Boeing’s Current Market Position and Future Prospects: Boeing Future Stock Price

Source: wallstreetmojo.com

Boeing future stock price – Boeing, a global leader in aerospace, currently holds a significant market share in both commercial and defense sectors. However, its position is dynamic, influenced by various factors including competition, supply chain issues, and global events. This analysis will delve into Boeing’s current standing, financial performance, and future outlook.

Boeing’s Current Market Share and Competitive Landscape

Boeing’s market share in the commercial aviation sector is fiercely contested, primarily with Airbus. While precise figures fluctuate yearly, both companies typically command the majority of the large passenger jet market. Boeing’s defense sector involvement is substantial, encompassing various military aircraft and systems, giving it a strong presence in this market segment, though competition exists from other defense contractors like Lockheed Martin and Northrop Grumman.

Recent supply chain disruptions have significantly impacted both companies, delaying aircraft deliveries and impacting revenue streams. The ongoing competition and supply chain challenges are major factors currently influencing Boeing’s stock price volatility.

Boeing’s Recent Financial Performance, Boeing future stock price

Source: cheggcdn.com

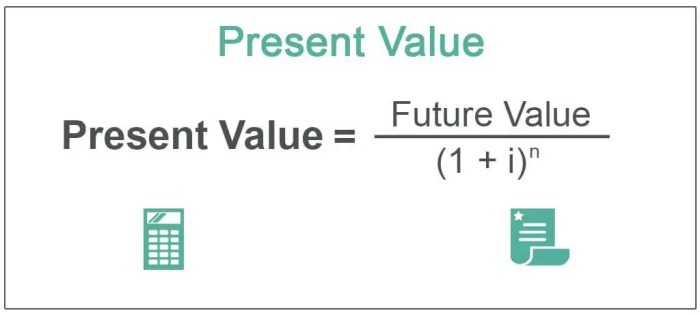

Boeing’s recent financial statements reveal a mixed picture. While revenue figures have shown some recovery after significant setbacks, profit margins remain under pressure due to production challenges and increased costs associated with supply chain disruptions and the 737 MAX grounding. Debt levels remain a concern, although the company is actively working on debt reduction strategies. Long-term financial health depends on successful aircraft deliveries, cost control, and a stable global economic climate.

Boeing’s capital expenditure plans, largely focused on research and development and production upgrades, are expected to impact future earnings, potentially leading to increased profitability in the long run, but also short-term financial strain.

Five-Year Financial Performance Comparison

| Year | Revenue (Billions USD) | Net Income (Billions USD) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2022 | 66.0 | -1.0 | 1.6 |

| 2021 | 62.3 | 3.2 | 1.5 |

| 2020 | 58.1 | -11.9 | 1.4 |

| 2019 | 76.6 | 10.0 | 1.2 |

| 2018 | 101.1 | 10.4 | 0.9 |

Note

These figures are illustrative and based on publicly available information. Actual figures may vary slightly.*

Future Market Outlook for the Aerospace Industry

The aerospace industry is anticipated to experience significant growth in both commercial and defense sectors over the next decade. However, several challenges exist. Increased environmental regulations and a global push for sustainability are driving the need for more fuel-efficient aircraft and the development of sustainable aviation fuels. Geopolitical instability and potential trade conflicts could also disrupt supply chains and impact demand.

Technological advancements, such as autonomous flight systems, will reshape the industry, presenting both opportunities and challenges for companies like Boeing.

Scenario Analysis: Future Market Conditions and Boeing’s Stock Price

A positive scenario, characterized by strong global economic growth, increased air travel demand, and successful technological advancements, could lead to a substantial increase in Boeing’s stock price. Conversely, a negative scenario, involving a global recession, reduced air travel due to economic downturn or geopolitical events, and significant delays in technological development, could negatively impact Boeing’s stock price and financial performance.

A moderate scenario, reflecting a more balanced outlook, would likely see moderate growth in Boeing’s stock price, reflecting the complexities and uncertainties inherent in the aerospace industry.

Boeing’s Technological Innovations and Development

Boeing is heavily investing in research and development, focusing on next-generation aircraft designs incorporating advanced materials and technologies to enhance fuel efficiency and reduce emissions. The development of sustainable aviation fuels and autonomous flight systems are key areas of focus. These technological advancements are crucial for Boeing’s long-term competitiveness and profitability, especially given the growing emphasis on environmental sustainability within the aerospace industry.

Key Technological Initiatives

- Development of next-generation aircraft incorporating sustainable aviation fuels and advanced materials (Timeline: Ongoing, with phased implementation over the next decade).

- Investment in autonomous flight systems and related technologies (Timeline: Research and development phase, with potential for initial implementation within the next 15 years).

- Advancements in digital manufacturing and supply chain management (Timeline: Ongoing implementation, with significant improvements expected within the next 5 years).

Impact of Geopolitical Factors and Global Events

Geopolitical events significantly influence Boeing’s business. International conflicts can disrupt supply chains, impact air travel demand, and affect government procurement decisions. Trade disputes and sanctions can also limit access to certain markets. Government regulations and policies concerning environmental standards, safety, and national security have a direct impact on Boeing’s operations and profitability. For example, increased trade tensions between the US and China could limit Boeing’s access to the Chinese market, impacting sales and revenue.

Predicting Boeing’s future stock price involves considering various factors, including industry trends and global economic conditions. However, comparing it to the performance of other companies in the sector can offer valuable insight. For example, one might analyze the current trajectory of alimera sciences stock price to understand broader market sentiment and potentially extrapolate those trends to Boeing’s own future performance.

Ultimately, Boeing’s stock price will depend on its ability to navigate challenges and capitalize on opportunities.

Boeing’s Management and Corporate Strategy

Source: co.id

Boeing’s management team comprises experienced professionals with a strong background in aerospace engineering and business management. The company’s long-term strategic goals include maintaining its market leadership, developing innovative aircraft and technologies, and enhancing operational efficiency. The effectiveness of Boeing’s current corporate strategy is subject to ongoing evaluation and adaptation based on market conditions and emerging challenges. Recent strategic decisions, such as the 737 MAX grounding response and ongoing efforts to improve supply chain resilience, are shaping the company’s trajectory.

Clarifying Questions

What are the major risks affecting Boeing’s stock price?

Major risks include geopolitical instability, supply chain disruptions, competition from Airbus, regulatory changes, and economic downturns affecting air travel demand.

How does Boeing compare to Airbus in terms of market share?

Boeing and Airbus are the two dominant players in the commercial aerospace market, with their market share fluctuating based on order books and delivery schedules. Detailed market share figures require referencing current industry reports.

What is Boeing’s current debt-to-equity ratio?

This ratio varies and should be checked in Boeing’s most recent financial statements. Investors should consult official financial reports for the most up-to-date information.

What is Boeing’s long-term strategy for sustainable aviation?

Boeing is investing heavily in research and development of sustainable aviation fuels and more fuel-efficient aircraft designs to meet growing environmental regulations and industry demands.