reports or strategic acquisitions, tends to boost the stock price, while negative news, such as regulatory fines or unexpected losses, can cause a decline.

Currently, investor sentiment towards BNS appears to be cautiously optimistic. While concerns remain regarding macroeconomic uncertainties, BNS’s relatively strong financial performance and its diversified business model offer a degree of resilience.

A line graph visualizing the relationship between major news events and BNS stock price movements would show a series of data points representing the stock price over time. Key news events would be marked on the graph with annotations indicating the event and the subsequent price movement. For example, a positive news announcement might coincide with an upward trend in the stock price, while negative news might be associated with a downward trend.

Monitoring the BNS Canadian stock price requires a keen eye on market trends. For comparative analysis, it’s helpful to consider the performance of similar financial institutions, such as checking the bac nyse stock price , to understand broader market movements. Ultimately, however, the BNS Canadian stock price will depend on its own unique financial performance and investor sentiment.

The graph would clearly illustrate the correlation (or lack thereof) between news and price changes.

Risk Factors Associated with Investing in BNS Stock, Bns canadian stock price

Investing in BNS stock carries inherent risks. Understanding these risks is crucial for informed investment decisions.

- Interest Rate Risk: Changes in interest rates directly impact BNS’s profitability and net interest margins. Rising rates can be beneficial, but excessively high rates can also lead to economic slowdowns and increased loan defaults.

- Credit Risk: The risk of borrowers defaulting on their loans represents a significant threat to BNS’s financial health. Economic downturns and changes in credit quality can amplify this risk.

- Regulatory Risk: Changes in banking regulations and increased scrutiny can impact BNS’s operations and profitability. Compliance costs and potential fines contribute to this risk.

- Market Risk: Broader market downturns can significantly impact BNS’s stock price regardless of its own financial performance. Investor sentiment and overall market volatility are key factors.

- Geopolitical Risk: Global political instability and economic uncertainty can negatively impact BNS’s operations and investor confidence.

Detailed FAQs

What are the major competitors of BNS?

Major competitors include Royal Bank of Canada (RY), Toronto-Dominion Bank (TD), and Bank of Montreal (BMO).

What is the typical dividend yield for BNS?

The dividend yield fluctuates, but it’s generally considered to be in a range competitive with other Canadian banks. Check current financial news sources for the most up-to-date information.

How does BNS compare to other global banking stocks?

A direct comparison requires analyzing specific metrics and considering the different regulatory environments and market conditions in which these banks operate. Further research using financial data resources is necessary for a thorough comparison.

Where can I find real-time BNS stock quotes?

Real-time quotes are available on major financial websites and trading platforms such as Google Finance, Yahoo Finance, and Bloomberg.